Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

This option prints an edit listing of journals entered in option 1, Entering G/L Journals (GL 1). It displays all entries by batch number and verifies that entries are valid and in balance. If approved by the system, it is given status In Balance and can be posted using option 3, Posting G/L Journals (GL 3).

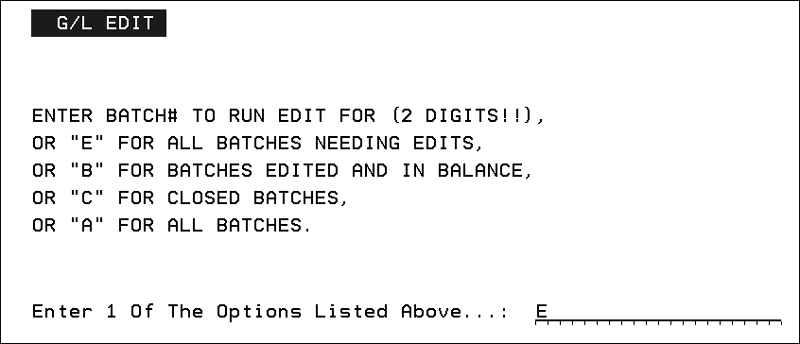

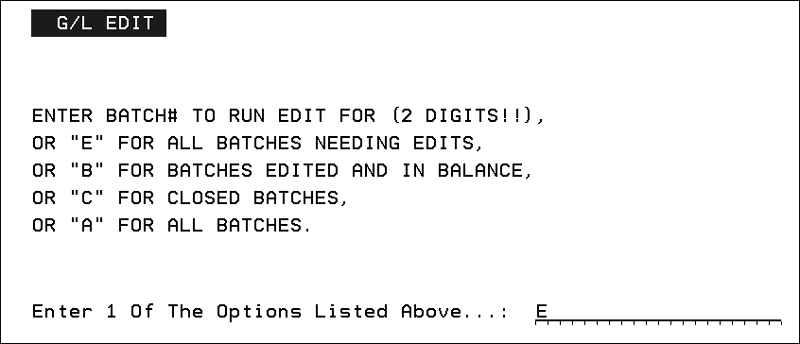

1. On the General Ledger Menu, enter 2 - Edit G/L Journals, and press Enter.

2. Enter a one-digit Company # or A for all companies, and press Enter.

3. If you enter a batch number, the system prints the edit for that batch number only. Following are descriptions of the available options.

E |

Print edits for all batches the system identifies as requiring an edit. E should be your most common choice. The system identifies any newly entered or corrected batch as needing to be edited, as well as any batches that were edited but found to contain errors. |

B |

Reprints batches already edited and found to be in balance, but were not yet posted. Posted batches are synonymous with closed batches. |

C |

Reprints batches already posted as closed. |

A |

Print edits for all batches existing in the G/L system in months that have not been closed. These edits include new batches, edited batches, and closed batches. Batches are inaccessible only for reprinting as edits when the month to which they belong is closed. |

Printing Batch Status Report (GL 4)

Entering Recurring Journal Entries (GL 5)

Searching the Chart of Accounts (GL 7)

How to Create AR Journal Entries for General Ledger