Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

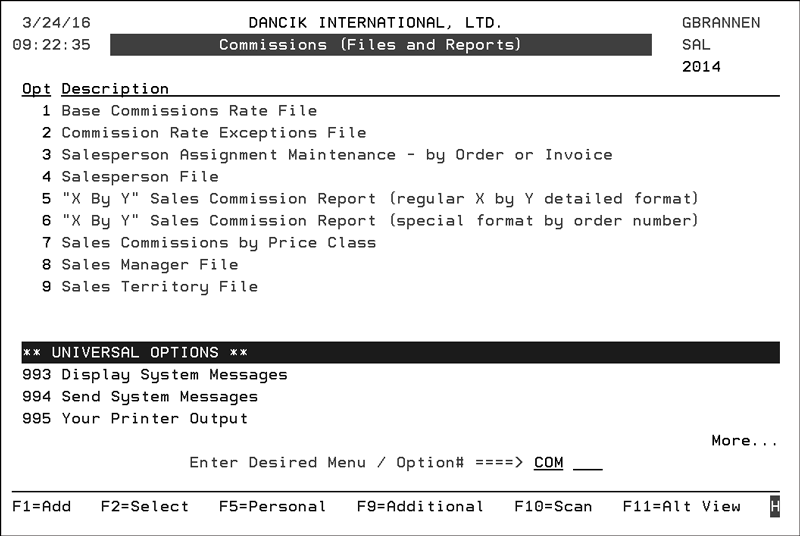

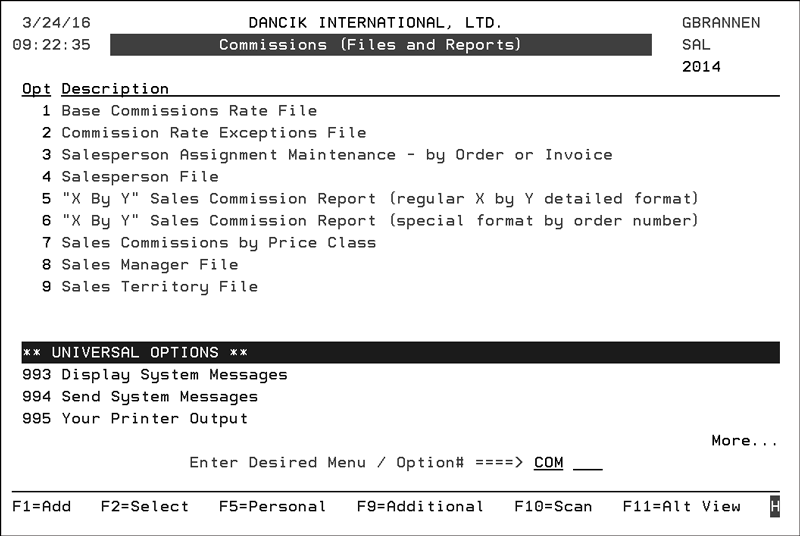

Commissions Menu

Base_Commissions_Rate_File_-_COM_1

Commission_Rate_Exceptions_File_-_COM_2

Maintain_Salesperson_Assignments_-_COM_3

X_by_Y_Sales_Commission_Report - Regular_Format__-_COM_5

X by Y Sales Commission Report - Special Format by Order Number -_COM_6

Sales_Commissions_by_Price_Class_-_COM_7

Base Commissions Rate File - COM 1

Options for Calculating Commissions

This file allows you to establish and update commission rates for your sales force. You can also add or subtract from a commission (by percentage points) using several parameters. Base commissions may be adjusted based upon gross profit percentage, age of invoices, and other factors. For example, this file supports a positive or negative percentage for “cuts”. This means you can either raise or lower commission rates if the order is a cut. Cuts are identified by the “C” code in the restriction field of a line item and are usually associated with rolled goods or laminates.

1. When this option is accessed the following screen displays. This screen displays all of the base commission records already established on your system. You can create base commissions that are very general, such as one rate for an entire company, including all branches, cost centers, and salespeople. You can also create very specific base commission rates that apply to one salesperson and/or cost center. In the example below, the most specific record shown is for company 2, branch RAL, cost center ARM, and salesperson BWO. A line item must match all of the criteria for that commission record to be applied.

|

2. You can search by entering values above any of the columns. Enter the necessary code in the Opt column of the entry you want to work with, inquire on, or delete. The following screen is an example of a Base Commission record:

|

The example above applies to salesperson 901, for sales with any branch and cost center within company #2. The commission rates shown above should be interpreted as follows:

Sales with gross profit percentage of 0.00% or less receive a commission equal to 2.00% of the sales value. (This entry covers all sales that have zero gross profit margin, or a negative gross profit margin. This may be important to compensate for sales of “drops” and other “below cost” items.)

Sales with gross profit percentages between 1-17%, receive a commission of 15.00% of the gross profit value.

17.00% of gross profit is paid on sales with gross profit percentages between 18-39%.

18.00% of gross profit is paid on sales with gross profit percentages above 40%.

A 1.00% reduction in commission is applied to sales flagged as “cuts”.

The fields on this screen are described in the following table.

Field |

Description |

Company |

Enter a valid company number. |

Branch |

Enter a branch code or ALL to apply this rate to all branches. |

Cost Center |

Enter a cost center code or ALL to apply this rate to all cost centers. |

Salesperson |

Enter a salesperson code or ALL to apply this rate to all salespeople. |

GP% Span From/To |

Enter the gross profit percent to begin and end your range span. For example, in the figure above, if a sale has a gross profit percentage between 1 and 17 percent, the commission is 15.00% of the gross profit provided there are no other factors (free delivery, cuts) involved. Note: All gross profit percentages on sales are rounded to the nearest whole percentage number before this table is accessed within the X by Y Commission Reports programs. |

Comm% |

Enter the commission percentage to apply if the GP% Span is met. Assume 2 decimal places when entering a commission percentage. For example, you can enter 15.00 to apply a 15% commission for meeting the GP% Span. |

S/P |

Enter S if the percentage applies to sales, or P if the percentage applies to gross profits. |

Free Delivery |

If the Billto file Delivery Charge field is set to N and the sale is a delivery (has a truck route), the percentage entered will be added or subtracted from the commission rate. This figure should normally be entered as a negative number. |

Extended Terms |

This field is not active, as this feature was superseded by the F9 screen. |

Cuts |

You can either raise or lower commission rates if the order is a cut. Cuts are identified by the “C” code in the restriction field of a line item and are usually associated with rolled goods or laminates. The percentage you enter will not apply to special orders or direct shipments. |

Other |

This field is not active, and is reserved for future use. |

GP% Span, or Disc% off LP, or Disc% off Billto List Price |

These options offer different methods for calculating commissions.

These options enable field salespeople who are allowed to negotiate prices to think in terms of the discounts they are offering without having to calculate gross profit percentage. The normal use case is to assign the full commission rate to prices that are not overridden, and then to reduce commissions commiserate with discounts from the customer's regularly assigned price. The new commission system allows for promotions to be paid at full commission rate, or to have their own “exceptional” rates. Note: For more information, refer to Options for Calculating Commissions. |

3. Press F2 to establish exceptions to the commission file. Establish exceptions and press F2 to return to the Base Commission File screen.

Note: Refer to Commission Rate Exceptions File for more information.

4. To establish commission adjustments based upon invoice aging parameters, press F9. The Update Commission Aging Parameters screen appears.

|

5. In the example above, if an invoice is paid in less than 30 days 1.00% gets added to the base commission. If the invoice is paid between 30 and 60 days, the commission rate is not affected. An invoice paid after 60 days, but less than 90 days has its commission rate reduced by 1.00%. Invoices paid equal or later than 90 days are reduced by 2.00%. The “S” code means the adjustment is based upon sales. A “P” code means the commission adjustments are based on gross profit. An “E” code eliminates the commission altogether.

Note: The Aging Parameters screen is only applicable when the X by Y Commissions Report is run based upon payment date.

The fields on the Aging Parameters Screen are described in the following table.

Field |

Description |

Aging on ___ Due Date___ Invoice Date |

Enter X before Due Date to calculate the age of a payment comparing the payment due to the due date. Enter X before Invoice Date to calculate the age of a payment by comparing the payment date to the invoice date. |

Days fields |

Fill in all of the days fields, even if some date ranges have the same commission % entries. You can enter any numeric values, as long as the days in the left column are always equal to the days in the right column of the entry just above. This ensures that there are no “holes” in the days covered. |

Comm% |

The commission % to add or subtract from the Base Commission Rate. |

S/P/E |

S calculates commission based on sales. P calculates commission based on gross profit. E eliminates commission on payments that meet the respective aging parameter. |

6. Press F6 to return to the Base Commission screen, F1 to go to the next record in the file, F8 to go to the first screen (search), or F7 to exit.

Options for Calculating Commissions

1. Three options at the bottom of the Base Commissions Rate File (COM 1) allow you to decide how to calculate a salesperson’s commission rate.

|

GP% Span (shown above)- Commissions are based on a gross profit percentage. This is the default. In the example shown above.

— Sales with gross profit percentage of 0.00% or less receive a commission equal to 2.00% of the sales value. (This entry covers all sales that have zero gross profit margin, or a negative gross profit margin.)

— Sales with gross profit percentages between 1-17%, receive a commission of 15.00% of the gross profit value.

— 17.00% of gross profit is paid on sales with gross profit percentages between 18-39%.

— 18.00% of gross profit is paid on sales with gross profit percentages above 40%.

— A 1.00% reduction in commission is applied to sales flagged as “cuts”.

Note: Since the Disc% off LP and Disc% off Billto List Price options base their commissions on discounts percentages taken off the List Price their discount structure (left hand column) is opposite from the GP% Span. These two options use the same table, but are activated by the options at the bottom of the screen.

Disc% off LP - List Pricing is designated in the Customer Price List# field on the Order Header.

Note: With this option the commission rate is based on discounts given during order entry, either from the Extra Charge/Discount field on the Order Header or by overriding the price at the detail level.

Two things on the commission screen change when this option is selected:

— The heading over the left hand column changes to Disc% From LP Scan.

— The field Use 0 disc rate if price NOT Overridden appears. If the list price is not overridden/discounted, the top level commission percentage (in this example 10%) is used.

|

In the example above:

— All commission percentages are based on sales, as directed by the S/P field: S= Sales and P=Profit.

— If the sale price is equal to or greater than the List Price (999- to 0), the commission is 10%.

— Sales with a 1-5% discount applied earn 8% of the sale value.

— Sales with a 6-10 discount applied earn 6% of the sale value.

— 3% of the sale value is paid, if the list prices were discounted from 11-25%.

— No commission is paid for sales with discounts of 26% or higher.

Disc% off Billto List Price - This pricing comes from the list price designated in the Customer Price List# field of the Billto File. It can be used when each store or customer account within a company uses its own Price List.

Note: With this option the commission rate is based on discounts given during order entry, either from the Extra Charge/Discount field on the Order Header or by overriding the price at the detail level.

Two things change on the commission screen when this option is selected:

— The heading over the left hand column changes to Disc% From Billto Last.

— The field Use 0 disc rate if price NOT Overridden appears. If the list price is not overridden/discounted, the top level commission percentage (in this example 10%) is used.

|

Note: Using Disc % off of list price or Billto List price does not preclude you from using a mixed strategy. You can base some commissions on discounts and others on GP%. Also note, commission exceptions can still be used but that they will not support the commission based on disc% off.

The information generated from these option carries over to the reports used for commissions.

COM 6 - “X By Y” Sales Commission Report (special format by order number)

The X by Y Sales Commission Report by Order Number includes all of the same parameters, features, and formulas as the regular X by Y Sales Commission report. It also includes a third level of sorting - by order number, within the X and Y parameters.

|

Order 1 - 409985 (Has a Promo Price)

The GP% on this order is 48.93%.

This order processed with a discount of 1.41%

The List Price was $1.42 and the item was actually sold for $1.40.

|

In this example, the discounted price was due to a promotion. When entering the commission percentages in the Base Commission table, if you enter an “X” for “Use 0 discount rate if price is not overridden”, then promo prices will NOT be considered discounts even though they are less than the customer’s regular list price.

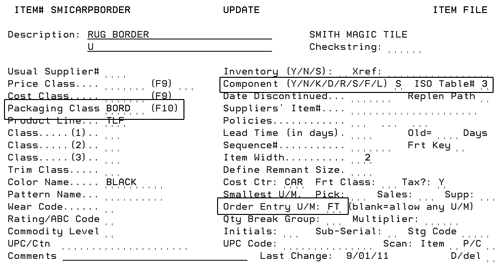

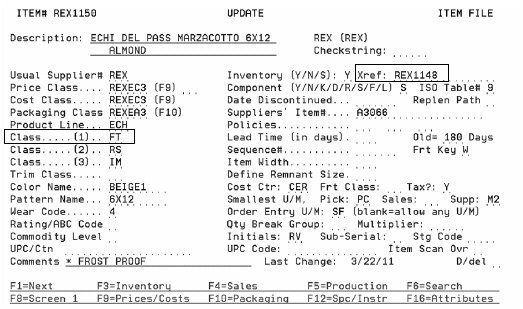

To check the list price, press F16 (Shift F4). This takes you to the Item File where you can press F9 to display the list price for the item.

|

Commission Rate Exceptions File - COM 2

The Commissions Exceptions File allows you to alter, eliminate, or change the commissions based on your exception parameters.

1. Enter a record number and action code (U to update, I to inquire, or A to add a new record) and then press Enter.

Note: Press F6 to search all the exception records already established on your system.

The following screen enables you to establish a commission rate exception. You may create up to 99,999 exception records.

|

2. You can apply an exception to any combination of the parameters on this screen. The example shown applies to two customers. You can apply exceptions for many commonly used fields, such as branch, warehouse, customer type, and item classes. You may also create exceptions that apply to special fields that relate to pricing and margins, such as by promotional program number. This option enables you to alter commission rates for specific promotional programs. This relates to the program number as it is entered in the Promotional Pricing File.

3. You can create commission exceptions by pricing method code. This option enables you to alter commission rates based on the pricing method used when the order was priced. For example, you could reduce commission every time a price is overridden, which is identified by pricing method X. You could alter commissions for all in-house promotions by specifying pricing method H. Refer to the Classification Codes File for a complete list of pricing method codes.

4. You can create commission exceptions by Credit/Comm Codes, which is a code that can be entered via Order Entry and Order Change; (in the C/C field at the line level of an order). Use the Credit/Comm code to flag certain types of sales such as “blowout price” or damaged goods, etc. You may also create commission exceptions based upon item policy codes such as policy “DI” for discontinued, and policy “SP” for “on specials list”.

5. Commission exceptions can each be one of the following three types:

Alter By - This type of exception raises or lowers the commission by a percentage. Many “Alter By” exceptions can be applied to the same line item.

Change To - This type of exception replaces the commission with the “change to” percentage, and only one “change to” can apply to any line item. Therefore the sequence in which you enter “change to” exceptions is very important. Enter them in the sequence of “most applicable” to “least applicable”.

Eliminate Commission - This type of exception works exactly like a “change to” except that it changes the commission rate to zero.

S/P - Designate whether you want to base the commission on Sales or Profit.

6. You may resequence records by pressing F10 on the first screen, which renumbers all of the exception records, leaving space to insert records.

7. The X by Y Commission Report, detailed versions, lists the exception record number that is assigned by the program to each exception. These are listed for each line item that has an exception applied. It is recommended that you supply a list of the exception records (and their meaning) to your salespeople, so that they can clearly see why all exceptions were made, by cross referencing number that appear on their commission reports.

Maintain Salesperson Assignments - COM 3

This maintenance program enables you to update both the secondary and primary salespersons on an order or invoice, even after it is invoiced. It requires the same password used to access the base commission file.

1. When the option is first accessed, the screen is blank.

2. Enter a password to populate the screen with information from the Invoice File.

Note: The password is the same password used for updating the Base Commissions File.

|

3. To update a salesperson assignment, enter a U in the appropriate Opt column and press Enter.

|

This screen displays the primary (header) salesperson and secondary salesperson assigned to the selected invoice. These fields will be blank if no salespeople are currently assigned to the invoice, or if the salespeople are assigned to detail lines, but not at “header level”.

You may change the primary (header) salesperson, but you cannot use the program to remove the primary salesperson. You can change or remove the secondary salesperson.

The X by Y Commission Reports support an invoice-level override to the secondary salesperson’s commission rate. This may be used when you want to pay a special percentage to a secondary salesperson who helped with a sale. You can override the secondary salesperson’s commission on the screen shown above. In this example, 5.00% of sales is paid to salesman 901 in addition to the commission due to salesperson 003. The commission % override is always calculated on sales not gross profit. You can not alter the commission percentage of the primary salesperson from this screen. The commission for primary salespeople is maintained using the Base Commissions and Commission Exceptions files.

All changes on this screen are documented automatically on the Invoice Notepad. The notepad shows the previous and new salespeople. If a commission override % is keyed or changed, the notepad indicates that a commission % was changed, but does not show the %, as that is not public information.

X by Y Sales Commission Report (Regular Format) - COM 5

The X by Y Sales Commission Report supports all of the sales commissions strategies available within the system. This report lists, in detail or summary format, the sales, gross profit, and commission calculations, sorted using any X by Y combination.

When running this report, the system prompts you for the basis of the commission: invoices created or invoices paid. The system also prompts you to include commission exceptions for aged invoices, and many other options.

X by Y Commissions Report - By Payment Dates - Header Page

Detailed X by Y Commissions Report - Primary Salespeople

Recap and Summary for Primary Salespeople

X by Y Commissions - Header Page - Secondary Salespeople

Support for Negative Commission Write-offs

Commissions Based on Parent or Child Items

1. Enter an R to run the report for range of dates and press Enter.

|

2. Decide if you want the commission report to be for invoices or payments, enter the appropriate option and press Enter.

Note: The decision to run the report for invoices or payments affects the information contained in the X by Y Sales Commission Report, Options Screen.

3. Next, select an option for salesperson assignments.

Option 1, the default option, uses the salespersons assigned on each invoice.

Option 2 uses the salespersons currently assigned to each customer account, if any. This option may be effective when you are reassigning salespeople and territories. It provides a way to show what a newly assigned salesperson or territory would have earned in any historical period on the system.

Option 3 is the same as option 1, except that whenever a secondary salesperson is found on an invoice, that invoice will be split between the two salespeople using the percentage keyed on the above screen. For example, a $100 invoice with a 25% split will appear as $75 for the primary salesperson, and $25 for the secondary salesperson.

4. Enter an option and press Enter. The next screen lets you pick a date range, and other parameters which can limit the amount of data retrieved for the report.

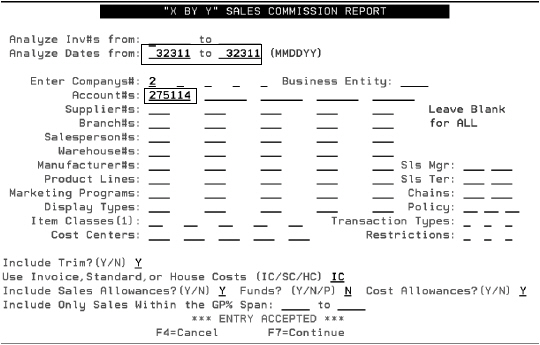

|

5. The first field, Analyze Inv#s from, lets you enter a range for invoices. The second field, Analyze Dates from, lets you analyze a time frame in a MMDDYY format. Enter other parameters as needed.

The fields at the bottom of the screen (described in the table below) control how gross profit percentages will be calculated. The default values are the recommended values for each field.

Field |

Description |

Include Trim |

Enter N to omit sales of items that have a trim class in the Item File. |

Use Invoice, Standard, or House Costs |

Enter IC to use the actual cost on each invoice/line. Enter SC to use the Standard Costs from the Cost or Item Files instead of the invoice costs. Enter HC to use the House Cost from the Cost File instead if the invoice costs. GP% is calculated using the cost selected here. The default is IC. |

Include Sales Allowances |

Enter Y to include the sales allowance (promo) portion of the price. Enter N to remove the sales allowance from the price. Y is the default. |

Include Funds |

Enter Y to include the fund/overbill portion of the price. Normally you should not pay commissions on funds. N is the default. |

Include Cost Allowances |

Enter Y to include the cost allowance (rebate) portion of the cost. Y is the default. |

Include Only Sales Within GP% Span |

You may limit the report to invoice/lines within an specified gross profit percentage range. |

6. Enter an invoice number range and/or date range and press Enter.

Note: If selecting to run the report for payments, the Analyze Dates field is replaced with Payment Dates.

7. The next series of screens let you pick the X and Y parameters. They are common to all X by Y reports. Normally for sales commissions your X parameter is Salesperson#, and your Y parameter is Cust Account#.

8. The next screen includes options that are specific to the X by Y commissions. The information contained in the following screen varies depending on whether you are running the report for invoices or payments. The figure and text below describe the screen that appears if the invoice option is taken.

This screen appears when commissions are paid based upon a range of invoices issued, such as “commissions for invoices issued in Oct., 2003”.

|

9. Choose if you want to run the report for paid invoices (P), unpaid invoices (U), or both (B). When running by invoice dates, the default option is B, to include all invoices regardless of payment.

10. Enter the days past due date you want to consider for the report, if you select U for the previous option. This enables you to run the report as a collection tool, listing only past due invoices for the salesperson, to help with collections.

11. Enter a Y in the Do you want to include Commission Exceptions field. The system will use the settings made in the Commission Exception File to calculate and report commissions.

12. The second part of the screen is devoted to options if a secondary salesperson is involved in the sale. Enter a Y in the Do you want to access the Secondary Salespeople field, if you want to consider the secondary salespeople.

Note: Secondary salespeople are added on the second line in the Salesperson field during order entry or through the Maintain Salesperson Assignments program.

13. Enter either a P, S, or B in the next field to print the commissions for the primary salesperson (P), secondary salesperson (S) or for both the primary and the secondary (B).

14. If you choose to run both reports, one for the primary and one for the secondary, the reports will run one after another. To avoid confusion, the primary and secondary information is not included on the same report. This allows for different formulas to apply to primary versus secondary reports.

15. Select one of the four secondary salesperson commission calculation options.

Use___ .___ % Commission, on (S/P) - Enter a commission percentage to be paid to the secondary salesperson. You can specify whether you want the commission percentage to come from the sale amount or the amount of gross profit generated from the sale, by entering an S or P.

Use ___.___ % of the Primary Slmn's Commission - Enter a percentage here, if you want to calculate the secondary salespersons’ commission as a percentage of the primary salespersons’ commission dollars. Using this option in conjunction with the option Reduce Primary Slmn's Commission by the Secondary Slmn's Comm creates a split commission. For example, if you entered 10.00 in this field and flagged the reduce option as Y, ten percent of the primary salesperson’s commission will go to the secondary salesperson.

Use Commission% from the Salesperson Master File - Normally the commission percentage in the Salesperson Master File is not used within the X by Y Commissions Program. The exception to this is that the secondary salesperson may use this method. This may be helpful when the secondary salespeople may also be primary salespeople, depending upon the sale. In this case, their commissions as primary salespeople are determined by the Base Commissions and Commissions Exceptions File, while their commissions as secondary salespeople are determined by the Salesperson File.

Note: A primary salesperson’s commission is always based on the Base Commission and Exceptions tables.

Use Commission% from the Base & Exception Commission Files - Uses the Base and Exception Commission Table for the secondary salesperson. The commission for the secondary salesperson is calculated independently from the primary, using the same files.

16. The option Reduce Primary Slmn's Commission by the Secondary Slmn's Comm causes whatever the commission is for the secondary salesperson to be subtracted from the primary salespersons’ commission dollars.

17. Enter a Y in the Use Commission Override% if found on specific orders/invoices field if you want to access the commissions for secondary salespeople that are overridden using the Maintain Salesperson Assignment program. Whenever an override is found it will be used.

Note: Your entries on this screen are saved and displayed as defaults the next time you run this report.

This screen appears when commissions are paid based upon payments received, such as “commissions for invoices paid in Oct., 2003”. The primary difference between the invoice and the payment options are three fields at the top of the screen.

|

18. Enter a Y in the field Do you want to use the Commission Table Based Upon Aging to take advantage of the settings made in the Commission Aging Parameters screen of the Base Commissions File.

Note: For more information of the steps required to set up commission rates, refer to Commission Rate Exceptions File - COM 2.

19. If you want to include commissions on partial payments, enter a Y in the field Do you want to include Commissions on Partial Payments.

If an invoice is partially paid within the specified payment date range, and you enter N, the system does not include the invoice when calculating commission. The program only pays commission on the full invoice amount when it is paid in full, or when a final partial payment is made which closes out the invoice.

If you enter Y the system divides the partial payment amount by the invoice amount to get a percentage of invoice dollars paid. This percentage is used to adjust the commission dollars. The salesperson is only paid commission on the percentage of the invoice that was paid.

The system handles partial payments as follows.

Let’s start with an invoice for $100.00 where the salesperson gets a 5% commission on a gross profit amount of $20.00. Let’s assume that the aging parameters cause the commission to be reduced by 2% if the invoice is paid between 31 and 45 days from the due date, and reduced by 3% if paid between 46 and 60 days from the due date. For this example, let’s assume the payment was made in 35 days, leaving a 3.00% commission. A partial payment of $75.00 is made on this invoice. The X by Y Commission report would see the partial pay invoice and calculate the partial payment factor as 75/100, which equals 0.75. The system, then multiplies the 3.00% by the 0.75 partial payment factor, which equals 2.25%. The 2.25% is used in the commissions report, as the applicable commission rate. The report shows the partial payment factor. This is the equivalent of paying commission only on the portion of the invoice that was paid.

If an invoice is partially paid in one month and the remaining balance is paid in full the following month or later, then the X by Y Commission Report only picks up the amounts of each partial payment and calculates the commission in the month when each payment is made. Using the example above, if the remaining balance on the invoice of $25.00 was paid in 45 - 60 days, and the 5.00% commission is reduced by 3.00%, then the commission report uses the following formula: The partial payment is .25 of the original invoice or 25/100. The remaining 2.00% commission is multiplied by the partial payment factor of .25, which equals a 0.50% commission rate.

If the invoice is partially paid one month, and the next month it is partially paid again, then the X by Y Commission report uses each partial payment. The calculation is similar to the one in the previous paragraph. It uses the amount paid in the payment date range specified. Regardless of the number of payments made, the sum of the partial payments can never exceed the total invoice amount.

The complete formula is as follows: Commission % = (Paid Amount/Invoice Amount) x (Original Base and Exceptions Commission % minus Aging Adjustment %).

20. With either partial payment option, N or Y, the same amount of commission is paid on any invoices that are paid in full. If you enter N, commission is only paid once, when the final payment is received. If you enter Y, commissions are paid on each partial payment. If you enter N, invoices that are never paid in full earn no commissions.

Note: The following payment codes, used in accounts receivable to clear an invoice, are NOT included in the X by Y Commission reports on paid invoices: WW, OA, AD, DM, WC, WN, and WP. These codes are used for write-offs and adjustments, which are not considered to be payments. Discounts allowed at the time of payment are considered to be part of the payment. Therefore, salespeople are paid for the full invoice amount even when an early pay discount is allowed.

21. The Increase Cost of Sales field allows you to add an overhead cost which reduces gross profit and commissions if commissions are based on gross profits. For example, if you enter 3.75%, then the costs on all invoices will be increased by 3.75% on the X by Y Commissions Report.

22. The next X by Y Sales Commission screen is the confirmation screen.

|

This screen confirms your X by Y parameters. You can enter X to start a new page for each salesperson (assuming your X parameter is salesperson). You may specify Y for Summary Report, and only the X by Y subtotals will print. Enter N for the regular detailed version, showing each line item sold. The customer version drops out cost and profit information. The default is M for management version, unless the user is coded to not see costs.

23. The final screen schedules the job. Enter a 1 to run the report.

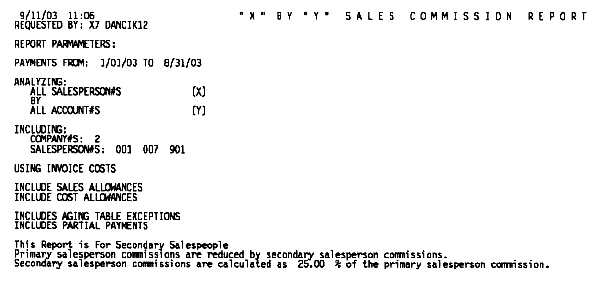

X by Y Commissions Report - By Payment Dates - Header Page

This header page for an X By Y Commissions Report was run by a payment date range, for both Primary and Secondary salespeople. The reports are both requested when the user enters “B” on the “options for secondary salespeople” screen. The reports are then run separately, and this header page goes with the first report that is generated, which is for the primary salespeople.

The header page displays the parameters that were selected. In this case, the user selected to give the Secondary salespeople 25% of the respective Primary salesperson's commissions, and to reduce the Primary salesperson's commissions by that 25%.

Detailed X by Y Commissions Report - Primary Salespeople

Each line item is listed, sorted by salesperson and then by customer account (the X and Y parameters).

The “Excpt” column on the far right of the report has several codes indicating exceptions including the following:

S means that the commission rate to the left is based on sales dollars.

P means that the commission rate to the left is based on gross profit dollars.

D means that an exception was made due to the order being a free delivery.

C means that an exception was made for the line item being a “cut” (as for a cut of carpet, vinyl, or laminate sheet goods).

75 is a commission exception number, meaning that the exception shown is Record 75 in the Commission Exceptions File. A salesperson could refer to that exception record to see what the exception was based upon. You should consider supplying your salespeople with a list of your exceptions.

“age” means that the exception is based on an aging parameter exception.

“spl” means that the commission was split and this is the amount that the commission was altered by. In this case, 25% of the commission is taken away to give to the secondary salesperson. The report shows which salesperson the commission is split with, and what the net payable commission amount is for each of the two salespeople on each split line item.

“pp” means partial payment. The commission is adjusted so that only the percentage of the invoice that was paid, is commissioned. The report shows what percentage of the invoice was paid, and what percentage of the commission is taken away due to the partial payment.

Note: There is a complete legend of all the exception codes at the bottom of each X by Y Commissions Report.

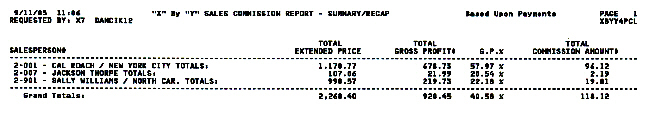

Recap and Summary for Primary Salespeople

This is the summary report for the primary salespeople, it goes with the prior reports. A detail and summary report is printed for the primary and secondary salespeople. This report lists each salesperson and the total commission amount payable.

Note: The summary report always summarizes based upon the “X” parameter of your X by Y Report. If your “X” parameter is not salesperson, then whatever your “X” parameter is will be summarized in this report.

X by Y Commissions - Header Page - Secondary Salespeople

The header page displays the parameters that were selected. In this case the user selected to give the Secondary salespeople 25% of the respective Primary salesperson's commissions, and to reduce the Primary salesperson's commissions by that 25%.

The Detail Report list each line item, sorted by secondary salesperson and then by customer account (the X and Y parameters).

This report (like the primary salesperson report) is limited to the salespeople that were selected on the parameters screen, and show on the header page.

This report shows an exception in the EXCPT column labeled ovr. This represents a commission override that was entered using the “Maintain Salesperson Commissions” program. The override was for 1.00% of sales. If you cross-reference this line item to the primary salesperson report, you will see that the primary salesperson receives a negative commission due to the selected option to “reduce the primary salesperson’s commission by the amount give to the secondary salesperson”. For this invoice/line, the secondary salesperson’s commission was greater than the primary salesperson commission.

Support for Negative Commission Write-offs

The commission reports can produce an additional report showing negative commission write-offs based AR write-off code WZ. This report can be used to impact salesperson commission amounts which are generated by write-offs in AR for amounts that were never paid.

Note: This functionality has to be activated via the System Wide Setting - Options for Salesperson Commissions.

Associated Files

Use the AR Ledger to find each account's current balances as well as aging and all open transactions, or those paid or closed in the current month. As shown in the figure below, write-offs (code WZ) are also displayed.

|

An Example

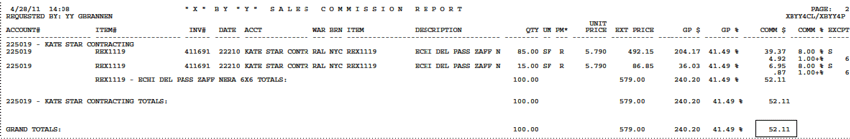

Let’s look at the reports for just one invoice that had write-offs on a couple of lines.

The commission report, which shows how much commission was paid per invoice, shows that $52.11 was paid in commissions for invoice 411691 (the report was run just for that invoice).

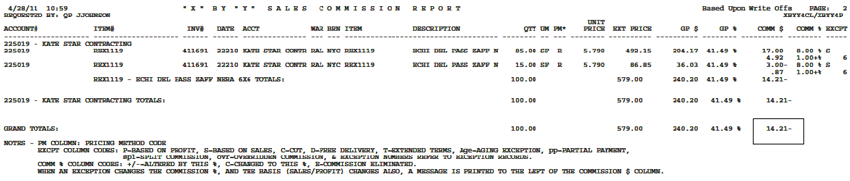

When we look at the commission write-off report, we see that $14.21 in commissions has been written off and should be taken off the $52.11 commission that the salesperson was originally slated to receive.

Here is how the commission write-offs were calculated.

By looking at the AR Ledger for Invoice 411691 we can see a $250 write-off.

To find the percentage of the invoice that was not paid divide 250/579. The $579 is the total Extended Price of the invoice. It is not the invoice total since it does not include any fees, charges or taxes.

250/579 = 43.17%

So now we know that 43.17 percent of the invoice was not paid for. The system uses that percentage to calculate how much should be deducted from the original commissions. The first and third lines had negative commissions (-17.00 and - 3.00)

Original Reduction

Commission Amount

39.37 x .4317 17.00

6.95 x .4317 3.00

Add all the commission payments, both the negative and the positive, and the total is 14.21.

52.11 - 14.21 = 37.90 (new commission payment)

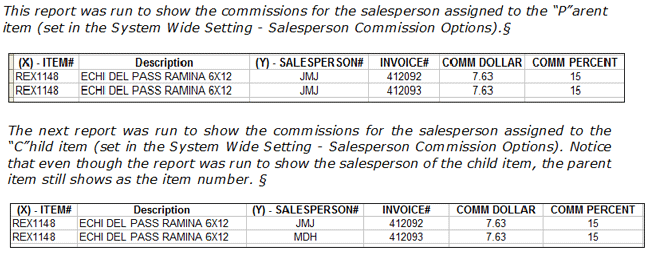

Commissions based on Parent or Child items

This functionality pertains to Crossover items. Crossover items are two or more item numbers assigned to the same inventory item. The two items have the same inventory, but can have different item numbers and different descriptions. You can use crossover items to market the same product under multiple numbers and names. For example, two different customers can have exclusive sales rights to the same item. Both customers can place orders under their own assigned item numbers and descriptions, and receive all documents (pick lists, invoices, bar code labels) with their assigned item numbers and descriptions, even though the actual inventory is the same.

The item containing the inventory is known as the parent item. The dependent items are known as child items.

This functionality allows you to report sales commissions based on the salesperson assigned to the parent item or to the child item.

Note: The System Wide Setting - Salesperson Commission Options lets you decide to base commissions on parent or child items.

Associated Files

Assigning Salespeople to Orders

The Dancik system supports several strategies for assigning salespeople to orders. These strategies can be used concurrently, and in some cases used in combination on the same order. Salesperson Codes can be assigned to orders in the following places:

Header of an order - Via the Salesperson field

Billto File - Account “profile” screen. This is the default unless overridden.

F14 “Codes” screen of the Billto File

Assigning Salespeople to Invoices

Salesperson Codes can be assigned to invoices in the following places:

The salesperson assignments on an order automatically flow through to all invoices for that order, unless overridden on the invoice.

The salesperson assignment for an invoice may be overridden by keying a salesperson code on the header of the invoice when the order is invoiced.

The salesperson assignment may be overridden even after invoicing, by using the Maintain Salesperson Assignments by Order or Invoice option on the Commissions menu.

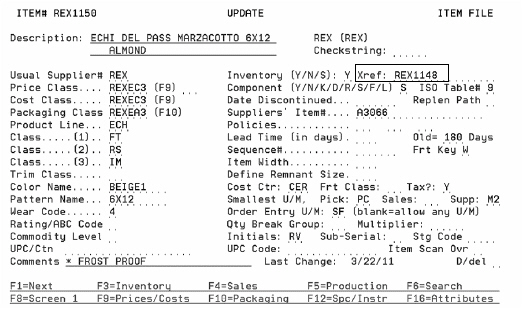

Item File - For child items ensure the parent item number is entered into the Xref field.

An Example

To show how this enhancement works consider the following two items.

REX1148 is the parent item (no entry in the Xref field). Also notice that this item is in Item Class (1) F1.

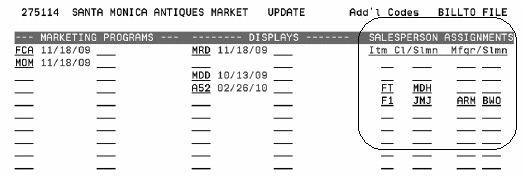

The item class is important because it is one way that salespeople can be assigned to items. This can be checked by accessing the Billto File for the account and then pressing F14 on the profile screen to display the Additional Codes screen. Note in the screen below, salesperson JHJ is assigned to Item Class F1 items.

REX1150 is set up as a child item to REX1148. It is an Item Class 1 FT item which we can in the screen above item class FT is assigned to salesperson MDH.

Now all that is left to do is run the report.

— For the purposes of this example, the report is run against a very narrow data set.

The report can be produced as a spool file, a pdf, or as a spreadsheet. A spreadsheet example is shown below.

X by Y Sales Commission Report (Special Format by Order Number) - COM 6

The X by Y Sales Commission Report by Order Number includes all of the same parameters, features, and formulas as the regular X by Y Sales Commission report. It also includes a third level of sorting - by order number, within the X and Y parameters.

This option enables you to print all line item details, or a summary by order within the X and Y parameters. You can use option 2 to apply commissions at the order level, instead of at the line item level. This is an extremely important option. If you apply commissions at order level instead of line level, consider the following:

Commissions based on gross profit % use the gross profit % of the entire order, not each line. This can cause different commission percentages to be applied, as line item GP% may vary on a line by line basis, and may differ from the blended order-level GP%.

Commission exceptions based upon item-level information (such as manufacturer or item) are ignored when you choose to calculate commissions at order level. This is because an order can consist of multiple products. Product information only exists at the line item level and line item calculations are not performed.

Examples

Commissions by Order - Header Page

Commissions - Calculated at Order Level not line item level

Sales and Commissions Split 50/50

Sales Commission Summary Report

X by Y Commissions by Order - Header Page

This header page is for an X By Y Commissions Report by Order that was run by a payment date range, for both Primary and Secondary salespeople. The reports are both requested at the same time, but are run separately, and this header page goes with the first report that is generated, which is for the Primary salespeople.

The header page displays the parameters that were selected. In this case the user selected to give the Secondary salespeople 25% of the respective Primary salesperson's commissions, and to reduce the Primary salesperson's commissions by that 25%. The header page also notes that any commission exceptions that are based on products or other line item data will not be used. This is because of the option to calculate commissions at order level (not at item level).

X by Y Commissions - Calculated at Order Level (not line item level)

Each line item is listed, sorted by salesperson and then by customer account (the X and Y parameters). The report is then sorted by order# and then invoice number within the X and Y parameters.

The Excpt column on the far right of the report has several codes indicating the exceptions. However, all commission calculations, including the commission exceptions are calculated at the order level only, based on the user's choice to calculate at order level. The line items are all listed, but the commission only shows next to the order-level sub-totals.

The order sub-total lines list the order#, followed by the ship via code, the customer PO#, and the order totals.

X by Y Commissions by Order - Calculated at Line Item Level

This is the header page for an X By Y Commissions Report by Order that was run by a payment date range, for both Primary and Secondary salespeople. The reports are both run separately, and this header page goes with the first report that is generated, which is for the Primary salespeople. Even though the report is sorted by order number, the calculations are done at line-item level, similar to the regular X by Y Commissions Report.

The header page displays the parameters that were selected. In this case the user selected to give the Secondary salespeople 25% of the respective Primary salesperson's commissions, and to reduce the Primary salesperson's commissions by that 25%. The header page also notes that all commission exceptions will be used, because the calculations are performed at line item level.

On the actual report, each line item is listed, sorted by salesperson and then by customer account (the X and Y parameters). The report is then sorted by order number and then invoice number within the X and Y parameters.

The Excpt column on the far right of the report lists the codes indicating exceptions, including “spl” for split commissions and “pp” for partial payments. All commission are calculated at the line item level, based on the user's choice to calculate at line level.

X by Y Commissions - Sales and Commissions Split 50/50

This is the header page for an X By Y Commissions Report by Order that was run by a payment date range, with the Split Sales & Commission Option. The split sales & commission option produces a single report, which splits the sales among the primary and secondary salespeople. For example, a single invoice may be listed twice - once under the primary salesperson and again under the secondary salesperson. The quantity and extended vales of the invoice are split by the percentage that the user requests, which in this example is a 50/50 split.

The header page displays the parameters that were selected. The header page also notes that all commission exceptions will be used, because the user selected to perform the calculations line item level.

Each line item is listed, sorted by salesperson and then by customer account (the X and Y parameters). The report is then sorted by order number and then invoice number within the X and Y parameters.

The Excpt column on the far right of the report lists the codes indicating exceptions, including “spl” for split commissions and “pp” for partial payments. All commission are calculated at the line item level, based on the user's choice to calculate at line level.

There can be several exceptions based upon age of the invoice when paid. For example:

an order which has its commission eliminated (E) due to the invoice being > 120 days old when paid.

aging exceptions for orders which add to the commission because the invoice was paid in less than 180 days.

orders with multiple lines can be split between salespersons. Each line can be split - with half the quantity and half the extended price and gross profit dollars allocated to each salesperson (due to the 50/50 split requested by the user). However, although the sales and GP dollars are split evenly, each salesperson has their own commission rates and their own exceptions. Therefore, the commission dollars for each salesperson is different.

Sales Commission Summary Report

All X by Y Commission Reports include a summary sheet that lists each “X” parameter (usually salesperson) and the total sales and commissions payable. This report may be used for payroll.

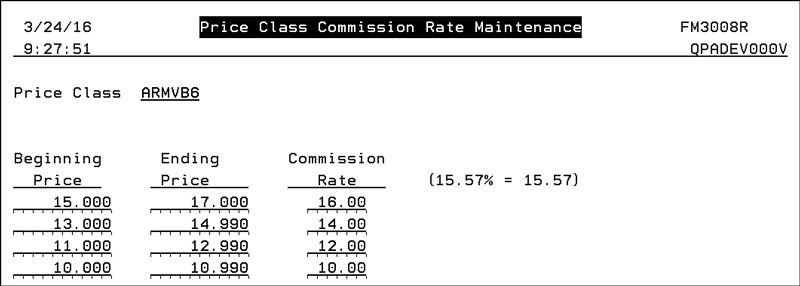

Sales Commissions by Price Class - COM 7

This is a self-contained alternate commission system with its own rate table and report. The Sales Commission by Price Class Table, accessed from the File Management application, allows you to structure a commission structure for each price class. The concept of this commission system is to base commission on the prices charged, based on rates for each product.

To show how this file works, let’s consider the following sales commission structure for price class ARMVB6.

For sales with a unit price from $10 to $10.99, the commission rate is 10%.

For sales with a unit price from $11 to $12.99 the commission rate is 12%.

For sales with a unit price from $13 to $14.99 the commission rate is 14%.

For sales with a unit price from $15 to $17 the commission rate is 16%.

Note: Only items that are within price classes that are included in this table are commissioned.

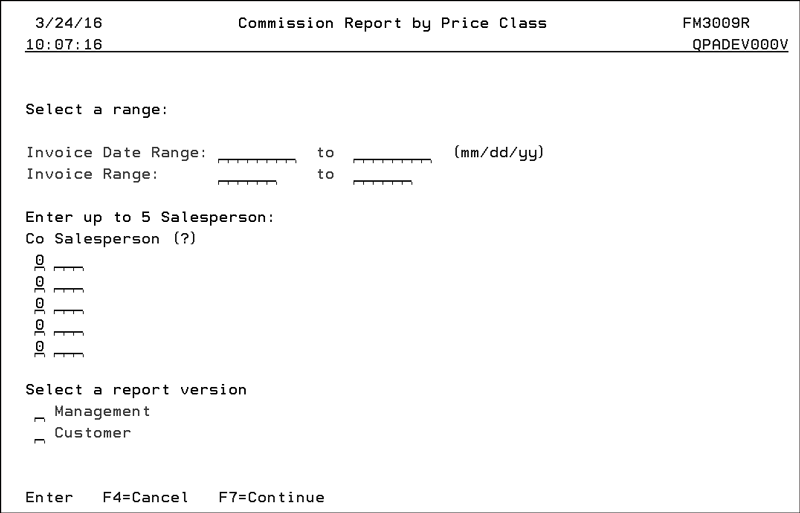

Running the Commission Report by Price Class

This report is accessed via option 2 on the first screen of option COM 7.

Enter either an invoice range or an invoice date range.

Enter up to 5 salespeople to run the report for.

Select a Report Version:

The customer version drops out cost and profit information.

The default is M for management version, unless the user is coded to not see costs.

Navigator Base Commission Rate File

Navigator Sales Commission by Price Class

Navigator Commission Aging Parameters

Navigator Commission Rate Exceptions

Navigator Sales Commission by Price Class

Assigning Salespeople to Orders

Base Commission Rates File - ACT 106

Commissions Exceptions File - ACT 107

Commission Report Based on Price Class (RSA 15)

How do I price an item to include freight, but omit the freight portion from my commission reports?