Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Managing Sales Tax

In order to effectively record, manage, and report sales taxes, several system features should be carefully considered. The goal is to automate the assignment of sales tax codes and rates, so human error is minimized. This document discusses the different tax set up and the available tax reports

Understanding Files That Control Sales Tax

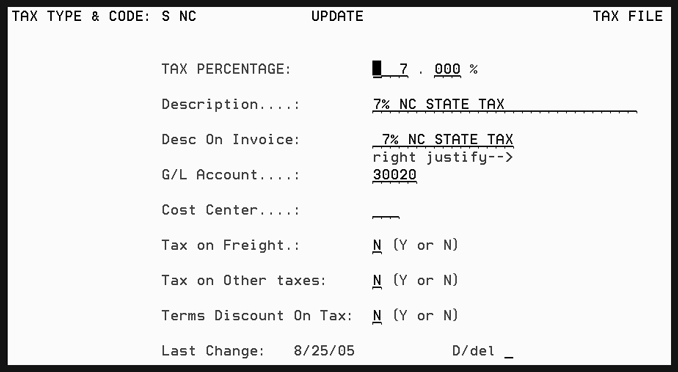

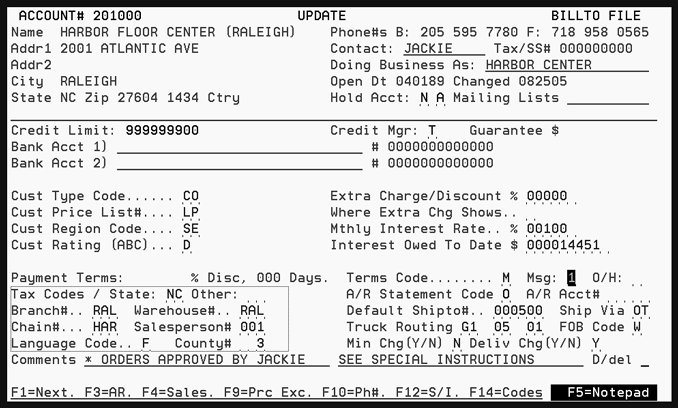

Tax codes can be assigned to each customer in the Billto File and overridden when necessary on Order or Invoicing Header screens. Each customer, order, or invoice can be assigned up to two tax codes. Each tax code represents a state, local, or combined tax percentage. The tax percentage is applied to taxable line items on an invoice. The total tax amount is shown on the bottom part of invoice. A sales tax report is available. See option 7 on the Sales Reports Menu. The Sales Tax Report can be sorted and sub totaled by entities such as state, county, or tax code. Tax Codes are defined in the Tax File on the File Maintenance Menu.

F6 miscellaneous charges are marked as taxable by entering an equal (=) sign, as instructed on the screen. If the Tax File record (related to the tax codes used on the order header) specifies Y for the Tax On Freight option, then all F6 miscellaneous charges will default to taxable the equal sign is automatically inserted). In this case, you must type any character except the equal sign to make the line untaxable. We recommend using an asterisk (*).

Tax codes can also be assigned in the County File. These County File tax codes can be used by Order Entry and the Recurring Invoice system. On the Order Entry Header Screen, you can use F9 to toggle between taxable and non-taxable status. If a customer is normally not taxed, then the Billto record will not have any tax codes assigned. In this case, Order Entry finds the applicable tax rate by retrieving the customer’s county number and checking the County File for tax codes. The tax codes from the County File are inserted on the Order Header Screen. The Recurring Invoice system is used primarily to bill samples and sample programs (quarterly sample or display invoices). This system can tax customers who are not normally taxed and therefore, have no tax codes in their file. The system uses the customer’s county number to find the applicable tax rate from the County File.

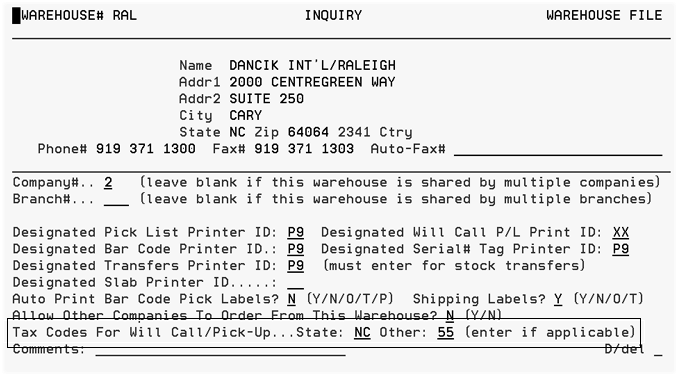

Based on local laws, tax can be based on the point of pick up, the location of the customer, or the location of the shipment. You can optionally assign tax codes to each warehouse to be used for pickups. Refer to “Warehouse File” in File Maintenance Reference for more information. You should also formulate policies for your order desk regarding when and how to override taxes for non-standard shipto points.

Understanding Files That Control Sales Tax

The following files and settings are maintained for sales tax:

Classification Codes File - Ship Via Codes (Menu FIL 19)

Warehouse Will Call Tax Table (Menu FIL 42)

Tax by Zip Code Table (Menu FIL 43)

Tax Exemptions by State/Province (Menu SYS 605)

System-Wide Settings (Menu SET 4)

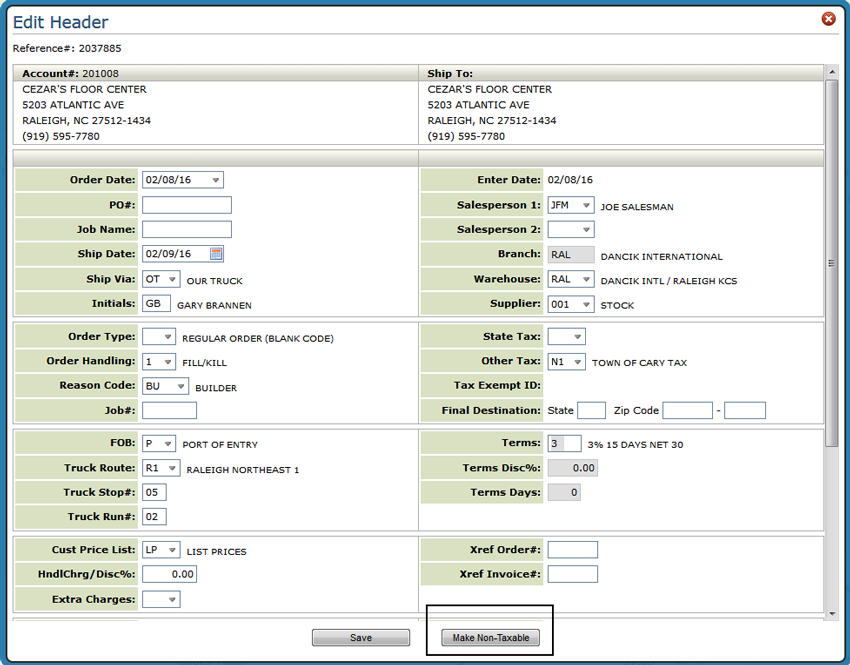

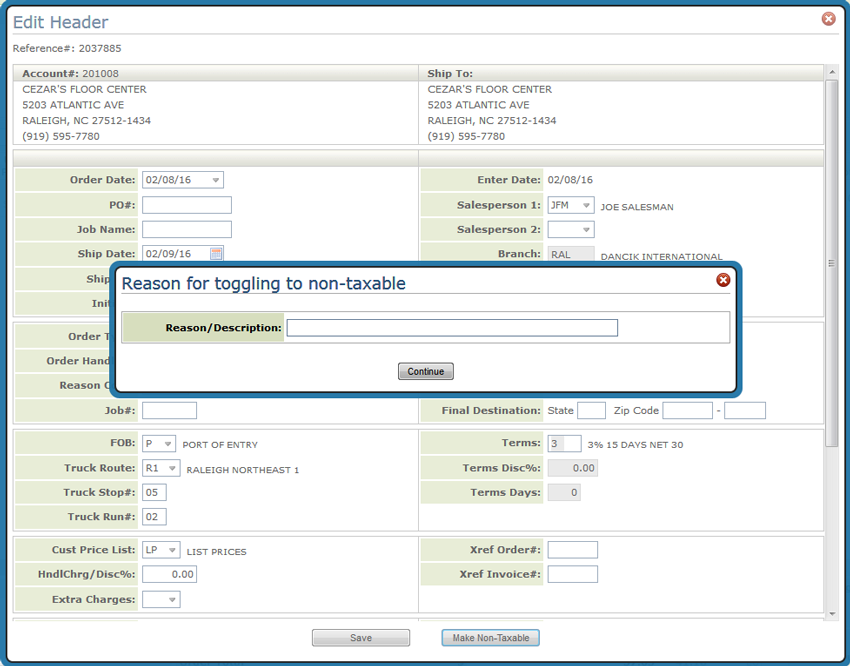

The Order Header contains functionality that allows you to toggle between making an order taxable or non-taxable.

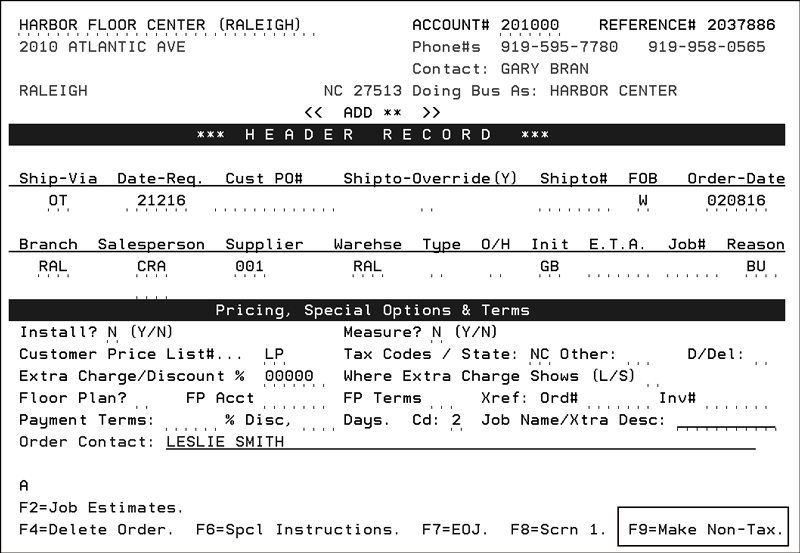

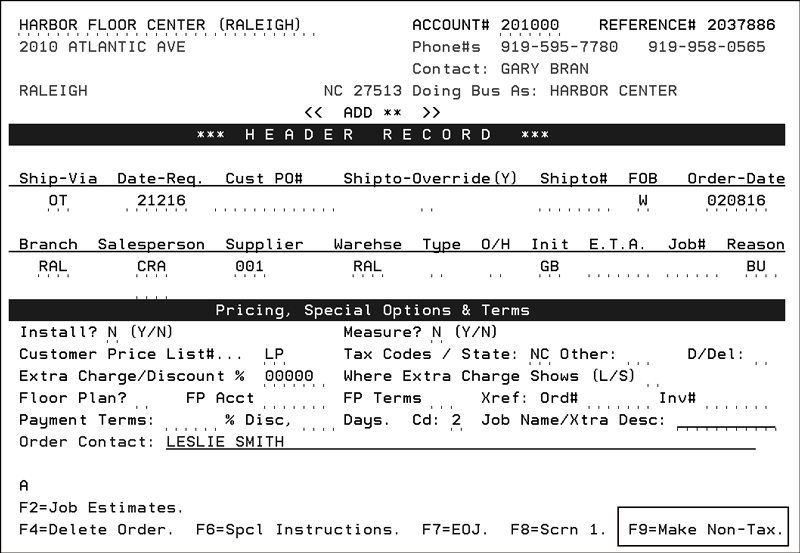

On the green screen, this functionality is accessed via the F9 function key.

In Navigator, click the Make Taxable/Non-Taxable button on the Order Header.

When changing the tax status of an order, a description is mandatory on both the green screen and Navigator.

Note: The Taxable/Non-Taxable functionality does not import information in from the Taxes by Zip Code Table or the County Tax File.

Green Screen only

After changing the tax status of an order you must process the order, before making another change to the tax information.

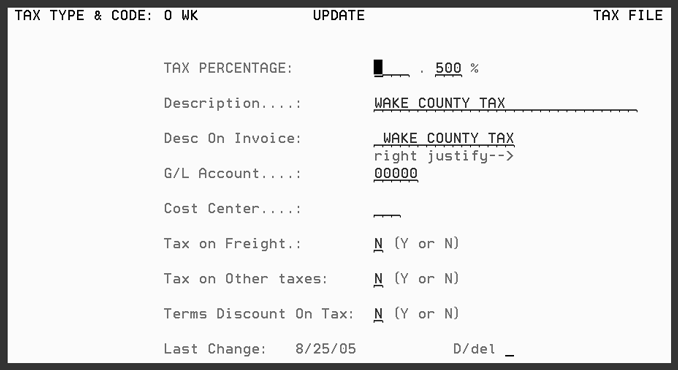

Create codes representing sales tax rates for each state/province, and each county/city/etc. These codes may be divided into two levels - State/Province Tax Codes, and Other Tax Codes. In countries that have a national goods and services tax (such as Canadian GST), you need to use the “Other Tax” code for the GST.

Note: A “tax code” represents a geographic area, such as a state, province, county, or city. A “tax rate” is assigned to a tax code, using the Tax File. The rate may be changed in the Tax File, without assigning a new tax code.

The recommended setup of the tax file is as follows:

Establish a State Tax Code for each state or province, with the respective state/province tax rates.

Establish Other Tax Codes for each county/city/local tax jurisdiction, with their respective tax rates.

Assign only a State Tax Code when only a state tax applies.

Assign both a State Tax Code and an Other Tax Code, when both state and local taxes apply. The system charges sales tax using both rates.

A taxable customer is defined as “a customer that should be automatically charged sales tax by you for business with you in at least one state/province”. It is recommended that you:

Insert the standard or most common tax code(s) for each taxable customer. Tax codes entered in the Billto File are used on taxable orders which are NOT considered “will calls”.

If the Billto File does NOT contain any tax codes, the customer is considered “non-taxable (tax exempt)”. The system attempts to tax a non-taxable (tax exempt) customer if:

— in Order Entry the “make order taxable” key is pressed

— in Order Entry, a “must tax” item is ordered (such as samples or displays)

— If the Tax by Zip Code Table (FIL 43) is used.

Note: If the option “Always make order non-taxable if Billto File has no tax codes” in the System Wide Setting (SET 4) - Options for Sales Tax is activated, the Tax by Zip Code Table and will call ship via orders are overridden.

Enter a County# in each Billto File record. The County# identifies the county of the customer for sales analysis purposes, and if the Billto File does NOT contain tax codes, the system can also find a customer's tax rates, by checking the County File.

The Warehouse File stores the tax codes used on taxable orders that are “will calls” (customer pick-ups as opposed to shipments) from each warehouse. These tax codes represent the tax for the state/province/county/city where the warehouse is located. If a customer is taxable, and the order is a “will call”, the Order Entry program automatically use the tax codes in the Warehouse File instead of the tax codes in the Billto File.

The County File is used on taxable orders that are shipped (as opposed to will call) into each county. The tax codes entered in the County File represent the tax for sales made in (or shipped into) each county. Each County File record is assigned a State and a County number. The Counties are user-defined. The County File tax codes are used when the system needs to tax a customer that is normally non-taxable (tax exempt) and therefore has no tax codes in the Billto File.

Note: You might need to establish multiple county codes for the same county if it has different municipalities that have different tax rates.

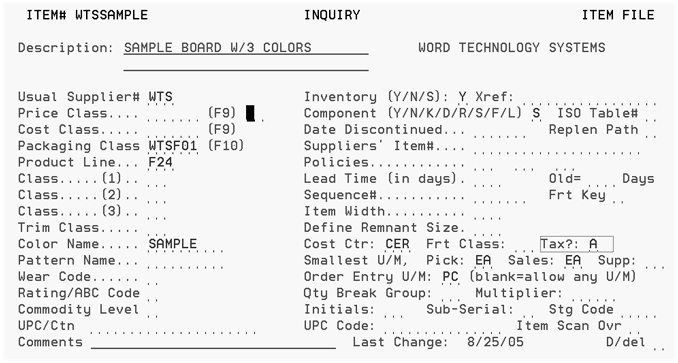

All items are considered taxable when an order is taxable. All items are considered non-taxable when an order is non-taxable. The only exceptions to these rules are for items that are coded in the Item File with Tax Code = A, or Tax Code = E.

Items with Tax Code = A are “Always Taxable”. Therefore, even if an order is non-taxable (no tax codes), the Order Entry program tries to find a tax rate for that item by using the various tax files - County File, Warehouse File, Tax By Zip File, etc. Once an item is placed with an "always tax item" it is recommended that if you need to change tax you delete the order and reenter it

Items with Tax Code = E are “Tax Exempt”. Therefore, even if an order is taxable, items coded with Tax Code = E are not taxed.

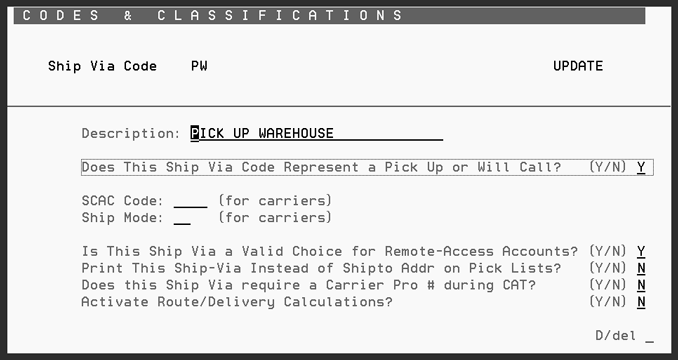

Classification Codes File - Ship Via Codes (Menu FIL 19)

Ship Via codes are created and maintained in the Classification Codes File. Each Ship Via is defined as either a “Will Call” or not. This is an extremely important setting for determining the correct sales tax. All orders with Ship Via codes that are defined as “Will Call/Pick Up” are taxed based on either of the following:

the tax codes in the Warehouse File (where the goods are picked up)

or the tax codes in the Warehouse Will Call Tax Table

All other Ship Via codes are considered to be “shipments” or “deliveries”, that are taxed based upon the tax codes in the files - such as Billto, County, and Tax By Zip, based on the address of the customer or shipto.

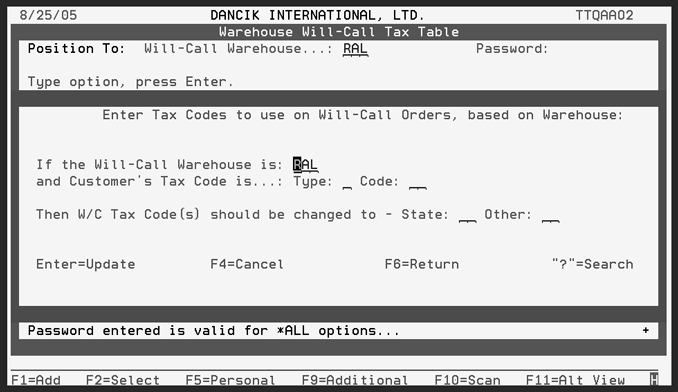

Warehouse Will Call Tax Table (Menu FIL 42)

This file/table can alter the usual will call tax codes (found in the Warehouse File) based on where a customer is located. This table is only needed in certain states. It adjusts the tax codes on an order, based upon the business address of the customer as well as the business address of the will call warehouse.

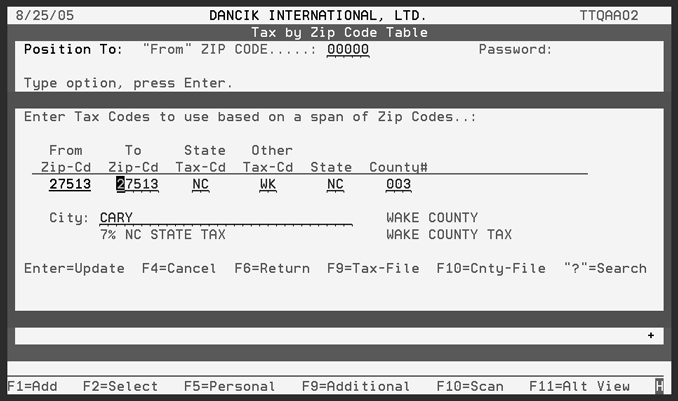

Tax by Zip Code Table (Menu FIL 43)

This file/table enables you to assign tax codes to each span of zip codes that you ship product into. This table is used when the system needs to tax an order that is being shipped to an address other than the address in the customer's Billto File. This table is crucial for determining the correct tax codes to apply to orders that are shipped to job sites or any address other than the customer's regular Billto File address.

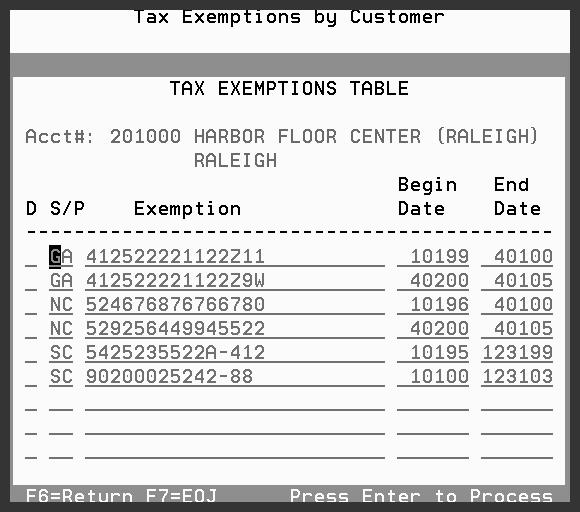

Tax Exemptions by State/Province (Menu SYS 605)

This file maintains exemptions by customer, by state or province, with start and expiration dates. If this file is activated, tax exemptions for each order are checked, based upon the customer account# and the state into which the material is being shipped, or the state assigned to the warehouse from which a will-call is made. If an exemption record is found for that account and state, and the current date is within the start/expiration date span of the exemption, the order will be considered non-taxable (tax exempt).

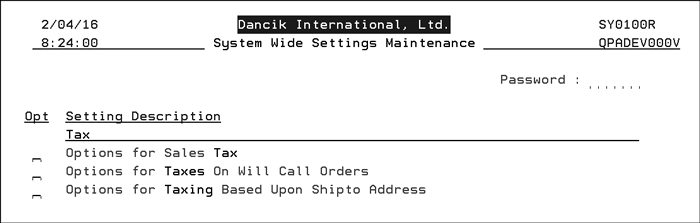

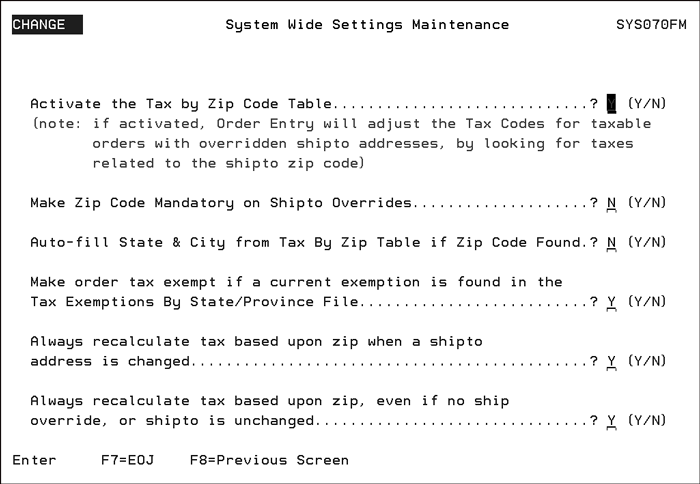

System Wide Settings (Menu SET 4)

This is a file of system settings that control many system features. These settings are maintained by your System Administrator or IT Department. There are settings that activate and control various tax-related files and features. Make sure that these are set to your requirements.

Options for Taxes On Will Call Orders

Options for Taxing Based Upon Shipto Address

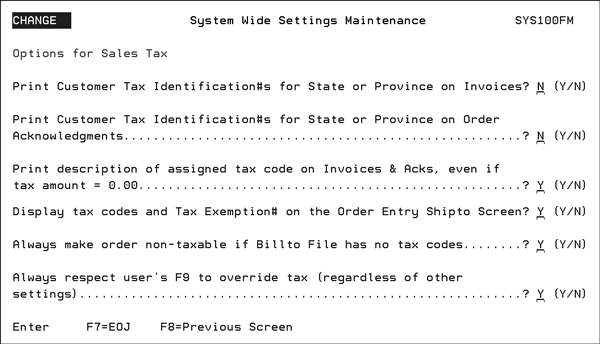

Print Customer Tax Identification#s for State or Province on Invoices - This setting causes the Customer's Tax Exemption number to print on the invoice if no tax was charged. The Tax Exemption number printed relates to the date of the invoice. Proper use of this feature ensures that during a tax audit all invoices will either show the tax that was charged or show the Tax Exemption number.

Note: Option SYS 605 - Tax Exemptions By State/Province File Maintenance allows for customers to have multiple tax exemption numbers per state or province based on beginning and ending dates.

Print Customer Tax Identification#s for State or Province on Order acknowledgements - This setting causes the current (active) Customer's Tax Exemption number to print on an acknowledgement if no tax was charged. Today's date is used to lookup the correct tax exemption number.

Print description of assigned tax code on Invoices & Acks, even if tax amount = 0.00 - This setting causes the tax description (such as “Export No Tax”) to print in cases when a tax code is assigned, but the tax rate is 0.00%.

Display tax codes and Tax Exemption# on the Order Entry Shipto Screen - This option causes the state and other tax codes to appear on the Shipto screen (below the Final Destination fields). Also, if an active Tax Exemption number was found for that state or province, then it displays as follows: XX Number (where XX is the state or province and Number is the Tax Exemption number).

Always make order non-taxable if Billto File has no tax codes - The Billto File (FIL 1) contains fields to enter two tax codes (State and Other, which could be used for local taxes). If both of these fields are empty, the order is automatically considered non-taxable. If this setting is activated and the Billto tax codes are blank, the order will remain non-taxable, regardless of the shipto, shipvia, and warehouse settings. However, the user can use F9 or manually override the tax fields in Order Entry. This ensures the Billto Record is the determining factor in whether order is tax vs non tax.

Always respect user's F9 to override tax (regardless of other settings) - The F9 function key on the Order Header Screen lets you toggle between making an order taxable or non-taxable. Enter a Y in this setting to always respect the tax F9 override. If this flag is activated, then once an F9 is pressed the user is in control. The tax codes remain as is, after an F9, only subject to the user manually overriding them. After the F9, changes in Ship Via, Warehouse, Shipto, etc, will NOT affect the tax. User will be asked to enter a reason for changing tax.

The use case outlined below is supported when the existing settings above and the Always make order non-taxable if Billto file has no tax codes is set to Y.

1. Order is entered for a billto with no tax codes.

2. Zip code entry is found but no updates are made to order header based on absence of codes in bill to file.

3. Tax exempt table (SYS 605) is checked but not necessary based on no tax codes in billto file.

4. Order is made taxable by pressing F9 toggle

This taxation rule override is honored in subsequent order changes even when auto recalculation logic is set to 'Y'

1. Order is entered for a billto with tax codes.

2. Zip code entry is found and codes are updated on order header based on presence of tax codes in bill-to file.

3. Tax exempt table is checked and no exemptions are found.

4. Order is made non-taxable by pressing F9 toggle.

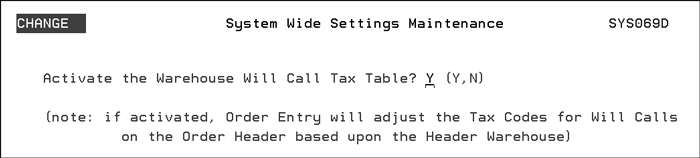

Options for Taxes On Will Call Orders

This setting activates the Will Call Tax Table. This table allows tax codes to be dynamically changed based upon the Header Warehouse. For example, if a customer normally assigned to warehouse NYC will pick up at warehouse PHI, then this table can automatically change the tax rates from a will call tax rate PHI to a will call tax rate for out of county or out of state customers from NYC.

Place an Y in the Activate the Warehouse Will Call Tax Table field to activate the table. If activated, Order Entry uses the information contained in the Will Call Tax Table to assess taxes based on the business address of the customer as well as the address of the warehouse.

If this feature is not activated, Order Entry uses the tax codes as defined in the warehouse file for will call (customer pick-up) orders.

Options for Taxing Based Upon Shipto Address

This setting lets you activate the Tax by Zip Code Table. The Tax by Zip Code table allows you to establish taxes for a single zip code or a range of zip codes. If activated, the Tax by Zip Code table takes effect when the normal account shipto address is overridden.

For example, if a shipment is made to an address that is overridden while entering an order (such as a job site), there will not be any pre-assigned tax codes for the new address. This setting and table allows for automatic tax code assignment based upon the shipto zip code.

Note This setting works in conjunction with the Order Entry Shipto screen and the Final Destination State and Zip Code fields.

Activate the Tax by Zip Code Table? - Enter a Y to activate the Tax by Zip Code table.

Note All the settings except Make order tax exempt if a current exemption is found in the Tax Exemptions By State/Province File are dependant on the first setting, Activate the Tax by Zip Code Table, being activated.

Make Zip Code Mandatory on Shipto Overrides? - Ensures the zip code must be entered on the Order Entry Shipto screen when you are overriding the shipto address. This option can work in conjunction with the next option to automatically populate the city and state when a zip code is entered.

Auto-fill State & City from Tax By Zip Table if Zip Code Found? - Activating this feature directs the system to automatically insert the state and city in the appropriate fields on the shipto screen. The city and state inserted are the ones associated with the zip code in the Tax by Zip Code Table.

Note: This only applies to Shipto Overrides.

Make order tax exempt if a current exemption is found in the Tax Exemptions By State/Province File - Entering a Y in this field ensures any tax exemptions created for a State/Province File are still used.

The last two options are intended for companies that use the Tax By Zip Code Table (FIL 43), and store tax exemption numbers in the Tax Exceptions File (SYS 605).

Always recalculate tax based upon zip when a shipto address is changed - If activated, this option ensures changes on the shipto screen (in Order Entry or Order Change) force a recalculation of the sales tax based on the new shipping information regardless of any prior settings.

Always recalculate tax based upon zip, even if no ship override, or shipto is unchanged - This option causes the tax to be calculated prior to displaying the shipto screen, even when no shipto change or shipto override is entered on the order header. This catches situations where the tax codes in the Billto File may not be as accurate as those related to the zip code of the Billto or the default shipto address.

The following topic may need to be considered when creating sales tax codes. Some option and recommendations may dictate the need the need for you to alter your current practices for handling sales tax.

Topic |

Options and Recommendations |

Sales Tax Reporting |

When creating your tax codes, review your sales tax reports and determine how you should create your sales tax codes. For example, if you have state, county and city tax - you need to combine the county and city as one tax code in the Tax File. |

Samples and Displays |

Determine the items that are tax exempt and those that are always taxed so that when ordering items not for re-sale the customer is taxed properly. |

Use Tax |

Determine how orders are entered so that it is easy for you to retrieve reports to pay use tax on products installed or samples given at no charge. |

For Will-Calls - The system finds the tax codes to assign to a Will-Call order in the following sequence:

1. Find customer tax codes in the Billto File.

2. If there are no tax codes in the Billto File, the customer is considered non-taxable (tax exempt), and the system does not normally check any other files. However, if an order is forced to be taxable (by selecting the “make taxable” option, or by ordering a “must tax” item), the system looks for tax codes in the County File, based on the state and county# in the customer's Billto File.

3. Find tax codes in the Warehouse File (using the header warehouse code).

4. If tax codes are found in the Warehouse File, they override Billto and County File tax codes.

5. Finally, the Warehouse Will-Call Tax Table is checked. If an applicable entry is found, the tax codes in the Warehouse Will-Call Tax Table override all other tax codes for a will-call order.

6. The Tax Exemptions by State/Province file is checked. If an exemption is found for the customer and warehouse state, the tax codes are removed from the order, and the order is considered non-taxable (tax exempt).

For Shipments/Deliveries - The system finds the tax codes to assign to a shipment/delivery order in the following sequence:

1 Find customer tax codes in the Billto File

2. If there are no tax codes in the Billto File, the customer is considered non-taxable (tax exempt), and the system does not normally check any other files. However, if an order is forced to be taxable (by selecting the “make taxable” option, or by ordering a “must tax” item), the system will look for tax codes in the County File, based on the state and county# in the customer's Billto File.

3. If no shipto#, no shipto override, and no “final destination state & zip” are included on the order, then the address of the shipment is considered to be the Billto address. In this case, the order is taxed using the tax codes found in the Billto File or County File. If no tax codes are found in either file, the order is not taxed.

4. If a shipto#, a shipto override, or a final destination zip code is entered on the order, the Tax by Zip Table is searched. The final destination zip code overrides the shipto zip code.

5. If a Tax by Zip record that is applicable to the zip code is found, then the tax codes for that zip code override all other tax codes found above.

6. The Tax Exemptions by State/Province file is checked. If an exemption is found for the customer and destination state, then the tax codes are removed from the order, and the order is considered non-taxable (tax exempt).

There are reporting options and a utility available for analyzing sales tax:

Sales Tax Reports (Menu RSA 6) - This is the main sales tax report, usually run at the end of a month or period, for reporting how much tax was charged, with several sorting and format options.

Sales Tax Report for Non-Taxed Items (Menu RSA 12) - Use this report to calculate potential use taxes, based upon orders that were not taxed, but may include items that require use taxes. This program looks for items that (a) were sold at “no charge”, (b) have special tax codes in the Item File, and (c) other items that were not charged tax.

Use the Tax Audit Inquiry by Invoice# (Menu SYS 909) to view how tax was applied to any invoice.

Invoice Registers show both taxable and non-taxable sales with a multitude of sort options.

The following are common errors found in sales tax reporting:

Make sure that all your ship via codes that represents customer pick-ups at the warehouse (for example ship via WC (will calls), PU (Pick Up Warehouse)), are marked as will call so that the proper tax rates are used.

Samples and display item files are marked as always taxable so that the proper tax rate is used when a customer requests for samples.

Tax rates increases - as soon as you change the tax file, the new tax rates are in affect. You cannot run sales tax reports against previous tax rates invoices unless you create another code that represents the new tax rate or change the tax rate back temporarily while you run the sales tax reports.

Note: The tax amount stored on the invoice is the tax at that time. Use the Tax Audit Inquiry by Invoice# (Menu SYS 909) to determine how tax was applied.

Canadian systems must code all customers for GST, and therefore all customers and orders are taxable. However, PST is charged on a customer-by-customer and order-by-order basis. Some features, as stated above, do not function properly for Canadian systems, since, unlike US systems, GST and PST are mutually exclusive. Special features are provided throughout the system regarding Canadian tax issues.

Options for Taxes On Will Call Orders

Tax Identification Number File - ACT 12

Tax by Zip Codes Table - FIL 43

Warehouse Will Call Tax Table - FIL 42

Option 4 - Tax, G/L & Delivery/Route Options

Tax Exemptions by State/Province File Maint - SYS 605

Tax Exemptions by State/Province File Listing - SYS 606

Navigator Tax, G/L & Delivery/Route Options

Sales Tax Reporting and the effects of Tax Rate Changes

Tax reporting for customers that are tax exempt

Dancik policy on state and local tax changes - what does Dancik provide/support

What are the effects of a change in tax Rates?

Making Handling/Restocking Charge NON Taxable on Taxable Order

How do I assign Sales Tax for a Customer with Multiple ShipTo Locations

Changing Tax field on item from A to Y causes taxes to be recalculated on open orders

How do I make my Labor Items tax exempt?

Taxes on Delivery Charges. How do they work?

When printing recurring invoices, it is taxing all customers with the same tax