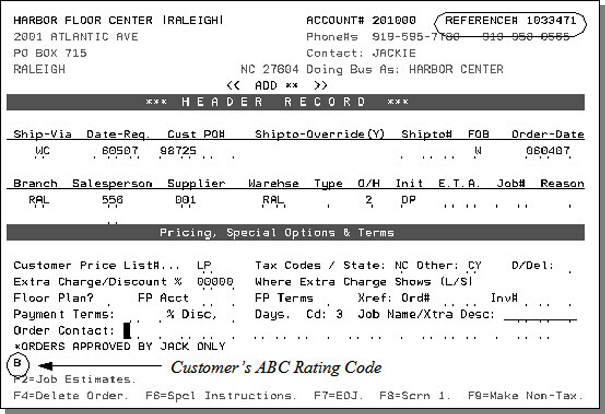

Order Header Screen

The Order Header Screen displays general information about the customer and the order. In the top right hand corner is the reference number. This number is system generated and appears on all order entry screens in the same location. For tracking purposes, we suggest you assign your customer this number. Every new order receives the next sequential reference number. If a customer cancels during order entry, the reference number is deleted and is not used again.

The Order Header Screen shown above is the standard screen. It can be customized to omit or add fields. This customization is done via the Custom Field Dynamic Screen Manager and activated through each user's CTRLUSER record. Examples of some of the information that can be added are: a Secondary salesperson number, a flag indicating the order requires an on-site measurement or installation.

Notes about this screen:

- Special comments entered in the Billto File appear toward the bottom of the screen. These comments flash if the first character of the comment entered in the Billto file is an asterisk (*).

- An order number is assigned only when the order is processed as a pick list, order acknowledgment, purchase order, point-of-sale, invoice, or processed but not printed.

- Ship via codes can automatically populate several codes on the Order Header screen, based upon the user's selection of Ship Via Code. These automatic settings are made in the Classification Codes File of the File Maintenance part of the system.

- Note the customer's ABC rating code in the lower left section of screen. This code indicates the relative importance of this customer to your company. Following is an example of how the codes can be structured.

- A customers are the top 10% of your customers who provide 50% of your company's profit. As A customers, they are your most important customers.

- B customers are the second most important group of customers.

- C customers are generally break even or unprofitable customers for your company.

- D customers are the most unprofitable group of customers for your company.

- Customers with code T are target customers, meaning they are the A customers of your competitor.

- In almost all of the fields, you can enter a ? to display a list of available options.

- The first three fields displayed are Ship Via, Date Req, and Cust - PO. These are usually the only fields you need to enter on this screen. The defaults are most likely acceptable for the other fields. You can change these default fields in exceptional situations.

ABC codes are created using the ABC Code File.

|

Field Name |

Description/Instructions |

|

Ship Via |

Enter the code representing the method of shipping for the order. Ship via codes are defined and can be displayed by the Classification Codes File Maintenance program. Your company can define and maintain its own set of codes. We recommend that you have a list of these codes handy for easy reference. The following are examples of some of the Ship Via codes that can be set up:

For

more information regarding the Will Call Tax Table, refer

to Warehouse

Will Call Tax Table.

Enter a question mark (?) to access a complete listing of all the ship via codes. The above codes are merely examples. Use the codes created on your system. If you enter SB (See Below), you should enter the shipping instructions using F6 message lines, as described later in this section. If the customer is picking up the material, use codes such as WC, PS or PW. If you provide delivery service, use codes such as OT or DE. The Ship Via field automatically completes if a default ship via code is in either the customer's Billto File or in your Control Panel. If defaults are in both places, the Control Panel default ship via overrides the Billto File default ship via. Your data processing department can designate up to three ship via codes which trigger the use of the customer's default truck route codes. Usually ship via codes OT or DE are used. When you enter a code, such as OT or DE, the truck routing programs are automatically utilized, and a truck route is assigned to the order. If you are a data processing or operations manager, be sure to consult with Kerridge as to the best automatic settings for delivery and truck route logic. Ship via codes can automatically populated on the Order Header screen, based upon the user's selection of Ship Via Code. These automatic settings are made in the Classification Codes File of the File Maintenance part of the system. When a user enters a Ship Via code that is meant to trigger other values on the Order Entry header screen, the following message is displayed. Please Note: Some values were changed on the header screen because of the new ship via code you entered. This feature can optionally change the header warehouse, order type, order-handling code, order reason code, FOB code, truck route, and install and measure flags. It may be used to ensure that certain values go with certain shipping techniques, such as Ship Via UA for UPS Air goes with FOB code C = Freight Collect. You can create strategies based upon ship via codes. The

Ship Via field can be made mandatory via the System Wide Setting

System-Wide Settings - Part 1 (Green Screen menu option SET 4). Also included in the setting is an

option to validate the ship via code against the Classifications

Codes File. If these settings are activated, and a ship via

code is not entered or an invalid one is used the error message

Invalid Ship Via Code

appears.

|

|

Date Required |

Enter the date on which the order is required to be shipped or picked up. Today's date automatically appears as the default. It is especially important for this date to be accurate if you are shipping or delivering to the customer. All truck routing programs utilize this date. If you are using the Delivery System, the next available delivery date for your customer displays automatically. Orders using the Delivery System should not override this field, unless your customer wants delivery outside the normal date. Associated Files

|

|

Cust PO# |

Enter the customer's purchase order number or job number for the order. If the customer does not have a purchase order number, you should enter information indicating how, when, or by whom the order was placed. This number, code, or name can be useful in tracking the order. Enter numbers or letters, or both. You can search for orders by this field after the order is processed. This can be very helpful because customers often refer to this number when making inquiries about an order. If you have multiple references which need to be entered, use this field for the reference that is most important or most frequently referred to. Then, use the Job Name field or a F6 message line, or both, to enter other references. For example, if a customer has a purchase order number and a job name, you could enter the purchase order number here and the job name in the Job Name field. This field is mandatory. For cash sales customers that usually do not have a purchase order, we recommend entering their last name. One of the options to search open orders is purchase orders, you can search for all purchase order numbers by last name. This is the only

field required for a retail customer.

You can enter up to 24 characters in the Cust PO# field. The additional PO number field will only appear if the edit mask in the Customer Preference File (FIL 38) is set to require more than 12 characters. If you are set up to enter 24 characters, your screen will have two 12 character PO# lines. If you are not set up there will only be one. In Order Inquiry,

the first 12 characters of the Customer PO number display

in the Customer PO Number field. The complete customer PO

number displays in the text of the order.

|

|

Shipto Override |

Leave this field blank if the shipto address for the order is the same as the customer's billto address, or if you have set up a shipto number for the shipto address. Enter Y if the order is to be delivered to an address which is neither the customer's billto address nor an address assigned to a shipto number. Shipping to a job site is an example of using this option. You can enter the shipto address on the next screen. Use either the shipto override Y, the Cust PO # field, or a message line to capture the customer's name for orders to customers who do not have an account number, such as when you use the Cash Sales account. Three special shipto override codes are available for direct ship orders:

These codes enable you to omit the final shipto locations from the purchase order to the supplier of the direct shipment. When you use one of these codes, you can still enter the address or shipto number of the final shipping destination. However, the address does not appear on the purchase order to your supplier. Instructions corresponding to the code as shown above appear in the shipto area of the purchase order. These options are useful if you want to conceal your actual shipto destination or customer from your supplier. Account numbers 80 - 99, which are always reserved for generic cash sales, automatically cause a Y to appear in the Shipto Override field. This procedure prompts you to enter a full name, address, and phone number, which can be used later for reference and for mailing lists or telemarketing. If you want Y to automatically appear in this field for other accounts, assign Default Shipto Number = 999999 in the Billto File. This can be an important feature for accounts that are credit risks and often require that you capture specific job site information. If you override the shipto address (enter a Y in this field), the system can use the Tax by Zip Code Table. This table allows you to base taxes upon the shipto destination when the shipto addresses overridden. For example, when a shipto address is overridden, the program checks for the zip code in the Tax by Zip Code table. If tax entries are found for that zip code, and the order is taxable, the tax rates on the order are changed to the tax rates in the Tax by Zip Table. The Tax by Zip

Codes Table is activated via the Options for Taxing Based Upon Shipto Address.

|

|

Shipto# |

Leave this field blank if you are shipping to the same address as the billto address that appears at the upper left corner of the screen. If the required shipto address has been assigned a shipto number, enter that number here. If the customer has a default shipto number entered in the Billto File, that number automatically appears here. Alternate addresses for a customer can be set up in the Shipto File. Special common shipto addresses such as drop off points, public warehouses, and your own company and branch locations can be set up as master shipto numbers and used here instead of entering them in individual orders. Refer to the File Maintenance for details. Many customers have multiple customer account numbers instead of one account number plus multiple shipto numbers. For example, if you sell to Sears, each store probably has its own account number because each store might have separate pricing or separate salespersons. In this scenario, the proper shipto is identified when selecting from the Billto Search Screen and a shipto number is not required in this field. Additionally, each store may have a billto address with a post office box and a default shipto number for their actual warehouse address. |

|

FOB |

FOB indicates freight on board. Enter a valid FOB code if applicable to your situation. The FOB code indicates the point after which freight is paid by the customer. It also indicates the mode of freight. FOB codes are created in and displayed by the Classification Codes File within File Maintenance. You can define and maintain your own customized set of codes. We recommend that you keep a list of these codes handy for easy reference. The following list shows how you might assign your FOB codes:

Enter a question mark (?) to search for the different FOB codes. These codes and the following examples are suggested codes and their respective uses. Use only those codes created on your system. In general, if the customer picks up at your warehouse, use code W. If you provide delivery service, use code C. For direct shipments, use code F if the customer is responsible for all freight from supplier to shipto location. If customer is responsible for freight only from the port-of-entry to shipto location, use code P. If you are responsible for all freight, use code C. If you use code S (see below), enter the FOB terms using the F6 message lines as described later in this chapter. If your company sells primarily retail, you should consider defining the FOB code as from or by, and use it to explain the customer's origin. For example, code Y would indicate the customer found you via the Yellow Pages, R could indicate the customer was referred, D would indicate a customer who drove by, or N could indicate a customer who responding to a newspaper ad. These codes can then be used for sales analysis on-screen via the Classifications Codes File and on reports using the X By Y Reports. The FOB field is completed automatically if default values are present in either the customer's Billto File record or in your Control Panel. A default FOB code in your Control Panel overrides a default FOB code in the Billto File. |

|

Order Date |

Enter the effective order date if different from the default date. The default date is today's date. The date you enter in this field is also the effective date for allocating inventory that appears on the Inventory Inquiry Stock Card Screens. If the order is being placed against future arriving stock, consider using code F in the Type field to indicate future orders and using the intended ship or pickup date as the order date. Although the material is still allocated immediately, the Detail Inventory Stock Card Screen shows the order as allocating from future stock rather than from current stock. The system also retains the date that an order was placed separately from the effective order date. If you are entering a temporary hold order, changing the order date extends the hold until 2 night job cycles after that date. Associated File |

|

Branch# |

The default branch is determined by the entry in the Control Panel for your workstation. The default in the Control Panel can be either your actual branch, or ALL if you are allowed to enter for multiple branches, or C* which causes the program to display the branch assigned to the customer for whom you are entering the order. In any case, this field completes automatically. The default can be changed only by authorized personnel. You are allowed to override the Branch field only if your Control Panel default is ALL. In that case, you must override ALL with a valid three-character branch number. The branch number determines which branch gets sales credit for the order. Do not confuse the branch number with the warehouse number, which determines the location of the stock, or the point of shipment. The two codes do not have to be the same. |

|

Salesperson# |

The salesperson whose number is assigned to this customer appears here. You may override it. If salespeople are assigned based upon the product, then this field is blank. It should remain blank unless an override is required. A salesperson number entered here overrides the regularly assigned salesperson number. If an order is to be overridden to more than one salesperson to split the commission, you must define a single salesperson number in the Salesperson File that represents the split commission. For example, salesperson 901 could indicate that Mr. Smith and Ms. Jones will split the commission. Order Entry supports a salesperson assigned to a shipto record. If a shipto record is selected on an order, and that ship record is assigned to a salesperson, then the shipto salesperson is automatically assigned to the order header. On the Order Header screen, if the Shipto# field is populated with a shipto that has a salesperson assigned, then the salesperson assigned in the Billto file is overridden by the Shipto Salesperson and is displayed throughout the order entry process. You can assign a second salesperson on the Order Header screen. There is a Primary Salesperson field, and a Secondary Salesperson field, located under the Primary Salesperson field. The

setting Allow

Update to Slmn#s in OE on the first screen of the User

ID Control Panel allows you to limit this field to

not allow any updates or to only allow updates to salespeople

in the Salesperson file.

|

|

Supplier# |

The default is 001 which means our inventory. Leave as 001 unless you are ordering from an outside supplier, such as when entering a purchase order or a direct shipment order. However, when creating special orders, you must still leave as 001. When entering special orders, the Order Entry program warns you whenever you attempt to purchase an item from a supplier that is not listed as a supplier of that item. In these cases, the special order supplier, on the detail line, is compared to the suppliers in the Item and Cost files. If a match is not found, a warning is issued. |

|

Warehouse# |

The default for this field is the warehouse assigned to your terminal or, if present in the Billto File, the default warehouse assigned to the customer. You can override this default. Enter the warehouse number from which the order is being delivered or picked up. This field is also referred to as the Header Warehouse to distinguish it from the Detail Warehouses, which are assigned to each line item. The Header Warehouse is where the pick list prints and from where the customer is serviced. The Detail Warehouse is where the stock is located. You can take stock from multiple warehouses and transfers are automatically generated. Refer to the section regarding transfers and instructions for entering line items. A Warehouse Price List Cross Reference table directs the system to automatically update the price list when the header warehouse is changed during order entry. This allows you to assign a different pricing structure for each warehouse. For

more information refer to Warehouse Price List Cross Reference Table - FIL 41 .

As an example of how this functionality works, consider the following example:

The feature only

applies to companies that base their pricing on the servicing

warehouse, as opposed to pricing by customer regardless of

the servicing warehouse.

The tax codes on the Order Entry Header Screen are automatically reset if the header warehouse is changed and the warehouse has applicable tax codes. The following example describes how tax codes can be reset:

In general, any change of a header warehouse or a ship via code causes the order entry or order change programs to reassess the tax codes. |

|

Type |

Enter a ? to display a list of order type codes. Order type codes can be user-defined or system defined. The user defined codes are informational only. Only the system generated codes: H, C, F, Q, U and V direct the system to perform an action described below. The order type codes are created via menu option Order and Serial Number Status Code Table - SET 7.

For

more information on returns and credits, refer to Quick

Credits Application.

|

|

O/H Order Handling Codes |

Order handling codes provide the default method of handling unless overridden. Sample order handling codes are shown below. 1-Fill/Kill - At the time the order is shipped or invoiced, any unshipped or un-invoiced lines on the order are cancelled. A fill/kill order is an order that can only have a single shipment and invoice generated against it. After the first shipment, all unfilled lines remaining on the order are automatically cancelled by the invoice update process. The customer will reorder the killed items as needed. Fill/Kill orders have the following effects on other parts of the system:

If an order

with Order Handling Code 1, or other Fill/Kill handling codes,

processes through Close-A-Truck with some remaining open back

orders, the remaining open back orders will not be accessible

via the Allocation Swapping module. This prevents accidently

filling back orders on orders which must be cancelled after

one shipment

2-Back order - At the time the order is shipped or invoiced, any unshipped or uninvoiced lines on the order remain at their current status. 3-Fill/Kill and Notify - Same effect as code 1, except the customer must be notified of what is being cancelled. 4 - Back order with new PO - Same effect as code 1, except the customer must be contacted for a new purchase order number to be used for remaining lines. A new order will be entered for remaining lines. 5- Must Ship Complete - All lines on this order must ship together. At the time of invoicing, unbilled lines (which should not occur) are left open. This OH code automatically withholds back order pick lists and bar code picking labels from printing until all back ordered items within the order are filled. When back orders are filled, the system checks to see if the order contains other back ordered items that are not yet filled. If the order has order handling code 5 (must ship complete), the pick list and bar code pick labels do not print. If the order has no more unfilled back ordered items, then the pick list or bar code labels will print. The Options for "Must Ship Complete" Ordersactivate system wide controls for "Must Ship Complete" orders.

6-Rush order/compensated - The order must be shipped as soon as possible. The customer is paying an additional rush delivery fee. The order is rushed at the customer's request. This code is used primarily for EDI in order to identify special circumstances to a trading partner. At the time of billing, unbilled lines are left open. 7-Rush order/uncompensated - The order must be shipped as soon as possible. The customer is not paying an additional rush delivery fee. The order is being rushed for reasons other than the customer's request. This code is used primarily for EDI in order to identify special circumstances to a trading partner. At the time of billing, unbilled lines are left open. 8-Special/EDI Order/Meaning assigned by trading partners. 9-Special/EDI Order/Meaning assigned by trading partners. The Order Entry and Order Change Programs issue an error message if the Order Handling Code does not contain one of the valid codes. Blank is considered valid. You can set up default Order Handling Codes for each customer in the Billto File. You can

search Order Handling Codes by entering a question mark (?)

in the Order Handling Code field.

|

|

Init |

Enter your initials or the initials of the person who took the order. The default is the operator ID as entered in the Control User program. The operator's initials can also be entered in the Control Panel for this terminal. User control overrides Control Panel. You may leave or override the default. |

|

ETA |

The recommended use for this field is to record the date the expected customer delivery date, when it is different than the ship date that you can offer. You may use this date to compare customer requested ship dates with actual shipping dates. This date is entered in MMDDYY format. The ETA date is shown on the Order Change and Order Inquiry screens. It does not affect the stock card in inventory inquiry. If the

order is processed using F9, making it a Point-of-Sale order,

the ETA date does not appear on an Order Inquiry. Since an

F9 order is by nature a cash and carry sale where the inventory

is considered shipped and sold immediately, the ETA does

not mean anything on order inquiry.

|

|

Job# |

This field is used only if you are assigning special job numbers to track large projects or groups of orders. Many available reports can sort by this field. For example, if you wanted to track all orders that relate to a new office complex being built in your area, you can assign a job number and enter that job number into all orders regardless of customer that are related to that job. You can run reports such as X By Y Gross Profit Analysis to analyze each job number. The job number you enter also appears next to the invoice number on all invoices for that job. |

|

Reason |

Order Reason Codes can be both system and user defined. They are meant to flag orders for special processing, primarily with regards to EDI. You can set up your own Order Reason Codes using the ORDERREAS table in the System Tables Program (SET 29). Order Reason Codes can only be entered in the Order Entry and Order Changes programs. By entering a question mark (?) in the Order Reason field, you can display a list of the codes established on your system. The default is for this field to be

an optional entry. However, it can be made mandatory via the

System Wide Setting - System-Wide Settings - Part 1 (Green Screen menu option SET 4).

|

|

Install Measure |

These fields are meant for companies that provide on-site installation and measurement services. These fields are only displayed if the Control Panel setting for Retail Environment is set to Y. If either of these fields is set to Y, Order Inquiry will automatically show the Installation and Measure status & dates. Installation

and measurement status and dates are entered using either

the Installation Scheduler web portal, or the Scheduler/Status

option within the Additional Functions screen of Order Entry

and Order Change. The Installation Scheduler web portal is

sold separately from the core system.

|

|

Customer Price List# |

The default is the customer price list number entered in the customer's Billto File. You can override this number. It represents the price level used to price the order, unless other exceptions are found for the individual items being ordered. |

|

Tax Codes/State |

The default is the state tax code entered in the customer's Billto file. You can override this code. If the order is taxable, enter the state code for the order. You can also press F9 from the Header Screen to make the order taxable or non-taxable. F9 should

not be used for Quotes. If it is, it essentially locks a quote

into being either taxable or non-taxable and it might need

to be changed further into the order process.

If not, leave this field blank. The tax rates that relate to each tax code are maintained in the Tax File program on the File Maintenance and Inquiry Menu. You can enter a question mark (?) and press Enter to search for and select different state tax codes. If a customer is normally non-taxable, but you need to tax the customer, press F9 to tax the customer only on this order. The tax rates entered in the County Codes File assigned to the customer is used as the tax rate. Order entry can automatically charge tax on specially-designated items, such as samples, even for customers who are normally tax-exempt. The automatic tax feature is activated when an item is ordered that has a tax code A (meaning always taxable). In this situation, the state tax code from the Billto File is inserted into this field. |

|

Tax Codes/Other |

Use this field if additional tax is being charged. For example, city tax or local tax. The default is the other tax code entered in the customer's Billto File. This tax code may be overridden. You can use either tax code or both. The tax codes are automatically reset if the header warehouse is changed and the warehouse has applicable tax codes. The following example describes how tax codes can be reset:

In general, any change of a header warehouse or a ship via code causes the order entry or order change programs to reassess the tax codes. For Canadian customers, the state tax code is used for PST and the other tax code is used for GST. Use the Tax File program to set up PST and GST codes and descriptions. You can enter a question mark (?) to search for different tax codes. |

|

D/del |

A D in this field indicates this order header was deleted. Deleted lines are removed from the system when the Night Jobs are run. Users are prevented from accessing this field. Press F4 from this screen if you want to delete an order. |

|

Extra Charge/ Discount |

If the order requires additional handling charge or discount percentage from its established price level, enter that percentage here. Assume two decimal places. If you are entering a discount, use the Field Minus key located on the numeric pad. The default is the Extra Chg/Disc entered in the customer's Billto File. This default can be overridden. Do not confuse this field with the Payment Terms/Discount field described below. This field relates to pricing, not to discounts for prompt payment. For example, to give a customer a 5% additional discount on the order, enter 00500 and press Field Minus. To give a customer a 2.75 % additional handling charge on the order, enter 00275 and press Field Exit. A negative number indicates a discount. A positive number indicates a handling charge. If you are creating an order for material that will be free of charge, for example, samples, enter 10000 S/B here. This means 100.00 % discount. The material will be free of charge and your inventory and other statistics will be updated correctly. We recommend that you not attempt mixing no charge items on the same order as billable items. If you enter a percentage here, you are required to enter information in the Where Extra Charge Shows field. |

|

Where Extra Charge Shows |

Enter in this field only if you intend to enter an extra charge or discount percentage. The default is the entry that appears in the customer's Billto File. It may be overridden.

For accurate sales analysis by item, we recommend that you use the L code whenever an extra charge/discount percentage is entered. This causes the adjustment to gross profit to be reflected for each item as well as for the entire order. Your company's financial managers should establish guidelines for entering discounts and handling charges. |

|

Floor Plan? |

Enter Y if this is a floor plan order. Pressing Enter through the Header Screen retrieves the default Floor Plan account number and terms. If you plan on

using Floor Plan terms, without third-party financing, enter

an N. Floor Plan Terms can

replace the regular Customer Terms File.

The term Floor Plan can be considered an industry synonym for third-party financing. Floor Plan is the concept of getting material into the showroom floor of a retail store. Special financing arrangements enable you to offer inventory to your customers at preferred terms, thereby increasing your presence with the customer. The basic theory behind the offering of a Floor Plan to a customer is that if the customer has more of your inventory on the floor, then he or she is more likely to sell more of your inventory. |

|

FP Acct |

Enter the Floor Plan account number if you override the default for this customer. |

|

FP Terms |

Enter the Floor Plan terms if you override the default. |

|

Xref Ord# Inv# |

These fields are required if you are entering a credit memo. Enter the original order number or invoice number this credit is referencing. |

|

Payment Terms: % Disc, Days |

Enter the terms of payment for the order. The default is the terms as entered in the customer's Billto File. You may override them. Customers can be assigned terms in these fields, or in the Terms Code field described below, or using both. See Examples of Payment Terms Entries. If you need to change an order from open account to COD, then enter 003 in the days field. If you change an account to cash, change the days field to 005. You can combine special terms with percentage discount as follows: 200 % Disc, 3 Days = 2.00% ~COD 100 % Disc, 5 Days = 1.00% Cash |

|

Cd: (Terms Code) |

This one-character field is used to represent terms that have been entered into the Payment Terms File. The default is the terms code as entered in the customer's Billto File. If your company offers payment terms that are dependent on the products you sell, such as different terms for different products, your customers will most likely be coded with an M as the terms code. M means use the manufacturer's terms, which are stored in the Product Line File. The Term %, Terms Days, and Terms Code fields can be used in conjunction with each other, but generally either a terms code or terms % plus terms days is used. It is important to note that a 003 in the Terms Days field indicates COD and an 005 indicates cash. You might see the combination of Terms Days 003 plus terms code M meaning customer is COD but gets the terms discounts applicable to each product. You can combine special terms with terms codes as follows:

You can leave Terms Percentage % and Days field blank and use terms code only. |

|

Job Name/Extra Description |

This field contains ten spaces for you to type in the job name or any additional information regarding the order. If a customer has special job or contract pricing. This field, as well as the Customer Purchase Order# field, is checked against the job, contract or purchase order numbers entered in the Special Price File. This field prints directly underneath the customer purchase order number on all documents. Entering a job name can help in tracking orders and in reporting. Making a Job Name Mandatory for specific accounts, manufacturers, branches and warehouses Associated Files

This functionality also extends to quotes. |

|

Order Contact |

This feature enables you to assign customer contact information to orders and invoices. It provides the following benefits:

This

feature must be activated using the System Wide Setting Option

for Customer Order Contacts.

To select a customer contact for this order/account. enter a ? and press Enter. The system can be set up to send an

email to the order contact if a valid email address is entered

in this field. This functionality is controlled by the System

Wide Setting - Options for Back Order Fill.

|

Function Keys

|

Function Key |

Description |

|

F2 |

This option ties into the Order Management capabilities which allows you to track estimated job totals and estimated job costs against actual billing and costs. This is primarily for commercial projects in which Work In Progress (WIP) reporting and accounting is required. You can use the Job Estimates Screen to enter, update, or inquire on costs and estimates. |

|

F4 |

Deletes an entire order. All lines on the order are deleted and the initial entry screen re-displays. If you press F4 accidentally from the Header screen, and you are authorized to do so, you may press F5 to undelete the entire order. Always review orders carefully after undeleting. When an order is canceled, a cancel order entry is automatically posted to order notepad in addition to what the user enters. This can help keep track of the order activity and can prevent a situation where a user does not enter cancel order. |

|

F6 |

Displays the Special Instructions screen that enables input of special instructions and miscellaneous charges. Press F6 from the Header Screen if you need to enter additional shipping instructions, customer references, or job numbers that relate to the entire order. |

|

F7 |

Ends job. If entries were made, the Print Selection Screen displays. If no entries were made, the menu is displayed. |

|

F8 |

Returns to the Entry Screen. If this is a new order and no line items have yet been entered, then no order has actually been created and the system automatically clears any stray header entries. |

|

F9 |

F9 acts as a toggle switch between taxable and non-taxable. For example, if an order is taxable, press F9 to make it non-taxable. If an order is non-taxable, F9 will make it taxable. F9 should

not be used for Quotes. If it is, it essentially locks a quote

into being either taxable or non-taxable and it might need

to be changed further into the order process.

This function finds tax rates in either the Billto or County Files. For example, if an order has no tax codes on the Header Screen, you can press F9 to obtain the tax codes from the customer's Billto File record and insert them in the Header Screen. If the customer is not normally taxed, there will be no tax codes in the customer's Billto File record. In that case, the program retrieves the county number (if any) from the Billto File and then checks the County File for tax codes to retrieve. If an order is already taxable (contains tax codes on the Order Header Screen), then F9 removes the tax codes and makes the order non-taxable. |