|

Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

International Transfers

System Wide Setting - International Transfer Options

International Transfer Cost Inquiry -SYS_713

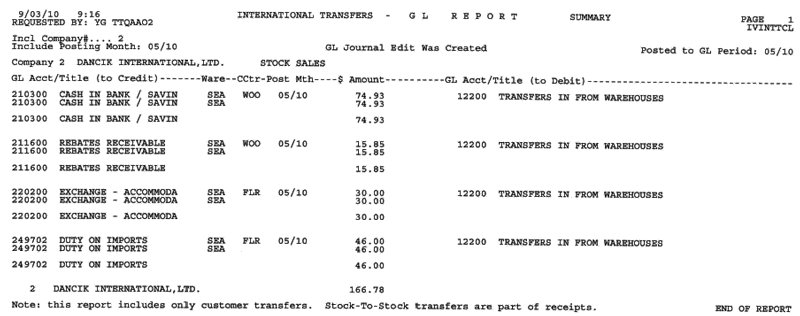

International Transfers GL Report and Journal Entries - SYS_714

This section describes the systems needed to manage the transfer of material between International warehouses. This process adds the necessary additional charges such as duty, exchange and additional freight to the receiving warehouse. It brings the same features used in Dancik’s transfer system within a single country to international (cross-border) transfer.

The International Transfer process eliminates any double keying of customer transfer orders, and facilitates global views and global selection of inventory regardless of the country. The underlying processes (to convert between currencies and apply duty and/or other charges) are transparent to the user while satisfying accounting requirements.

The examples supplied for the International Transfers feature highlight transfers between the US and Canada. However, this feature can be used by customers having operations in other countries where exchange rate, duty, freight, and supplier rebate tables are applicable to landed cost.

System Wide Setting - International Transfer Options

This setting has two activation options.

|

Activate International Transfer Processing - This option activates the “International Transfers Table” which directs the system on how to use the currently existing exchange rate, duty, freight, and supplier rebate tables for international transfers. This table identifies the supplier codes that represents each of the companies that transfer goods across international borders.

Activate International Transfer Journal Entries - Activate this option to ensure additional freight and handling charges associated with international transfers are applied to the proper GL accounts. This GL mapping is built into the Inventory To GL Interface file.

International Transfers Table (SET 34)

This table directs the system on how to use the current exchange rate, duty, freight, and supplier rebate tables for international transfers. It identifies the supplier codes that represents each of the companies that transfer goods across international borders.

1. This table is accessed through menu option SET 34.

|

2. For this functionality to apply to a warehouse combination (a “from” and a “to” warehouse) both warehouses need to be included in this table. In the example shown below, the Seattle and Vancouver warehouses transfer material back and forth. Since the transfers can go both directions, each warehouse is listed a “From” and a “To” warehouse.

|

The Selling Company represents the company from which the customer placed the order. In the example shown above, American warehouses (i.e. Seattle) and branches are included in Company 2. Canadian warehouses and branches are included in company 0. An order from a customer in Company 0 selecting inventory to transfer from SEA to VAN is considered an international transfer, based on the first table entry shown above. An order that is from a customer in Company 2 that selects inventory to transfer from VAN to SEA is considered an international transfer, based on the second table entry shown above.

All transfer “from/to” combinations of warehouses that cross international borders should be entered in the International Transfers Table. When an international transfer is made, the system will retrieve the applicable duty, exchange, supplier rebate, and freight rates from the respective tables on the System Settings menu and apply those rates to the landed cost being transferred. When received at the destination warehouse, the landed cost will equal the landed cost at the source warehouse plus any applicable duties, exchanges, supplier rebates, and freight table charges. This process is nearly identical to the process that occurs when receiving material from a foreign supplier.

3. To add a new warehouse combination, press F1. To update an existing one, use option “U”.

|

Note: If the last four features on the International Transfers Table are activated, the “Use Extra Receiving Features” must be activated through the Warehouse Settings Table (SET 14).

Field |

Description |

Selling Company’s Supplier# |

Enter the code of supplier that supplies the product to the transferring warehouse. In the example shown above, TAR is a supplier to warehouse/distributor SEA. |

Apply Exchange Rate |

Activate this option to direct the system to use the information in the following tables: Supplier Currency Code Maintenance Table (SET 12) This table is used to link suppliers with currency codes. Ensure all the “new” supplier files that represent your international suppliers are linked to the correct currency. Currency Code/Exch Rate Table (SET 11) This table enables you to define codes representing each currency, and the respective exchange rates. |

Apply Duty |

Activate this setting to use the rates established in the Duty Table (SET 13) to define duty rates for products. Ensure all the “new” supplier codes (e.g. TAR) are included in the table. |

Apply Freight |

If this setting is activated the system checks the Freight Cost Override Table (SET 9) to see if any additional freight needs to be applied to the receipt. Freight table rates override the standard freight cost. These rates can be per unit, per weight in pounds or kilograms, or per cube. A freight table defines the freight cost or rates between one or more suppliers and each of your warehouses. Freight tables offer a more precise means of calculating the freight cost per unit upon receiving - when and if you have consistent and defined freight costs. Freight Cost Override Tables are associated with the Cost File. Each Cost File record can be assigned a freight table via the Frt Tab # field on the Cost Class detail screen. To override or add to the standard freight cost for international transfers ensure:

|

Apply Supplier Rebate |

Applies the rebate percentage set up in the Expected Suppliers Rebate Table (SET 10) for the supplier. This Expected Suppliers Rebate Table enables you to define supplier rebates that reduce landed cost within the Receiving System. Ensure all the “new” supplier codes (e.g. TAR) are included in the table. |

International Transfer Cost Inquiry (SYS 713)

This utility displays freight costs as they would be calculated on transfers that are considered international. It provides a way to quickly and easily check freight costs on international transfers before the receipt is actually entered.

1. Access the International Transfer Cost Inquiry via option 713 on the Special System Maintenance Functions Menu.

|

2. On the screen that appears, enter the company, sending warehouse, receiving warehouse, item number, and base cost.

The company# is for the “to” warehouse (customer that is placing the order).

Note: If you do not enter a base Cost, the standard base cost from the cost file is used.

3. Press Enter to calculate the freight and landed cost.

In the example shown below, Company 0 (VAN) is inquiring on the international transfer cost of item TAR USA5 002 from warehouse SEA. The landed cost before the transfer is $.10.

The landed cost of the item after the transfer will be $.130.

|

Accounting Considerations

1. The Inventory Summaries By G/L Acct (GL 112) is run as usual at the end of a month. The extended format of this report includes a section entitled “Transfer IN/OUT”.

2. For transfers, the additional freight at the destination warehouse is journaled to the GL account for “additional freight” in the Inventory To GL Interface file.

International Transfers GL Report and Journal Entries (SYS 714)

This program lists the breakdown of freight costs for international transfers to include duty, exchange rate and freight. It also creates actual entries to record the break down to offset the lump sum freight posting.

|

Enter a “Y” in the Create GL Journal Entries field to breakdown the additional freight cost into separate GL accounts.

A separate journal is created by using option SYS 714 which reduces the GL account assigned to “additional freight” by the amount of duty, exchange, and supplier rebates incurred by the international transfers. The net effect is that the freight account, duty accounts, supplier rebate accounts, and exchange accounts are now adjusted for the international transfers.

A summary version of the report is shown below.

Note: The GL accounts used for the duty, exchange, and supplier rebates come from the duty, exchange, and supplier rebate tables on the SET menu.