Applying Mass Inventory Updates - INV 8

Audit Trail For Write-Downs and Write-Offs

This option contains a series of extremely powerful inventory functions. It enables you to revalue inventory, write off small quantities, prepare GL journals for books only revaluations, and update serial number status codes using a variety of options and parameters. All options can be run in a test mode, so that a report listing the results of an entry can be printed prior to actual updates.

- To access this program, select option 8 - Inventory Mass Updates & Writedowns on the Inventory Menu. The first screen to appear request a password. Enter one and press Enter.

- The next screen is the Option Selection Screen. This screen allows you to specify the following types of processing.

- Option 1: Write Off Quantities of Inventory (reduce to zero) - This option reduces the available quantity of the selected inventory to zero.

- Option 2: Write Down Inventory Values (Actual) - This option reduces the inventory based on the values specified on the Write Down By Screen.

- Option 3: Write Down Inventory Values (Virtual) Report Only - This option creates and posts general ledger transactions to the current accounting period. Inventory values are affected only in the general ledger, not in the inventory files.

- Option 4: Write Down Inventory Values (Correct Write downs) - This option can be used to reverse a previous write down that was incorrect.

- Option 5: Update Serial Number Status Codes Only - This option can be used to change the serial number status. Inventory values are not affected.

- Select one update option, then select to run the update for serial numbered items or non-serial numbered items. Press Enter and then F7 to proceed to the Parameter Selection screen.

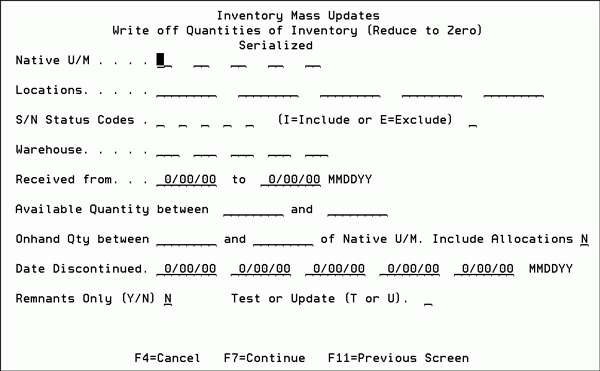

- Enter the values for the inventory being processed or leave blank to process all items. For example, you can enter five manufacturers and five product lines to run the update for. Press Enter to proceed to the second Parameter Selection screen.

- For writing off small quantities of material, such as wood and ceramic odd lots, and rolled goods remnants, use the Available Qty and Onhand Qty fields. These fields restrict the write-off to inventory records to a specified available quantity and onhand quantity.

- A 3 SF or less quantity with a customer order against it

- A 30 SF quantity with a 27 SF order against it leaving 3 SF available. The order could be cancelled, and the 3 SF would not be left if you have already written it off. Follow the recommendations described above to prevent these potential problems.

- Enter a value of Y or N in the Remnants Only field. Y selects serial numbers that are within the remnant quantity as defined in the Item File (FIL 2). The default value is N.

- The Include Allocations parameter, when set to Y, writes down values of the entire onhand quantity, including allocations. When set to N, only the available quantity is written down.

- If you want to run a test on your entries before actually running the update, enter a T in the Test or Update field. The system allows you to view your results prior to updating.

- Enter the values for the inventory being processed, or leave the values blank, to process items with any values in the categories that are left blank.

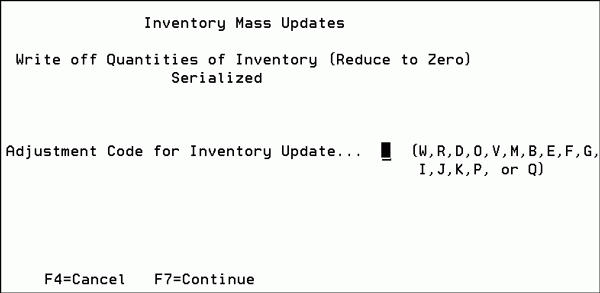

- If you choose option 1, the following screen appears.

- Enter an adjustment code. The available codes are:

- W - write-offs of quantities

- R - remanufactured

- D - damaged

- O - other

- V - return to vendor. This method enables you to write-off large numbers of records simultaneously when returning material to a vendor.

- M - measurement

- B, E, F, G, I, J, K, P, Q - user-defined codes. Assign your own meaning to these codes.

- Enter an adjustment code. The available codes are:

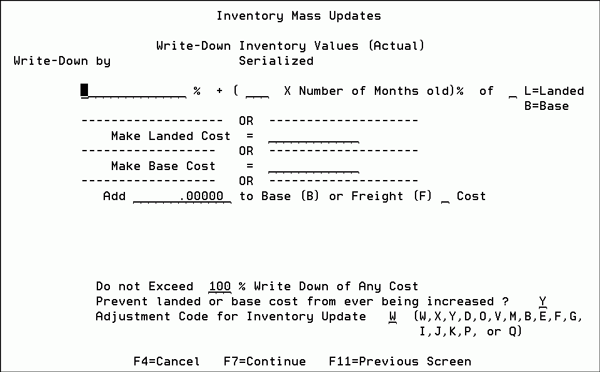

- If you entered options 2, 3, or 4 the following Write-Down Method Selection screen appears.

- Write-Down By: When specifying a factor to multiply the number of months old by, the result is added to the write-down percentage. Either the landed or base cost is multiplied by the write-down percentage to calculate the write down amount.

- Make Landed Cost: Specify a new landed cost for the items selected during the write-down process.

- Make Base Cost: Specify a new base cost for the items selected during the write-down process.

-

W - write-down

-

R - remanufactured

-

D - damaged

-

O - other

-

M - measurement

- The final screen in the process is the Job Scheduler screen. It allows you to select a time frame to run the job.

When executing options 1 through 4 you must indicate whether serial number or non-serial number items are being processed. Option 5 automatically selects serial number items.

This screen continues the item selection values. Keep in mind that these values are an and/or relationship. For example, Native U/M = SF SY and Warehouse = NYC RAL means the item must have a native U/M of SF or SY and be in either NYC or RAL warehouse.

For example, if you want to write off all serial or lot number quantities under three square feet, you should enter:

Available Qty Between 0 and 3 SF

Onhand Qty Between 0 and 3 SF.

By entering into both parameters, you prevent the possible write off of quantities for the following two conditions, in which you probably would not want to write off:

The next screen to appear depends on the processing option you selected in step 3 on the Inventory Mass Updates Option Selection Screen.

This screen allows you to specify one of the three following methods for reducing the inventory:

There are two fail-safe mechanisms on this screen. The first allows you to cap all write-downs at 100% or less of the existing cost, regardless of your other entries. For example, if you selected to subtract 5.00 from the base cost, but the base cost was only 4.00, the program does not subtract more than the percent of the cost it is set not to exceed. If you enter 80% as the percentage not to exceed, then the program would only write-down a cost of 5.00 to 1.00. You can also enter Y to prevent costs from being increased, regardless of your other entries. For example, if you selected to make landed cost 1.00, but a landed cost was .75, it would not be increased. Only costs greater than 1.00 would be changed.

This program automatically prevents costs from being written down to zero or negative. The lowest cost the program writes down to is .00001 per unit.

Use any of the adjustment codes shown on the above screen for your write-downs. The default adjustment code is W.

The fields on the Write-Down Method Selection screen are described below.

|

Field Name |

Description/Instructions |

|

Write-Down by % |

Enter the percentage by which to reduce the inventory. For example, 90% should read 90.00. |

|

Month Factor |

Enter the value to be multiplied by the number of months old to equal a percentage that will be added to the write-down by percentage. The percentage is multiplied by either the landed or base cost to calculate the write-down value. |

|

Make Landed Cost |

Enter the value for the new landed cost for the inventory write downs. The selected items/serial numbers will be written down so that their base cost becomes this value. |

|

Make Base Cost |

Enter the value for the new base cost for the inventory write-down. The selected items/serial numbers will be written down so that their base cost becomes this value. |

|

Do Not Exceed ___% Write Down of Any Cost |

Enter the percentage of the cost of any item that the inventory write-down should not exceed. |

|

Prevent Landed or Base Cost from ever being increased? |

Enter Y to prevent the landed or base cost from ever being increased. If you do not want to increase the landed or base cost, enter Y. The default value is Y. This option prevents an intended write-down from increasing the cost of an item that was previously written down even further than the new write-down. |

|

Adjustment Code for Inventory Update |

Enter one of the following values: Inventory adjustments that are created will use this adjustment code, and will appear on the Stock Card Screen of each updated item. |

Audit Trail For Write-Downs and Write-Offs

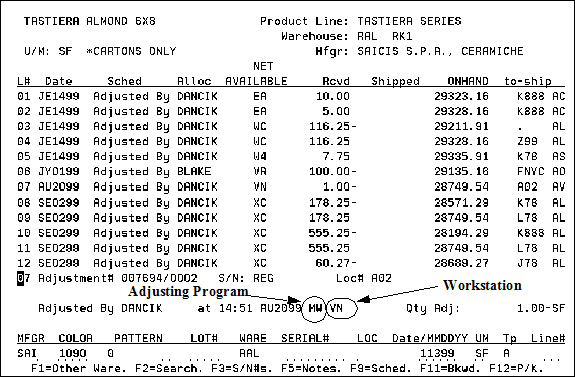

The Mass Write-Down Program and the Write-Off of Small Quantities Program creates an audit record in the Inventory Stock Card screens of all items which are updated. The audit record includes the user, date, time and program used to make the adjustment.

The following screen displays a write-down and its audit record. This Stock Card Screen includes only Type A transactions, which are adjustments. Adjustments are requested by entering A in the Tp (type) field. This example also shows the details behind line number seven, which indicates the adjustment was made at 2:51pm on August 20th, by Kerridge at workstation VN, using program MW (mass write-downs).

The following is a list of program ID code abbreviations indicating which program was used to make the adjustment.

|

Program ID Code |

Program Description |

|

II |

Update Mode of Inventory Inquiry |

|

AI |

Adjustments By Item |

|

AS |

Adjustments By Serial Number. |

|

AL |

Adjustments by Location. |

|

CC |

Cycle Count Updates. |

|

MW |

Mass Write-Downs program. |

|

AP |

Adjustments API. This is embedded in other applications, including Light Manufacturing. |

|

WS |

Write-Off of Small Lots and serial numbers. |