Payment System Setup

This menu system allows open invoices to be paid online.

PAY 1 - Payment Profile Maintenance

PAY 2 - Reason for Other Amt. Maintenance

PAY 3 - Payment Option Maintenance

PAY 4 - Payment Inst Profile Maintenance

PAY 5 - Payment Codes Cross Reference

PAY 10 - Work with Running Mode

PAY 100 - Pay Portal Configuration

Making Online Payments in Decor 24

Making a Payment through CardConnect

Making Credit Card Payments in Navigator using CardConnect

Making a Payment through CyberSouce/Wells Fargo

Sequence of Steps for Set-Up

The sequence of steps for setting up the system to make online payments varies based on which payment option you plan on using:

- For Payment Request or Remittance Advice payment options:

- Create Payment Option for Payment Request or Remittance Advice via menu option PAY 3.

- Create a Payment Profile for Payment Request or Remittance Advice via menu option PAY 1.

- Add Payment Option from Step 1 to F9 Option on Payment profile.

- For Credit Card payments

- Create Payment Institution via Pay 4.

- Create Payment Option via PAY 3.

- Create Payment Profile via PAY 1.

- Add Payment Option from Step 1 to F9 Option on Payment profile.

- For all payment options, the Payment Profile needs to be linked to an individual Decor 24 user via menu option D24 2 or all Decor 24 users via the global Decor 24 settings (menu option D24 1).

- Users can update other payment features as follows:

- Map payment codes associated with transactions in AR Payments tab to values from ACT 115 via PAY 5.

- For Payment Profiles where short payments are authorized, set up reason codes in menu option PAY 2 and add them to F8 Reasons on Payment profile via PAY 1

PAY 1 - Payment Profile Maintenance

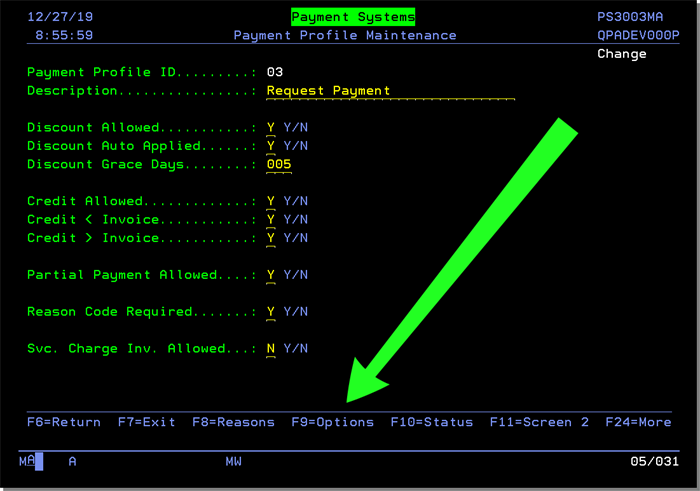

Use this option to create payment profiles that allow or deny access to specific functionality within the online payment process.

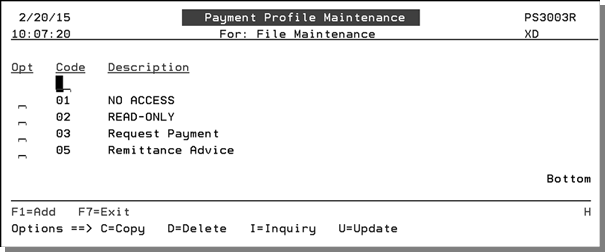

1. Access menu option PAY 1 - Payment Profile Maintenance. The established payment profiles are listed.

- Payment profile 01 - No access is intended for customers who are not allowed to use this new functionality but are allowed to see prices.

- Payment profile 02 - Read Only allows customers to view Payment History but not create new payments.

2. To create a new Payment Profile press F1.

3. To update an existing one, enter a "U" in its Opt field and press Enter.

|

Setting |

Description |

|

Payment Profile ID Description |

Each Payment Profile is assigned a 2 character numeric code and a description. |

|

Discount Allowed

Discount Auto Applied

Discount Grace Days |

Enter a Y in the Discount Allowed field to allow discounts on invoice payments.

If Discount Auto Applied is activated, the discount amount is automatically applied to the invoice. Enter the number of Discount Grace Days for the discount to be taken within (this value will be added to extend the days in which discount amount appears). |

|

Partial Pmt Allowed |

Enter a Y to allow the user to enter a payment amount OTHER than invoice total. |

|

Credit Allowed

Credit < Invoice

Credit > Invoice |

Enter a Y to allow the user to apply credits toward the payment. The setting Credit < Invoice allows the customer to apply a credit to partially pay an invoice ($50 credit applied to $100) The setting Credit > Invoice allows a credit to be applied to an invoice less than credit amount ($100 credit applied to a $50 invoice). |

|

A special situation exists if:

In this situation, the following error is displayed Credit amounts cannot be less than total amount due. |

|

|

Reason Code Required |

Enter a Y to make a reason code mandatory. The reason codes available for this payment profile are accessed via the F8=Reasons function.

The Reason Codes are created via menu option PAY 2 - Reason for Other Amt. Maintenance. |

| Svc. Charge Inv. Allowed |

Service charge invoices are created during AR End of Month processing when option option 9 - Print Ledgers is run (menu option EOM 9). They have a special transaction code (0X) and are have the label service charge invoice in PO Field. Activate this setting to display Service Charge invoices on the AR Payment tab when paying invoices. There is also a global/user setting (on screen 9) that allows you to include or omit service charges on the Decor 24 open invoices screen. |

Function Keys

The function keys display when Updating an existing Payment Profile.

|

Function Key |

Description |

|

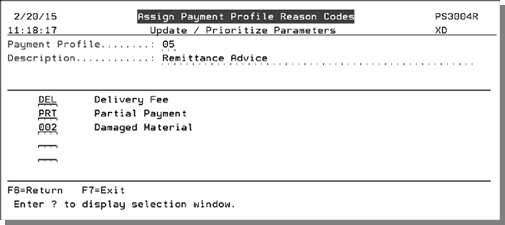

F8 = Reasons |

Use this function to add payment reason codes to the profile. The reason codes are created via option PAY 2. |

|

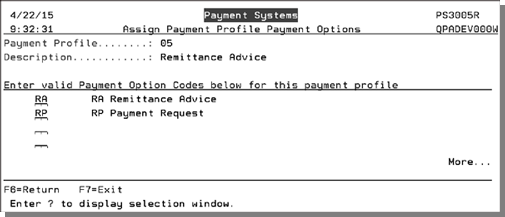

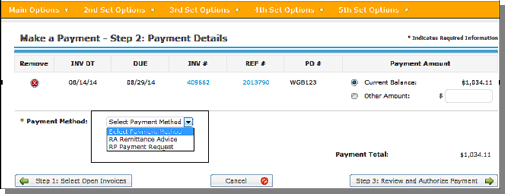

F9=Options |

This function controls the payment options available on the Payment Method drop down list.

In DNav - Online, the Payment Method is toward the bottom of the window in Step 2 of the online payment process.

These codes are created via menu option PAY 3 - Payment Option Maintenance.

|

|

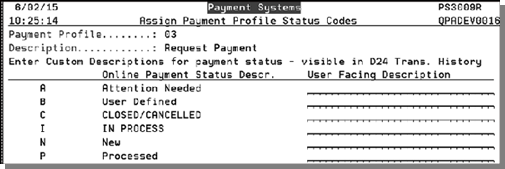

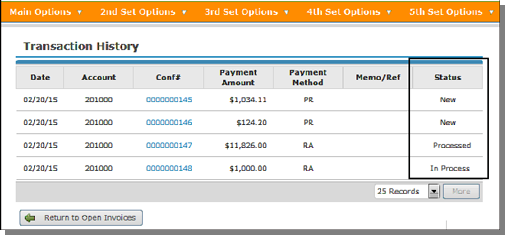

F10=Status |

These invoice status descriptions allow you to track the Transaction History.

In DNav Online they appear on the Transaction History.

|

|

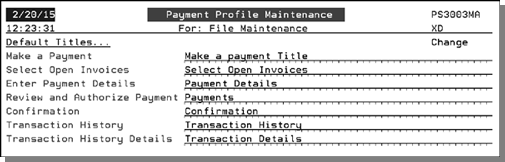

F11=Screen 2 |

This option presents you with 5screens that allow you to change the verbiage on the titles. labels, headings, and buttons on the Decor 24 application to better suit your business terminology.

Press F11 to work through the screens. |

|

F13 - Trans Codes F14 - Disputes F15 - Splits |

Use these functions to omit invoices that contain the entered AR transaction codes, Dispute Codes, and Split codes. If a code is entered on these screens, any invoices containing that code will not be eligible for payment in Decor 24 via this payment profile. |

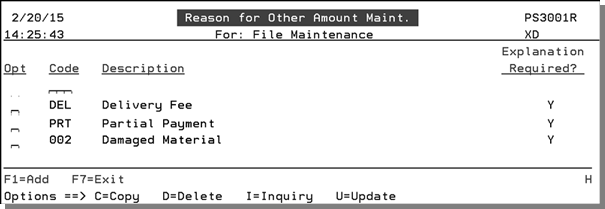

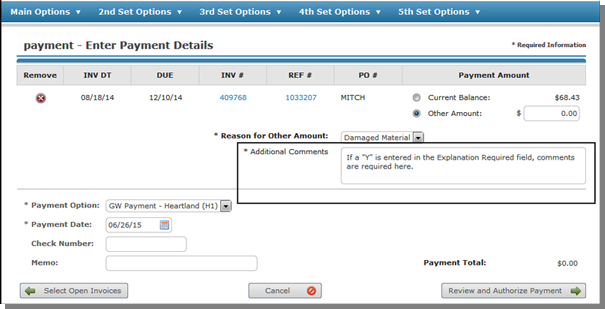

PAY 2 - Reason for Other Amt. Maintenance

This option allows you to create reason codes for partial payment or short payments on an invoice. For example, a customer might not want to pay a delivery charge or some of the material was damaged.

- Access the menu option PAY 2- Reason for Other Amt. Maintenance. The established codes appear.

- To create new codes press F1=Add.

- To update existing codes enter a U in their respective Opt field.

- These codes are used if an amount other than the full invoice amount is paid.

- Users have to be granted permission to make partial payments via the Payment Profile option (PAY 1).

- Enter a Y in the Explanation Required setting to require the user to enter comments in the Additional Comments box when making a partial payment.

-

The Cross-Referenced AR Dispute Code links the D24 customer facing other amount reason code to the ACT 104 Dispute Code. This cross-reference is used in the Navigator AR Automated Deposit workflow.

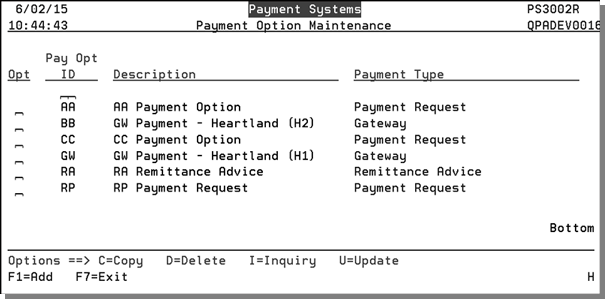

PAY 3 - Payment Option Maintenance

Use this option to create and maintain the payment options that are accessed via the F9=Options on the Payment Profile screen.

Enter a U to update the details behind a Payment Option.

The setting Payment Institution Profile ties the payment option to a payment institution, such as Heartland, established via menu option PAY 4. The Payment Institution Codes are supplied by KerridgeNC.

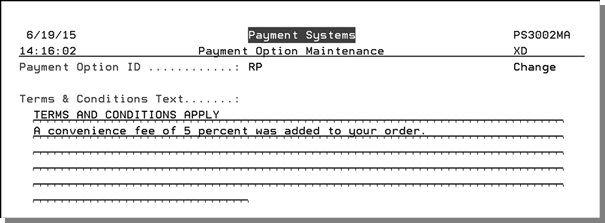

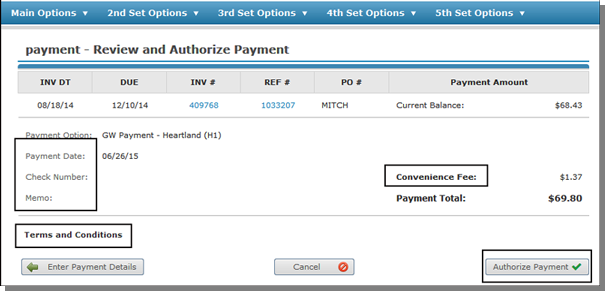

The Convenience Fee Percent allows you to increase the payment total by the percentage entered. The convenience fee can be set-up on the Kerridge system for each payment type. For example, you might charge a 5 percent convenience fee for credit cards and a 3 percent fee for checks. If you use the KCS system to assess convenience fees, you will need to fill out the Terms & Conditions Text on screen 2. Press F11 to access screen 2.

The Label Overrides, at the bottom of the screen, allow you to change the text on the Decor 24 Review and Authorize Payment window.

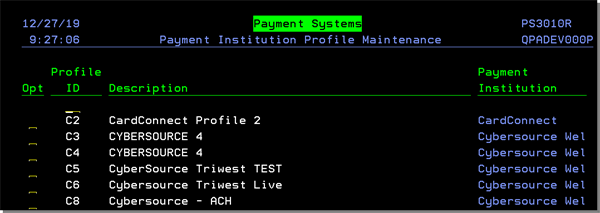

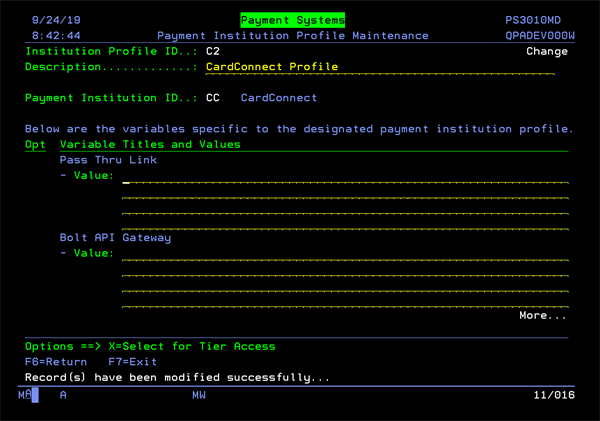

PAY 4 - Payment Inst Profile Maintenance

This option allows you to create and maintain the third party payment institution that allows your customers to pay online.

Press F1 to create a new Payment Institution Profile.

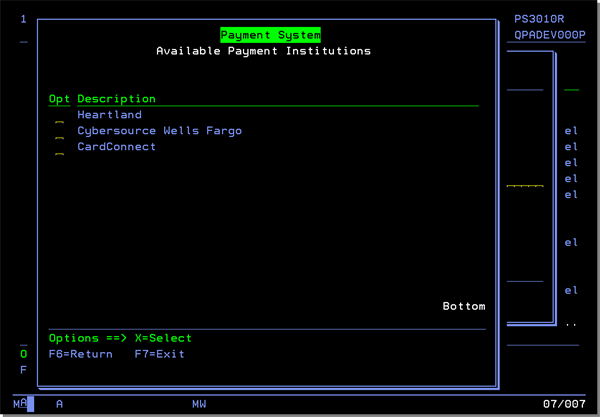

Enter a ? in the Payment Institution ID setting to display a listing of the available Payment Institutions.

Press Enter to add more information about the profile.

The Payment Institution details vary depending on which one you are working with.

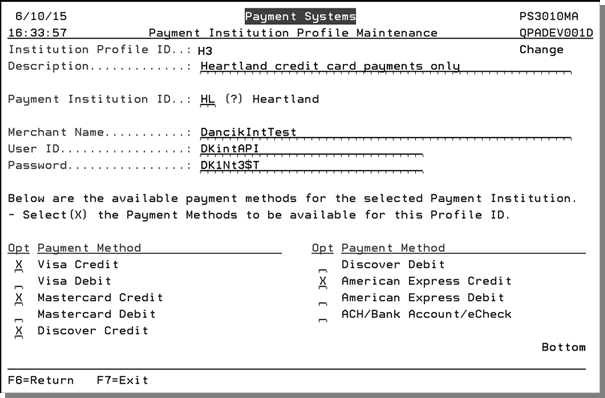

Heartland

Enter the Payment Institution ID code. These codes are created by KerridgeNC.

Enter the Merchant Name, User ID, and Password given to you by Heartland.

Select the Payment Methods for this profile. Do not select Payment Methods that are not set up in the Merchant Account that you have established with your payment processer (i.e. Heartland).

The payment methods selected are the ones that will display will making payments using the payment portal.

Card Connect and Cybersource

These options allow you to create and maintain the third party payment institution (CardConnect) that allows your customers to pay online.

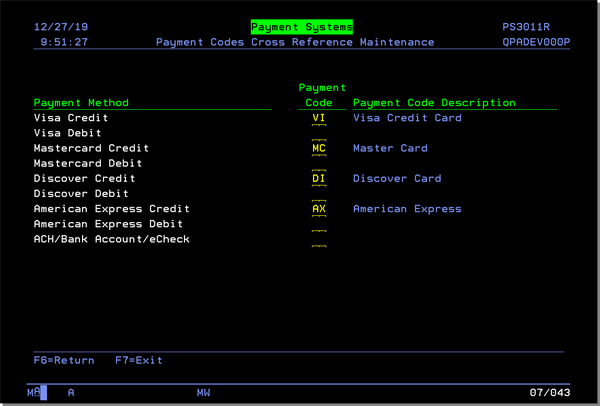

PAY 5 - Payment Codes Cross Reference

This file cross references the payment methods shared between the KCS system and your payment processor to Payment codes used by KCS' accounting systems.

The descriptions listed under the heading Payment Method are shared between Kerridge and your payment processor.

The Payment Codes are used by the Accounting system. These codes are created in the Payment Method Code Maintenance File (menu option ACT 115).

In order for a payment method to be cross referenced to a payment code, the payment code must be created in the Payment Method Code Maintenance File.

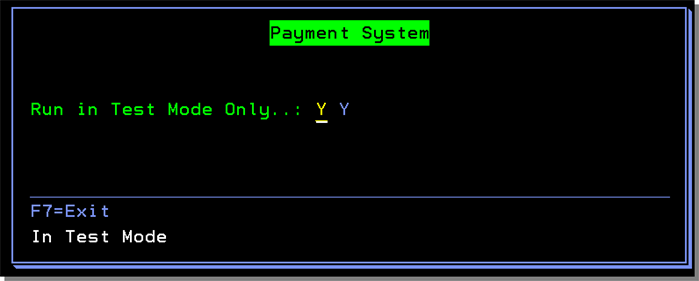

PAY 10 - Work with Running Mode

PAY 10 works in conjunction with the different callback URLs for two of our Payment Providers: Heartland and Cybersource.

This option provides a way to test the payments before they actually start using it. To make test transactions in their test environment, use the Y (test) option while their production environment is N.

Heartland is setup with 3 different callback URLs that post the data back to the Kerridge system.

- Test - Y

- Staging - S

- Production - N

CyberSource has 2:

- Test - Y

- Production - N

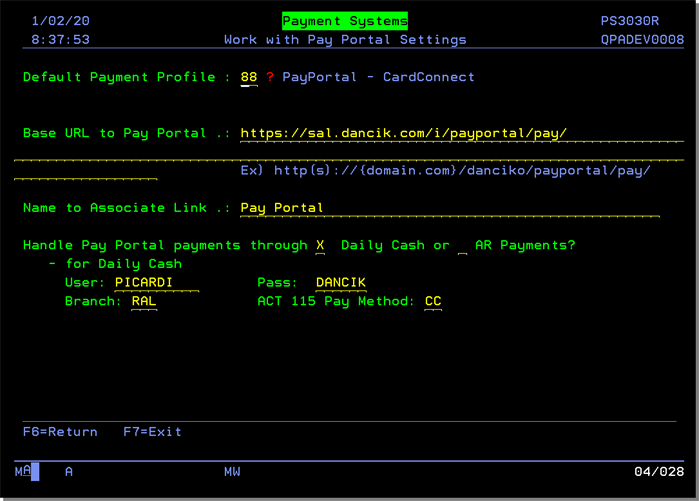

PAY 100 - Pay Portal Configuration

This option, added in Nov 2017 via spec 5402, provides a payment URL via an automated email that can be used in Navigator and the Installation Manager. It provides a way to proactively request payment.

This option allows you to set up payment defaults.

- Assign a Default Payment Profile. Payment profiles are created via menu option PAY 1 and can allow or deny access to specific functionality within the online payment process.

- The Base URL to Pay Portal is defaulted in.

- Pay Portal is the default Name to Associate Link. You can change the default here.

- The setting Handle Pay Portal payments through Daily Cash or AR Payments allows you to decide how to post portal payments.

- If AR Payments is selected the portal payments are written to the AR payments tab in Navigator.

- Unposted payments in AR Payments (PS0010F) are not represented in the Order Inquiry/Change, Cash Register, or Installation manager balance due values.

- Transactions listed in the AR Payments (PS0010F) are posted via the manual cash deposit workflow.

- If Daily Cash is selected:

- Payments made in the payment portal are written to the Daily Cash file.

- Using the Daily Cash workflow inherits update of balance due, and the ability to post pay portal transactions via the daily cash workflow.

- If Daily Cash is selected: Enter the User, Branch, Password, and Payment Method used.

- If AR Payments is selected the portal payments are written to the AR payments tab in Navigator.