Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Understanding AP vs Manifest Reconciliation

This process allows users to match inventory receipts to the actual AP invoices received from the supplier.

The AP vs. Manifest Reconciliation can assist you in reconciling your receipts against the AP invoices for cost variances and capture your outstanding receipts (accruals). Using this procedure with other GL interfaces will assist you in reconciling your inventory value.

Using the AP vs Manifest Reconciliation_

The following table lists other areas that you should be aware of when performing this procedure. Furthermore, you may need to consider changing your procedures and processes regarding AP, receiving and GL. Sometimes it is necessary to create new GL account numbers or change financial reporting to accommodate these changes.

Topic |

Recommendations |

Inventory Cut off Time |

There is not an end of month specifically for inventory. As soon as you begin the AR end of month close, any receiving, transfers, and/or adjustments up to that point is considered the next month's transactions. Note: Be careful when you are closing AR. If it's on the last day of the month, do not start your AR month end of close until you have confirmed that all receiving, adjustments, and transfers for the month are entered. |

Cost Variances |

Determine your acceptable cost variance limit and the procedures to manage them when the cost is over or under. If the cost on your invoices is over the allowable limit, you need to correct it by unreceiving and re-receiving at the correct cost. Make sure you post the variance that appears on the Inventory Reconciliation report as some invoices could have gone through the system with the incorrect cost. |

GL Account # |

Determine what GL account number you will use to post AP invoices from suppliers. If your Inventory to GL Interface for receiving is set up to do the following: Debit Credit Inventory $XXX.XX Purchases $XXX.XX (To record inventory receipts) Note: The purchases account may also be known as “Purchases Clearing or Unvouchered Receipts (liability account)” or a variety of other terms. Upon receipt of the invoice from the supplier the following journal would be recorded: Debit Credit Purchases $XXX.XX Accounts Payable $XXX.XX (To record payable to supplier) |

Manifest # |

Review the bill of ladings from your receipts and invoices from the suppliers and see what number you will use as the manifest #. Make sure that all receipts of inventory have manifest#s. The manifest number is the number that links a supplier's invoice to their receipt. The manifest number can be called many different names by different suppliers. You can use a PO number as a manifest number. However, we recommend that if you use the PO number, then you add a date at the end of it. This way, should your PO number wheel wrap the manifest number is still unique. |

Invoices from suppliers |

Review your invoices from suppliers and see which suppliers send multiple invoices per manifest or multiple manifests for one invoice. |

Personnel responsibilities |

Determine who is responsible:

|

Using the AP vs. Manifest Reconciliation

Make sure all your settings are in place to use the AP vs. Manifest Reconciliation.

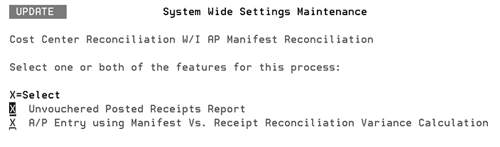

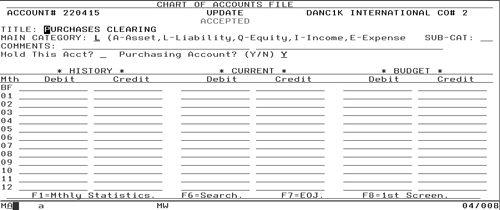

System Wide Settings - Cost Center Reconciliation W/I AP Manifest Reconciliation - activate one or both of the options shown below.

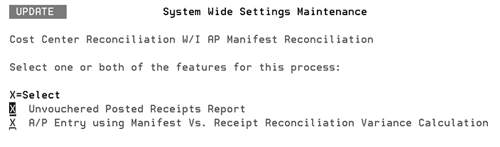

AP and GL Default Maintenance - Enter your allowable cost variances. You need to enter the dollar amount and a percentage. The system acts on the lower of the two amounts as each invoice is processed. Also enter a Y in the Manifest Number required on Purchasing Entries during A/P Entry field.

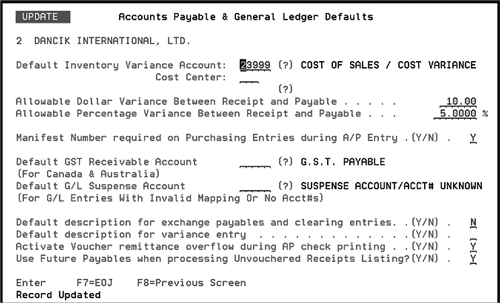

Make sure in the Chart of Accounts file for the account number that AP uses when posting AP invoices the Purchasing Account flag is set to Y.

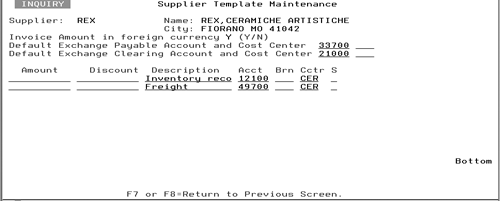

Make sure all the Supplier Files that use the AP Reconciliation use the expense template by pressing F10 in the Supplier File. The following figure shows a Supplier File Template.

Make sure all warehouse settings are set up to require a manifest number when entering a receipt.

Ensure procedures for accounting are in place such as how to match the invoices, cost corrections, etc.

Use the Update Manifest# by Receipt option to split manifest numbers for multiple invoices or to combine to one invoice.

Run the unvouchered receipts report immediately prior to AP end of month to capture the outstanding receipts.

Run the unvouchered report using option 217 - Job/Po/Manifest Audits (A/P vs Rcvg) on the Accounts Payable (AP) menu.

— Select option 1 - to Audit Accounts Payable/Receiving By Job/PO#/Manifest#.

— Take option 3 - keys a Manifest# into the Manifest# field of the Receipts & Accounts Payable programs.

— Enter the date span. We recommend that you enter a date span so that the report generates faster.

— If you want to run the cost variances report enter either “S” for summary, “E” for exceptions, “D” for detail, otherwise enter “B” to bypass this report.

— Enter “Y” to run the unvouchered report.

— Enter “N” to process the date range.

Run the Manifest Reconciliation report at month end to capture any cost variances from AP vs. Receiving.

Use the Clear/Reinstate a Manifest option to clear any receipts that should not be on the unvouchered listing. Ex: User adjusting inventory through the receiving program vs. the adjustment program.

Make sure you run the unvouchered report prior to month end.

Have all supplier invoices follow the reconciliation process.

Users using adjustments to receive inventory.

Supplier's invoices do not match to bill of ladings.

Suppliers have multiple invoices for one manifest numbers.

User errors on cost corrections.

Are the invoices posted to the proper GL account#?

Navigator Manifest Reconciliation