Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

After entering transactions using option 1, select this option to run a printed listing edit of AP invoices. The edit will either issue a message, APPROVED FOR UPDATE, or a list the errors that prevent posting of AP invoices. You need an approved edit before the system allows you to post.

1. From the Accounts Payable Menu, select option 2 - Edit A/P Transactions.

2. Press Enter. The system prompts you to enter a Company #.

3. Type the one-digit company number and press Enter. When the edits are processed, they are sent to the print spool.

The AP Edit report lists all of the transactions you entered in option 1 - Enter A/P Transactions, but have not yet posted with menu option 3 - Post A/P Transactions. A voucher invoice is considered in balance if the amount debited to G/L accounts is equal to the amount credited to G/L accounts, and the full amount of each invoice was allocated to one or more expense accounts.

If all vouchered invoices on the edit are in balance, you can post the transactions. The message, This Batch Approved For Posting, appears at the end of the edit. The system also checks that the batch total entered by the operator equals the batch total as calculated by the program.

Note: If all vouchers invoices within a batch are in balance, the system accepts the batch for posting, even if the batch total is out of balance. The message, Warning/Batch Control Is Out of Balance But Invoice Control Is O.K. / Computer Will Accept For Posting, prints at the end of the edit if you do not balance to the batch total.

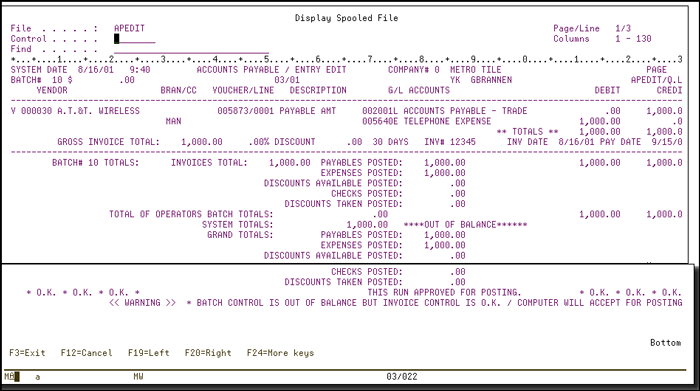

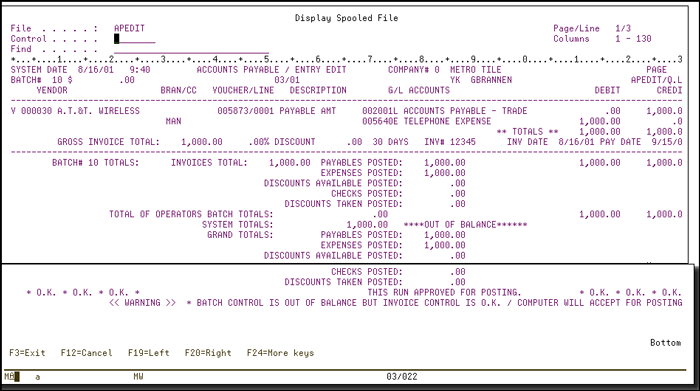

Sample Edit #1

The sample edit shown below is the simplest possible example. The entire edit consists of a single batch, and the batch consists of a single voucher. The voucher is for an invoice from vendor 000030 AT&T Wireless. The invoice is for $1000.00 for telephone expenses. The G/L account for Accounts Payable acct. 0020001 is credited $1000.00 and the entire $1000.00 expense is debited to the G/L expense account for Telephone Expense account 005640. The system has assigned voucher 005873 to this transaction. Only one line number was needed—line 0001. If you want to make a change before posting, you can return to the Enter A/P Transaction program, option 1, on the menu and access transactions under the voucher and line numbers listed on the edit.

Each Voucher is listed separately between two dotted lines. The Gross Invoice Total is compared to the total amount posted to expense accounts, and the total debits is compared to the total credits. Both comparisons must be equal for the voucher to be acceptable for posting.

The G/L account numbers, names and the amounts to be posted to them are displayed. The letter following the G/L account number is the main category code as entered in the Chart of Accounts File A = Asset, L = Liability, E = Expense, Q = Equity, I = Income.

The Batch Totals section of the edit summarizes each batch in logical terms. Instead of using the terms debit and credit, this section shows how much will actually be posted. The above example shows that $100.00 of payables will be added to the system and $100.00 of expenses are incurred. If the above example was a credit memo for $100.00-, both of the figures would have a negative indicating a decrease in open payables and expenses.

The Total of Operators Batch Totals is the sum of the operator’s entries in the batch total field on Screen 1 of the A/P posting program. If the edit includes two batches, and the operator entered $50.00 as the batch total for the first and $25.00 as the batch total for the second, $75.00 would appear here.

The System Totals is the sum of the batch totals that the system has calculated by adding all of the entries in each batch.

The Grand Totals are the sum of the batch totals.

If the edit is considered acceptable for posting, the message, This Run Approved For Posting, is printed.

Note: Each edit may consist of many batches, each containing many voucher numbers. All vouchers in an edit must be in balance in order to post any of them. You can not post part of an edit.

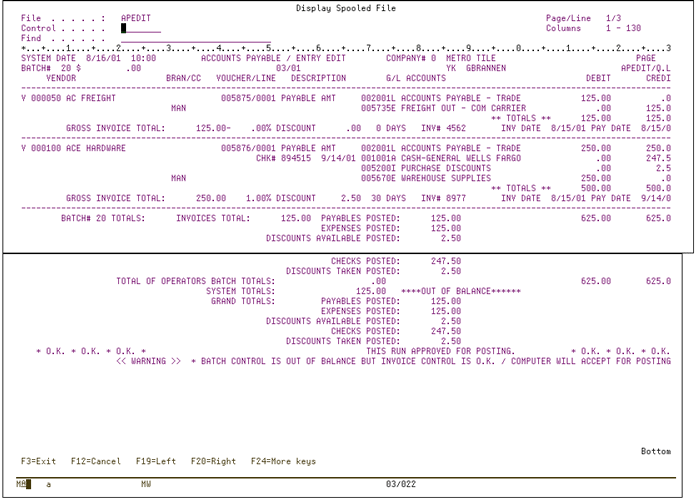

Sample Edit #2

This edit lists a batch which includes two vouchers, each for a different vendor. The first is a credit memo. The second is a prepaid invoice.

The credit memo voucher 000433 looks similar to a regular vendor invoice. However, the debits and credits are reversed. The second voucher 000043 has four G/L accounts that are involved in this trans-action. It represents the prepaid invoice. The vendor's bill for $250.00 was paid by manual check 504199. Both the bill and the check are being recorded by this transaction. A discount of 1.00% $2.50 was taken. The G/L account for accounts payable is credited $250.00 for the bill and debited $250.00 for the payment. The cash account is credited $247.00, the amount of the check. The discount of $2.50 is credited to the Purchase Discounts account, which is an income I account. The expense account for computer supplies is debited $250.00.

The pay date, in this case, is also the Check Date.

Entering Invoices In Navigator