Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Fund Management (menu option FND)

How the System Processes Funds

Fund Statement Code Maintenance By Account Number - FND_3

A fund is essentially a bank account for your customers where the bank is your company, and your customer's deposits can be in the form of dollars, points, or both. Each customer can have their own fund, or many funds, each with their own purpose. For example, one fund can contain dollars that are to pay for an upcoming trip (vacation) and another fund can contain promotional points that can earn a free advertisement for your customer's business. Technically, the system considers a fund to be the combination of a customer account and a marketing program. The key to the Fund File is customer account number plus a marketing program code.

Fund management comes with its own language. Before we examine the finer points of managing funds, here are some terms you should be familiar with.

Term |

Definition |

Overbill |

A unit charge added on to the amount normally charged a customer. For example, you normally charge $3.69, but you are adding a .20 overbill thereby actually charging $3.89. The .20 per unit goes toward the fund. |

Hidden Overbill |

A unit charge added on to the amount you could charge the customer of which the customer. For example, you have just saved $.20 per unit with a new deal from your supplier, and you tell your customer that if he buys enough of the product he will get a free toaster. You keep the customer's price the same, but divert the extra $.20 gross profit (due to the cost savings) into a fund for toasters that the customer is actually paying for. |

Free |

The illusion of goods or services provided without expense. |

Fund Contribution |

Any deposit into a fund. The deposit can be in the form of dollars or points. Fund contributions are made via overbills, point promotions, and direct contributions via use of a Fund Item. |

Fund Item |

An item that is used in Order Entry and invoicing for the sole purpose of depositing to or withdrawing from a fund. This method enables a customer to directly contribute to the fund. For example, the customer may have, through overbills, accumulated $2200.00 towards a trip, but the deadline is near and $2500.00 is required to qualify for the trip. Using a fund item, the customer can request to be billed the additional $300.00 needed to go on the trip. In Order Entry, a fund item is used to bill the $300.00. The transaction affects funds without affecting sales. |

Trip Fund |

A fund that is designed specifically to accrue funds for a travel event or vacation. |

1099 Form |

What you need to send your customers who have participated in a trip fund. You should be aware of what type of promotions qualify for a 1099. If in fact the customer paid for their own trip via overbills, you may not be required to consider any of the funds to be a perk or extra income for the customer. If your company is contributing to, or matching funds, then you probably need to issue a 1099. You must familiarize yourself with all government requirements regarding funds. |

Matching Funds |

An automatic contribution to a customer's fund, made by your company for a specific percentage of the customer's contribution. In a 100% matching fund, your company matches the customer's contribution completely. |

Co-op Fund |

Similar to a matching fund, but usually for cooperative marketing between the supplier, wholesaler, and retailer. When the retailer contributes a certain amount, the wholesaler and/or manufacturer also contributes toward a joint marketing event. |

Trip Reserve |

Although this term is not used within the software itself, it is commonly used in the industry. A trip reserve is a general fund that can be used toward any applicable trips. For example, you might have a 1996 trip to Bermuda that requires $2500.00 per person, a 1996 Florida trip for $500.00, and a 1997 Australia trip for $3500.00. A trip reserve fund could be used for all or any of the trips offered by your company. When a trip is taken, the trip reserve fund is reduced by the value of the trip, and remaining dollars and points can be applied to the next trip. |

Points |

Promotional points can be assigned to a sale instead of, or in addition to, an overbill. Promotional points have no affect on the prices or gross profit within the system. However, when points are used, your company should probably assign a dollar value to each point for internal analysis. You may not want your customers to know that each point is worth $.05, or whatever value you assign. |

Fund Type |

There are different types of funds, as designated by the Fund type field in the Fund File. Basic fund types includes: trip reserve fund, special trip funds, cooperative advertising funds, give-away funds and margin adjustment funds. Examples of these types of funds will follow. |

Complete the following steps to create and manage a fund.

1. Define the marketing programs for which the funds will be collected. Funds can be collected in dollars, points, or both. For example, enter marketing program H04 for the Hawaii 2004 trip fund. The marketing program is established in the Classification Codes File.

2. Create Promotional Pricing File entries that either overbill, assign points, or both for specified products. Specify that the promotional price record is to contribute to a marketing program. For example, enter a promotional pricing records that adds $1.00 per unit of tile, and contributes to marketing program H04, the Hawaii 2004 trip. Usually, the Promotional File record is assigned to specific accounts, or to the same marketing program to which the funds are contributed. For example, you could assign marketing program H04 to all customers signed up for that trip by entering H04 on the Codes Screen of the Billto File. Then, you can assign the Promotional File records to marketing program H04 instead of to the specific accounts. The system automatically applies the promotion to any customer assigned to H04.

3. Create a default Fund File record in the Fund File for that marketing program. A default Fund File record is created using the marketing program code and account number 000000. This record can establish the rule governing the fund for all accounts that use the fund without having to enter a fund record for each account. The system automatically creates the fund records as required.

4. Optionally, you can create Fund File records for specific account numbers. This is necessary only if the rules governing the fund are different for individual accounts. For example, some accounts may want to see the overbills separately on the invoice, and other may not. Optionally, load "balance forward" amounts for each fund if you have been manually managing the fund and there are existing balances.

5. Monitor the fund using the available screen displays and reports:

Fund File Profile Screen shows information and balances.

Order Entry Additional Functions Screen enables drill down fund inquiries by account and marketing program.

Fund Analysis Report and Promotional Pricing Report can list fund details.

Fund Listing shows summarized fund balance information.

How the System Processes Funds

Order Entry automatically picks up the overbilled dollars and promotional points for customers and products that have promotional programs involving funds. The overbilled dollars and points on the Order Entry and Inquiry screens.

Gross profit never includes overbilled dollars or promotional points in its calculations. Each line item on the system has a separate field for fund dollars and for points.

Invoices pick up the overbilled dollars and promotional points as assigned at order entry, but these values can be overridden when invoicing.

When invoices are posted during the night jobs, Fund File records are added (if new) or updated (if they already exist) and new balances for both dollars and points are established. All sales and gross profit statistics exclude fund dollars. Net invoice amount and accounts receivable include fund dollars.

Up-to-date fund balances and history for customers can be viewed from within Order Entry by using the F4 option on the Wildcard Screen. From a detail line on order entry, press F24 followed by F4 to view a customer's fund information.

The basic accounting for an invoice with fund dollars is as follows:

If the invoice is for $110.00, including $5.00 in fund dollars, accounts receivable is debited for $110.00, sales is credited for $105.00, and a liability accounts (such as “accrued funds”) is credited for $5.00. The $5.00 fund contribution is a liability; it is reserved for covering a future expense such a paying for a trip.

A promotion for a trip to Bermuda is established in the following example. The trip is being funded by a 1% overbill on all floor tile products. All of the screens necessary to create the trip fund promotion are displayed.

First, establish a marketing program code using the Classification Codes File as shown above. Marketing code BER is the central data element for the Bermuda trip fund.

You can create many different Promotional File entries that contribute funds based on products. The above screen shows the first screen of a Promotional File entry for item class floor tile. The promotion is called BER2K for each identification when searching files and printing reports.

The above screen displays the Promotional file Profile Screen, which includes a 1% overbill being contributed to marketing program BER. The sub-type F (for fund) is not required, but sub-types can be user-defined for each searching and reporting. This screen causes a 1% overbill to be added to the price for all items in class FT.

The above screen is the third in the Promotional Pricing File. It displays the customers assigned to the promotion. Note that all customers in marketing program BER are affected by this promotion.

Use the previous three screens as a guideline to linking various items at various overbill amounts to the same marketing program. For example, some products could contribute $1.00 per EA; other could contribute 2% of the price.

In order to assign customers to the trip promotion, you must enter the marketing program in the F14 screen of the Billto File of all participating customers. Using this method, this single entry connects he customer to all promotions that point to the marketing program BER.

In order to establish guidelines for the handling of the fund, and a place to store fund contribution balances, enter a default fund record for marketing program BER in the fund File. The default record is always entered with account number 000000. All accounts use the guidelines in this records, unless the account is given its own fund guidelines, as shown on the following screen.

This screen depicts an account that has its own Fund File record, with guidelines different than those in the default BER fund record. This account also has a specific goal of $1500.00, indicating that two couples will attempt to participate in the Bermuda trip.

The above screen is optional. It is used only if you need to enter balance forward amounts that existed prior to setting up the fund on this system. Enter the account number of each customer, the marketing program, and A to add records. Also enter the password. If the fund was previously active, you may have to enter U to update rather than A to add. The following screen appears.

The above screen displays on entry of $475.25 and 150 points being entered as the balance forward for this fund. Ensure there is a password protecting this function, as these balances are actual accounting records.

Setting Up a Co-Op Advertising Fund

A co-operative advertising fund is established nearly identically to a trip fund. However, the types of promotions are specifically related to the cooperating suppliers, and are often fixed dollar overbills rather than percentages.

The above screen displays a $.50 per SF overbills for Castello Ceramic Tile. Refer to other screens in this section that illustrate the creation of a trip promotion.

The Fund File enables you to collect data and establish marketing guidelines for customer funds. Customer funds are liability accounts in which you collect dollars or points toward a marketing event. For example, you could overbill a group of customers by 5% for all sales of certain products, so that they could partake in a company trip when they have accumulated $300.00 each.

Use the Promotional Pricing File to establish which products are overbilled or given points. In the Promotional Pricing File you can also designate which marketing programs and customers are to be affected. The Fund File remembers the overbilled amounts and points for each marketing program and customer. The Fund File also contains rules and comments that govern how the funds are handled.

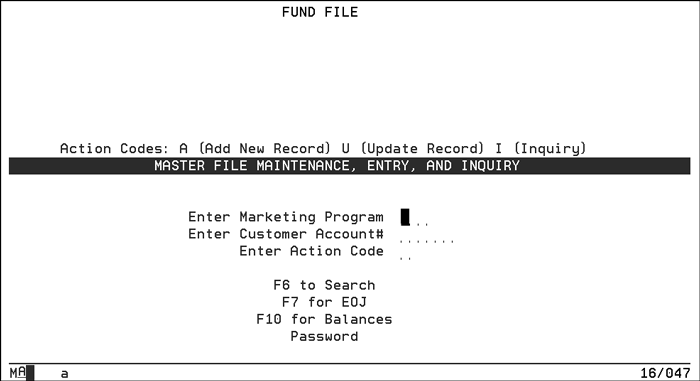

To access this file, select option 1 on the Fund Fund Management Menu (FND).

A fund is a combination of a marketing program and a customer account number.

Following is a description of the fields on this screen.

Field Name |

Description/Instructions |

Enter Marketing Program |

Enter a three-character marketing program. Marketing programs are first established in the Classification Code File. For example, marketing program H97 could represent the 1997 Hawaii trip, or marketing program ADV could represent an ongoing advertising fund. |

Enter Customer Acct# |

Enter an actual account number, or enter 000000 if you are creating a default fund record for the marketing program. A default fund record can establish the rules for the fund for all customers in the marketing program without having to enter fund records by account number. |

This screen defines the rules that govern the fund and displays the balances in the fund..

Field Name |

Description/Instructions |

Marketing Program Name |

This is the marketing program name as entered into the Classification Codes File. This is not an input field. |

Customer Name |

This is the customer name from the Billto file. This is not an input field. If account number 000000 was entered on the Entry Screen, then this field displays Default Record. A Default Fund Record establish rules for all accounts that are in this marketing program except for accounts that have Fund File Records for their specific account. |

Open or Close Fund |

Enter an O to indicate the fund is considered open, or C to indicate it is considered closed. This field causes no action to be taken. It is the Promotional File entries that determine whether or not dollars or points are still being allocated to the fund. This field is primarily for information purposes. |

Fund Type |

This is a user-defined field indicating the type of fund. Suggested codes are:

|

G/L Acct# |

Enter the general ledger account number to which this fund should post. The general ledger account number is usually a liability account. |

Cost Ctr |

Enter the cost center to which this fund should post for general ledger, or leave this field blank. |

Important: When overbilling is used to move dollars into funds, it is not part of the gross profit calculation. For example, if a product is sold at $2.00 per PC, but has an additional $.50 overbill for a fund, the gross profit calculation is figured using $2.00 rather than $2.50. |

|

% of Overbills to be Contributed by House |

This field is for information purposes only. Complete this field only if you company will deposit into this fund a percentage of the amount overbilled to the customer. |

% of Total Sales to be Contributed by House |

This field is for informational purposes only. Complete this field only if your company will deposit into this fund a percentage of the customer's sales. For example, 1% of customers sales will be contributed by your company toward this field. |

Each Point is Earned Per |

If this fund will accumulate points, enter the number of units or dollars for which each point is earned. For example, each point is earned per three units. Promotional points can be earned per unit sold, or per dollar sold. For example, one point per square foot versus one point per dollar. You can also enter a divider can be any quantity between 1 and 999. Invoices and promotional sales reports reflect your entries in these field. |

Unit or Dollars |

Enter $ if points are earned per dollar. Enter U if points are earned per unit sold. |

Text |

Enter important descriptions or information about this fund here. Use the Notepad if more space is needed. |

Date Fund Opened |

This field displays the date on which the fund record was entered on the system. |

Date 1st Contribution |

This field displays the date of the first dollar or point contribution to this fund. |

Date Last Contribution |

This field displays the date of the most recent dollar or point contribution to this fund. |

Date Fund Closed |

The date the fund is closed displays here A C will display in the Open/Close Fund field. |

Current Balance |

The following four fields show the balance in the fund through the last Nigh Jobs run, or through yesterday's invoices. |

Customer Contributions |

This is the balance in dollars of fund contributions filled to the customer for this fund. This balance is updated by the Invoicing System. |

House Contributions |

This field is not automatically active. It represents funds not actually billed that will be contributed by the house (your company) to the fund. |

Total Contributions |

This is the total accumulated dollars in this fund. |

Total Points |

This is the total points contributed, via invoicing, to this fund. |

Goal $ |

This is the goal, in dollars, that you are targeting to collect in this fund. |

Goal Points |

This is the goal, in points, that you are targeting to collect in this fund. |

Show Fund $ Separately on Invoice? |

Enter Y to show the fund contribution (overbill) portion of the price separately from the basic price of the goods on the invoice. Enter N to not show separately. The invoice displays the price including the fund amount as a single price. |

Show Fund Mrktg Prgm# on Invoice? |

Enter Y to show the marketing program under any line item on an invoice that includes a contribution to this fund. Enter N if you do not want to show the marketing programs. |

Show this Fund Description on Invoice |

Enter a description to print on an invoice under any line item that includes a contribution to this fund. Leave this field blank if you do not want to show a description of the fund. |

When assigning promotional points in the Promotional Pricing File, you can specify any number of promotional points from 1 - 99999, which are then qualified by the Fund File parameters. For example, the Promotional Pricing File included 10 points and an invoice is created for 20 units (native units of measure) at $5.00 each, which extends to $100.00. If the Fund File contains each point earned per one unit, then this invoice earns 200 points. That is 10 points multiplied by 20 units sold, and divided by one per unit. If the Fund File states that each point earned per $2.00, then this invoice earns 500 points, that is, 10 points multiplied by $100.00 and divided by $2.00 per point.

The amount overbilled is never included when figuring points based on dollars. The points are figured using the extended dollar amount excluding the fund dollars.

The invoice print program handles funds as follows:

If a line on an invoice contains any fund dollars or points, the program checks the Fund File.

The program first checks for a Fund File record for that specific customer and marketing program.

If no specific Fund File record is found, the system checks for a default fund record for that marketing program. Default records are entered in the Fund File with a marketing program code and account number 000000.

If a Fund File record is found, the system checks for a default fund record for that marketing program. Default records are entered in the Fund File with a marketing program code and account number 000000.

If a Fund file record is found, the invoice program prints that line according to the parameters in the Fund File.

If a Fund File record is not found, the invoice program prints according to system defaults, which are to show the regular price, the overbill amount, and the points separately.

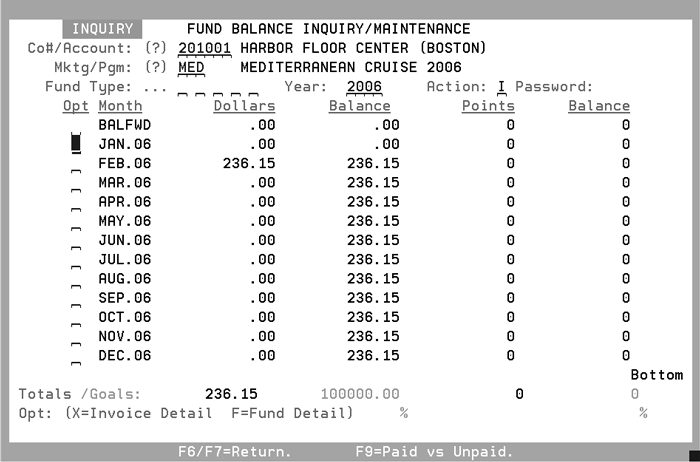

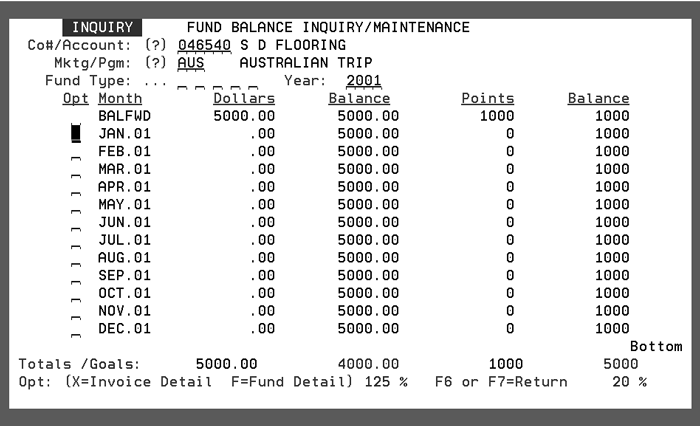

This screen displays past, current, and month-by-month balances for a customer (all of the customer's funds combined), a specific fund, or combination of funds for a customer. This screen can be accessed via F10 from the Fund File Entry or Profile Screens.

Following is a description of the fields on this screen.

Field Name |

Description/Instructions |

Co# / Account |

Enter the company and account number for the customer whose fund balance you wish to inquire. |

Mktg/Pgm |

Enter the marketing program for which you wish inquire, or leave this field blank to view a combined total for the account or to select be fund type. |

Fund Type |

You can enter up to five different fund types which you wish to combine on the display. If all fund type fields are blank, then the display combines all fund types from the file when building the display. This field is applicable only if you leave the Marketing Program field blank. The program adds all funds for the specified customer and fund types. |

Year |

Enter the year in which you wish to view the monthly breakdown. If you leave this filed blank, then a screen displaying all available years appears. |

Opt |

This option field enables you to enter a code that can retrieve more detail for the selected month. If multiple marketing programs are being displayed, option M displays all of the separate marketing programs. If shows the marketing programs which make up the value shown for the month. If a single marketing program is displayed: X indicates to show the invoice detail for the month and marketing program selected. F indicates to show a Detail Screen which displays the same information as the Fund Profile screen. |

% |

This field displays the percentage of the total goal amount the customer has reached. The percentage is displayed for both dollars and points. For example, 50% means the customer has achieved 50% of their goal. |

Month |

Displays the month and year. |

Dollars |

Displays the dollar amount accumulated. |

Balance |

Displays a running balance of the dollars and points. |

Points |

Displays the points accumulated. |

Totals |

Displays the total dollars and points. |

Goals |

Displays the dollar and points goals for the marketing program for the customer. If all marketing programs are displayed, then this field displays the accumulated goal amounts of all marketing programs |

Fund Statement Code Maintenance By Account Number FND 3

The Fund Statement Codes by Customer File enables you to enter a user-defined statement code next to each customer account number that is to receive a fund statement.

Following is a description of the fields on the above screen.

Field Name |

Description/Instructions |

Co/Acct |

Enter a company number plus the account number in order to position the Search Screen from that account number. |

Name |

Enter a customer name, or part of the customer name, in order to position the search alphabetically from that name. |

Code |

Enter any one-character code for the statement code. This code can then be used to select by in the Fund Statements Program. |

This option lists the contents of the Fund File. It prints basic information about each fund as well as current balances.

Following is a description of the fields on the above screen.

Field Name |

Description/Instructions |

Option 1 |

Sorts the listing by marketing program followed by customer account number. |

Option 2 |

Sorts the listing by customer account number followed by marketing program. |

This program prints an analysis of activity (not balances) for funds. It is a detailed report which lists each invoice/line number that has contributed to each fund.

Note: This report automatically accesses ROLLOVER files if (a) ROLLOVER Files exist and are active, and (b) the date ranges include invoices that are in the ROLLOVER file for invoices. Rollover functionality must be activated via the System Wide Setting Options for Rollover Files.

The above screen enables you to select by the criteria shown. You can mix the various parameters. The parameters have an AND relationship going down and an OR relationship going across. We recommend that when using the invoice numbers, invoice dates, and accounting months parameters, that you enter only one of these three options. The accounting month option is the recommended option for reconciling fund activity. Also note the two versions of marketing program selections. The two marketing program selections must be carefully observed. When selecting marketing program from the Billto File, the program checks that the selected marketing programs on this screen are in the Billto File. When selecting marketing programs on this screen are in the actual invoice/line record. The marketing program on the invoice/line is the one actually used for the fund contribution.

The second part of the Fund Analysis Report controls the sorting and subtotaling of the Fund analysis Report.

The above screen contains default values as shown. You can change to any of the options listed. You must enter 1, 2, 3, and 4 next to the four fields by which you want to sort. 1 if the primary sort, 2 is the first sub sort, followed by 3 and then by 4.

The Fund Balance Report contains summaries by branch and/or customers. It shows the previous balances, month’s activity, and current balances.

Following is a description of the fields on the above screen.

Field Name |

Description/Instructions |

Company / Branch |

Enter a company number and branch. Optionally, you can leave this field blank to include all branches. |

Month / Year |

You are required to enter a month and year. Enter the month for which you want balances listed. |

Report Level |

Enter D to print the details of each customer within the branch. Enter S for summary by branch only. Enter B if you want both reports. |

Ignore Zero |

Enter Y to omit fund accounts with zero fund balances. |

Fund Type |

Enter a specific fund type code. Optionally, you can leave this field blank to include all fund types. |

Salesperson |

Enter a specific salesperson. Optionally, you can leave this field blank to include all salespeople. |

Conversion for dollars per point |

This optional field enables you to enter a dollar amount per point conversion. The report prints the value of the points per fund using this conversion. |

This program creates statements for customers regarding their fund balances and their monthly contribution. Various formats can be created using the options shown on the following screen.

Following is a description of the fields on the above screen.

Field Name |

Description/Instructions |

Account # |

Enter a specific customer account number. Optionally, you can leave this field blank to include all account numbers or enter a question mark (?) to instigate a search. |

Mktg/Pgm |

Enter a specific marketing program. Optionally, you can leave this field blank to include all programs or enter a question mark (?) to instigate a search. |

Co#/Branch |

Enter a specific company or branch number. Optionally, you can leave this field blank to include all company or branch numbers or enter a questions mark (?) to instigate a search. |

Month/Year of Statements |

You are required to enter the month and year for which to print statements. |

Statement Type |

1 - Invoice Detail - provides a statement listing each invoice for the month. 2 - Fund Detail - provides a statement listing each fund into which you contributed. 3 - Fund Summary - combines all funds into one statement.4 - Fund Type - summarizes funds by fund type. |

Include Customers with Statement Code |

Limit your entry in this field to a specific statement code as entered in the Fund Statement Code Maintenance Program. Optionally, you can leave this field blank to include customers with any statement code or no statement code. |

Print Statement Notes |

Enter Y to print the statement notes. Statement notes are maintained using F9 from this screen. |

Fund Type |

Enter a specific fund type. Optionally, you can leave this field blank to include funds regardless of type. |

Show Goals on Statement |

Enter Y to show the goals of each fund and the percentage of each goal achieved. |

The following screen displays when you press F9 from the Fund Statement Print Selection screen.

Following is a description of the field on the above screen.

Field Name |

Description/Instructions |

Statement Type |

Enter type 1, 2, 3 or 4. Each type represents a style of report each with its own headings. Enter type 1, 2, 3, or 4 to display the heading fields for that type. |

Select a statement type and press Enter. The following figure displays an example of an Invoice detail (option 1).

Field Name |

Description/Instructions |

Heading 1 and 2 |

Two lines are provided for the top of page headings on the Fund Statements. |

Text Area |

Additional lines are provided on this screen for you to insert comments or instructions regarding the Fund Statements. These comments print under the headings on the statement. Press RollUp and Roll Down to access more lines. |

Usually fund contributions are added to the price of regularly sold items. However, sometimes you need to directly manipulate a fund. Fund items are special items used to contribute or withdraw fund dollars without involving inventory or affecting sales. They are used for the following situations.

Bill a customer for an amount that will be added to a fund when no actual merchandise is being ordered.

Credit or withdraw funds when no merchandise is involved, such as when a fund is being closed at the end of a promotion.

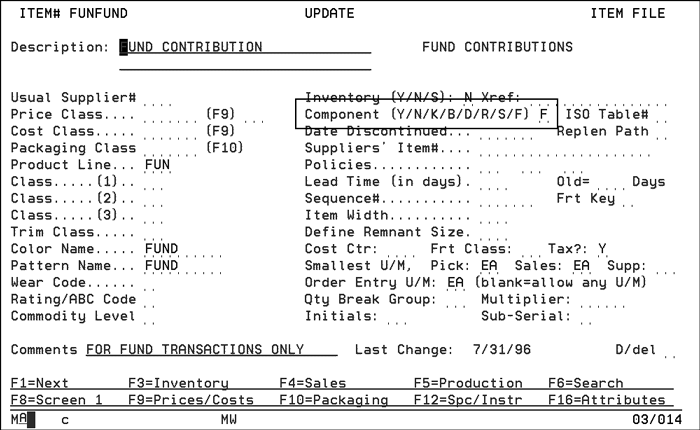

Fund items are set up in the Item File. We recommend that you set up a manufacturer code for this purpose. You can select any code. Following is a sample of a Fund Item in the Item File Maintenance Program:

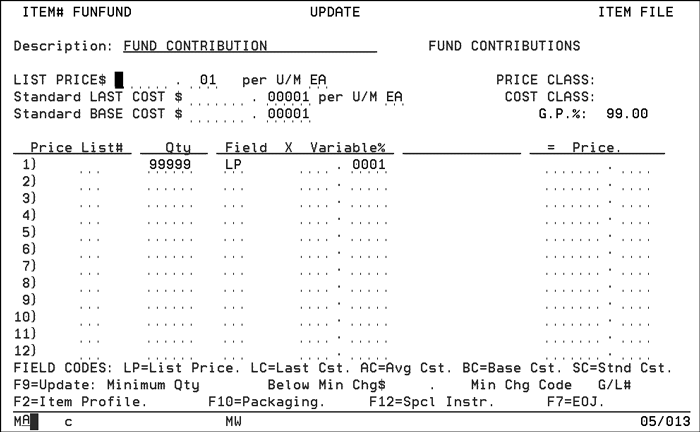

The above screen shows a sample fund item. The essential field in defining a fund items is Component Code, which must contain an F. The following screen is the F9 Pricing Screen in the fund item. Note that the fund item above has no price class, cost class, or packaging class.

The above screen shows fund item pricing. Price and cost are .001 and .00001, respectively. However, order entry forces all fund items to have no cost or price. You are prompted to enter the fund contribution required.

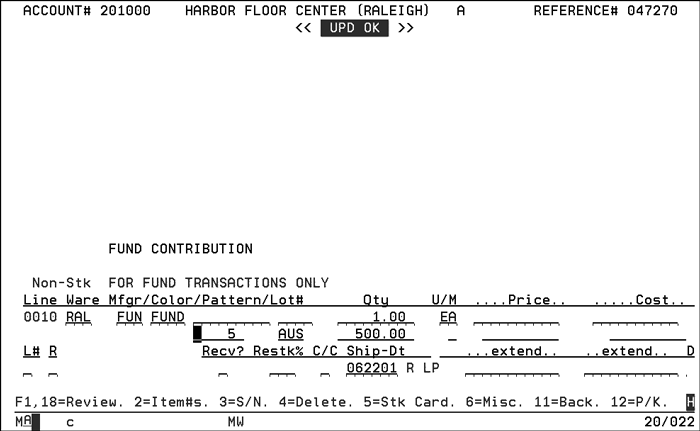

The following screens show how fund items are used in order entry.

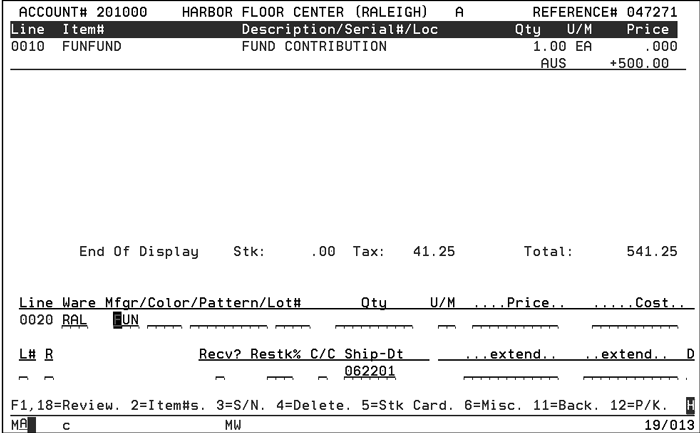

The above screen shows the proper use of a fund item in order entry. When you enter a fund item, the additional fields display as shown above. Enter the quantity as 1 EA (as in 1 contribution) and enter the fund related fields as shown. Enter points if applicable. The example shows 5 points being entered. Enter the marketing program to which you want to contribute. The above example shows marketing program AUS. Enter the fund dollar contribution, if applicable. The example shows $500.00. Note that the price and cost fields are always zero for fund items. This example shows a contribution of $500.00 plus 5 points to the Smith Floor AUS fund. The following screen shows this entry in review mode.

The above screen shows Order Entry review of a fund item with tax. Tax is applied only to taxable orders, exactly as it would be applied when ordering merchandise. There is a Company Settings File option that controls whether or not fund contributions should be taxed. We recommend that you tax funds exactly like merchandise unless you have specific information to the contrary.

There are many ways to close out funds. Our recommendations follow:

1. Expire all promotional pricing records that are contributing to the fund being closed unless it is an ongoing promotion such as a trip reserve fund or general fund.

2. Invoice any remaining open orders with fund contributions for that fund.

3. Use fund items to invoice customers for any shortfalls in their funds that may be required to finalize their participation in a trip or promotional event.

4. Create a credit memo for each customer being closed out:

Use fund items with a negative quantity to indicate credit.

Credit each customer the full amount being used for the trip or promotional event. Their fund will be reduced by this amount.

Credits to customers must not be mailed! Run these credits in a separate batch.

Immediately after night jobs post the credits to accounts receivable, clear the credits from accounts receivable by

— entering a zero check and batch amount (make check# = fund)

— clear the credits from each customer's account.

— enter offsetting amount to make check and batch total equal zero in the Miscellaneous Cash General Ledger account (account 9999 on A/R). Accomplish this by using the G/L account for "Accrued Promotional Expense".

5. The accounting works as follows:

The credit memo to close out each customer's fund credits A/R and debits the Fund Contribution Liability account.

The clearing of the credits through A/R debits A/R and credits the liability account for the accrued (expected) expense for the trip.

When you are actually invoiced for expenses regarding the trip or event, you will debit (clear) the accrued expense for the trip or event.

After all expenses for the trip or event are realized, the remainder in the accrued expense liability account is booked to a profit or loss account. The remainder is the profit or loss on the trip or event.

In order to close out funds without issuing credit memos, you would have to reduce each customer's fund using "back door" methods, such as adjusting the fund balance forward records. We do no recommend this method because it leaves no proper audit trail. In any case, you must also ensure that your general ledger fund liability accounts are reduced accordingly.

Promotional Pricing File - FIL 30

System Wide Setting - Options for Labor and Fund Items (Items with Comp. Codes L & F)

Customer Fund Balances in Order Entry

Reports

List Funds File - RMF 112

Fund Analysis Reports - RPT 360

How to Add / Deduct to Fund Balances/Marketing Programs (Points)

How to reduce Point Fund Balance

How to manually enter a fund to an order

How to research pricing situations - promos, rebates, funds, etc

Funds from invoice not moving into fund file for a specific account