Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Setting up the system for receipts matching

Setting up the AP and GL defaults

Running the Unvouchered Receipts Report

This process allows the user to match inventory receipts to the actual AP invoices received from the supplier. Depending on the mapping you choose, this process can also allow you to automatically accrue the liability upon the receipt of inventory.

For example, your inventory transactions could occur as follows:

Upon receipt of inventory into the warehouse, your Inventory to GL Interface could be mapped to make the following journal entry:

|

|

Debit |

Credit |

Inventory |

|

$XXX.XX |

|

|

Purchases |

|

$XXX.XX |

Note: The purchases account may also be known as “Purchases Clearing, Unvouchered Receipts, Accrued Inventory or a variety of other terms. This is a liability account.

Upon receipt of the invoice from the supplier the following journal would be recorded:

|

|

Debit |

Credit |

Purchases |

|

$XXX.XX |

|

|

Accounts Payable |

|

$XXX.XX |

At the end of the accounting period, any balance in this Purchases account is a liability or your “unvouchered receipts.”

Note: If you plan on using this feature, make sure you have a proper cut-off of the prior month’s receipts.

Setting up the system for receipts matching

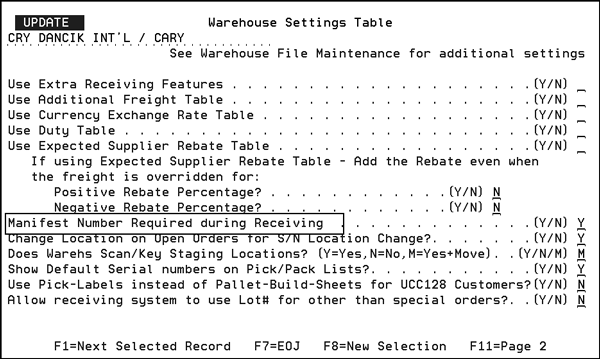

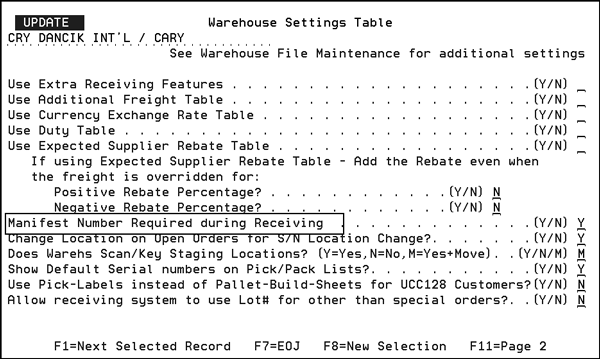

Warehouse Settings Table

1. On the System Settings Menu, select option 14 - Warehouse Settings. Enter an action code and then a warehouse to access the Warehouse Settings Table.

2. Ensure the field Manifest Number Required during Receiving is set to Y.

Creating a GL Account for liability

1. Create a GL Account to accrue this liability. Again, some customers refer to this as “Unvouchered Receipts,” “Purchases Clearing,” “Purchases,” or “Inventory AP Accrual.”

2. This GL Account is created in the Chart of Accounts File. To access the Chart of Accounts file, select option 7 - Chart of Accounts on the Accounting/File Maintenance menu (ACT).

3. The Chart of Accounts Entry screen appears. Enter the company and account number.

4. Enter Y in the Purchasing Account field.

Creating a GL Account for variance

You also need to create a GL account in the chart of accounts file for any variances that may exist between the inventory receipt and the actual invoice.

Setting up the AP and GL defaults

These defaults allow you to enter the amount of variance you will allow the system to give automatically.

1. Enter Option 109 - AP & GL Defaults Maintenance File on the Accounting / File Maintenance Menu (Menu option ACT 109).

2. Enter the default GL# for the variance. Note, this can be overridden at the time of AP Entry.

3. Enter an acceptable dollar variance amount and acceptable percentage. The system will use the lessor of the two.

4. Enter Y to require a manifest number when entering an AP invoice for any suppliers of inventory.

5. Enter Y to use Future Payables when processing Unvouchered Receipts. This will allow the unvouchered report to not drop the manifests already vouchered in the future month.

6. Update the template in the Supplier File (ACT 01). The default expense account should be the purchases account.

7. Press F10 to update the template.

1. Select option AP 217 Job/PO/ManifestAudits.

2. Take option 1 - Audit Accounts Payable/Receiving By Job/PO#/Manifest#.

3. Take option 3.

4. Enter the month to run the report for.

5. The next question refers to the variance report. You can run a summary or detail report to show manifests that have a variance or take option “B” to bypass the report.

6. The last option refers to the unvouchered report and how you want to see the unvouchered. Entering a “Y” omits the date as entered on the first parameter screen. It reports all receipts without any invoices. Entering an “N” only shows the unvouchered for the month requested.

Note: This report lists the unvouchered as of the day you run it. You cannot go back and rerun this report.

AP & GL Defaults Maintenance File - ACT 109

Warehouse Settings Table - SET 14

Understanding AP vs. Manifest Reconciliation

Update Manifests By Receipt - AP 9

Inventory to GL Interface File - ACT 103

Updating Cost of Inventory Receipts through AP via Manifest view and update (When does it not work)

Who should use the Manifest Inquiry & Update program - The Purchasing Department or the Accounts