General Ledger Demand Reports

Select one of the following options to generate the report you need:

Chart of Accounts List - GL 101

Recurring Journal List - GL 105

Income and Expense Spreadsheets GL 108

List G/L Interfaces with Other Applications - GL 110

Sales Summaries by G/L Account - GL 111

Inventory Summaries By G/L Account - GL 112

Chart of Accounts List - GL 101

On the General Ledger Menu, select option 101 - Chart of Accounts List. On the screen that appears enter a company number. The chart of accounts is sorted by company or account number for one or all companies. It provides the title of each account, the main category, subcategory, and comments. It also notes if an account number has been put on hold. Accounts on hold can not be used when posting to A/P or G/L. Main categories include:

- A - Assets

- L - Liability

- I - Income

- E - Expense

- Q - Equity

Trial Balance - GL 102

This report provides the beginning balance, ending balance and activity for each account in the chart of accounts for the month requested. It also shows a recap of total assets, liabilities, equity, income, expenses, and net profit or loss year-to-date.

- On the General Ledger Reports menu, select option 102 - Trial Balance Report, and press Enter.

- Enter a one-digit Company#, and press Enter.

- Enter A to print the trial balance for the company as a whole or enter a branch number which was set up in the File Maintenance Menu. Be careful to enter A (not ALL) when running a company wide trial balance. If you type ALL you are requesting a Trial Balance for a branch called ALL .

- Enter one of the following choices:

- C to include only batches that were posted.

- B to include posted batches and any batch that was edited and in balance.

- A to include all posted batches, all batches that were edited and in balance and all batches that have not yet been edited or corrected.

- C is the default. Options other than C should be used only to include unposted transactions. Enter your desired option and press Enter.

- Enter the Posting Month for which to run the Trial Balance Report in YYMM format, and press Enter to select a report version.

The Summary Version shows only the current balances in each account.

The Super-Summary Version shows only the current balance, but drops accounts with a zero balance.

General Ledger - GL 103

The General Ledger Report provides the beginning balance, ending balance and all journal entries that affected every account in the chart of accounts for the open month you have requested. If multiple months are left open at one time, the G/L Report shows the beginning balance of the first unclosed month, followed by all JEs for all unclosed months, followed by the ending balance. If the month for which you requested the report has been closed, the G/L Report lists the ending balance for that month. The G/L Report shows details of each JE, such as description, branch, cost center, account number, and account name. It also places an asterisk (*) next to any journals that have notepad entries and prints all notes as footnotes to the report. The G/L Report can optionally show the detail A/P transactions that make up the A/P JEs that are automatically summarized and posted to the G/L. The A/P details, when requested, show vendor, vendor invoice number, and description.

- From the General Ledger Menu, enter 103 and press Enter. The next series of screens lead you through the selection of:

- A single company or all companies on the system.

- A single company or all companies on the system.

- A specific cost center to include in the general ledger or enter A to print General Ledger for all cost centers.

- A batch type. Enter one of the following choices:

- C to include only batches that were posted. C is the default. Options other than C should be used only to include unposted transactions.

- B to include posted batches and any batch that was edited and in balance.

- A to include all posted batches, all batches that were edited and in balance and all batches that have not yet been edited or corrected.

- The Posting Month for which to run the G/L Report in YYMM format, and press Enter.

- Pick one of the following printing options.

- Option Y includes all A/P transactions that make up each journal entry summarized and auto-posted from the A/P system. The supporting A/P shows the vendor, amount of the invoice, date, invoice number, and any description that was entered when the vendor invoice was recorded.

- An N option will not print supporting A/P transactions but still shows the summarized journal entries which auto post from the A/P system.

- On the next screen enter Y or N to print or omit accounts with no balance or activity.

- Accounts with zero balances and zero activity in the requested month can be optionally omitted from the report.

- On the next screen, you can limit the detail information to a single requested month, when multiple months remain open.

- Enter Y to print details for all unclosed prior months. For example, if you are running the report for 9/07, and 7/07, 8/07, and 9/07 are still open, the report begins with the 6/07 end of month balance, lists all transactions for 7/07, 8/07, and 9/07, and then the closing balances for 9/07.

If you enter N, the report begins with the 8/07 end of month balance, lists the transactions for 9/07 only, and the closing balances for 9/07.

Audit Trails - GL 104

The Audit Trail Report is used to analyze selected data from the G/L and A/P systems. You can generate a report from a certain date span or month span. You can request an audit trail for all or specific companies, branches, cost centers, job transaction codes, account types, account numbers, journal numbers, batch numbers, source codes, workstation IDs, and many combinations of these.

Examples of Requesting an Audit.

The Audit Trail Report is primarily used to access very specific information such as:

- All transactions that affected a specific account number within a specified time-span.

- All transactions that affected a branch or cost center within a specified time span.

- Specific journal numbers or batches.

- Entries entered by a specific operator or workstation.

Using the parameter screens, you can select the data you want, and then sort and subtotal the way you want.

1. From General Ledger Reports Menu, enter 104, and press Enter.

2. Enter one of the following options.

- Option 1 - Draws information only from months that are currently unclosed on the G/L system.

- Option 2 - Draws information only from months that are currently closed on the G/L system.

- Option 3 - The default. Draws information from both closed and unclosed months. If you are uncertain or unconcerned about the status of the month, choose option number 3.

- Option 4 - Returns you to the General Ledger Reports menu.

3. Press Enter. To access a Parameter Selection screen. Enter data into the appropriate the fields to limit the report.

For example, to report on a single account number, enter one of the account number fields. Leaving the other categories blank instructs the selection program not to check data for those categories.

Following is a description of the fields on this screen.

|

Field Name |

Description/Instructions |

|

Company # |

Enter one, or up to five, company numbers for which you want to run the Audit Trail Report. |

|

Branch |

Enter one, or up to five, branches to run the Audit Trail Report. |

|

Cost Center |

Enter one, or up to five, cost centers or cost center groups to run the Audit Trail Report. |

|

Job Trans CD |

Enter one, or up to five, transaction codes to run the Audit Trail Report. |

|

Acct Type |

Enter one or all the account types available to run the Audit Trail Report

|

|

Account # |

Enter one, or up to five, chart of account numbers or a range of chart of account numbers to run the Audit Trail Report. |

|

Journal # |

Enter one, or up to five, journal numbers to run the Audit Trail Report. |

|

Batch # |

Enter one, or up to five, batches to run the Audit Trail Report. |

|

Source Code |

Enter one, or up to five, source codes to run the Audit Trail Report. |

|

Init/WSID |

Enter one, or up to five, initials or workstation IDs to run the Audit Trail Report. |

|

Enter Posting Month to Include |

The posting month is the accounting period in which transactions are posted. You must enter it in YYMM format. |

|

Enter Transaction Dates to Include |

The transaction date is the date on which the journal entry was entered. You must enter it in YYMMDD format. |

4. After entering the appropriate parameters, press Enter. If no errors are found, the message Entry Accepted is displayed. Press F7 to continue. The Sort Parameters screen appears.

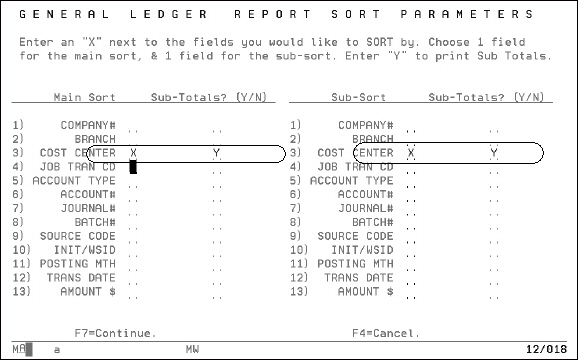

5. Select a main and a sub-sort field.

- Enter X next to one and only one field in the Main Sort column.

- In the Sub-Totals field, enter Y to print subtotals for the main sort parameter, or N to not to print subtotals.

- Enter X next to one and only one field in the Sub-Sort column. In the Sub-Totals field, enter Y to print subtotals for the sub-sort parameter, or N to not to print subtotals.

Examples of Requesting an Audit

Example 1 - Requesting an Audit of One Account Number

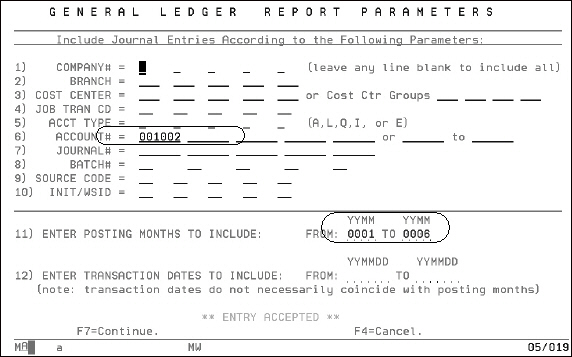

In this example, an Audit Trail Report is requested for account number 001002 (Travel & Entertainment) from January 2000 to June 2000.

1. Complete the fields on the G/L Report Parameters screen, as necessary.

2. Press F7 to continue to the Sort Parameters Screen.

3. Select Branch as your main sorting parameter, and enter Y to include sub-totals for this parameter.

4. Select Cost Center as the sub-sort parameter and also have the system include sub-totals on the audit report.

The main sort for this Audit Trail Report is by branch with subtotals for each branch. The sub-sort is by cost center in all branches with subtotals.

5. Press Enter to accept your entry and then F7 to continue to the next screen to select a printing option.

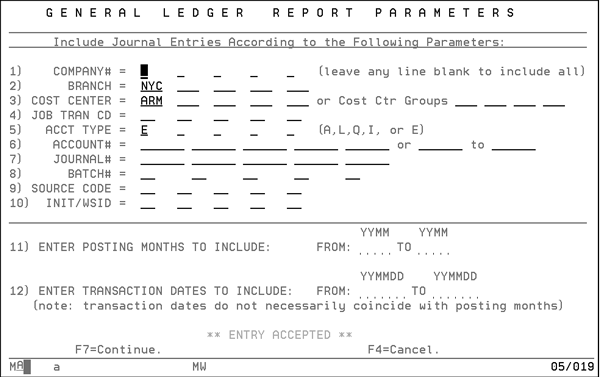

Example 2 - Requesting an Audit with Combination Parameters

The parameters requested on the following screen limit the audit to all expense accounts of the cost center ARM in the branch NYC.

Press Enter to accept your entry and then F7 to continue to the Sort Parameters screen.

The main sort in this example will be by Account# with a subtotal for every account number. The sub-sort is by journal number without any subtotals for each journal.

Recurring Journal List - GL 105

This program lists RJEs as entered in GL option 5 in the format of a journal edit. The Recurring Journal list appears on the Job Queue ready to print.

Batch Status Report - GL 106

The Batch Status Report shows all batch numbers entered in the G/L and their status. If a batch number has no current activity, it is not listed, including batch numbers never before used, and batch numbers used in months that have not been closed. Once a month has been closed all batch numbers used that month become available to use again and drop off the Batch Status Report.

The following batch status descriptions are possible.

|

New |

Currently being created via the G/L Entry program. |

|

To Edit |

Requires an edit or has error and requires corrections as well as another edit. |

|

In Balance |

Edited and found error-free and in balance was not yet closed. The In Balance status is assigned by the Edit Journals option. |

|

Closed |

Closed/posted. Closed status is assigned by running option 3, the Post Journals option. When the month in which this batch is included is closed, the batch number becomes available to use again and drops off the Batch Status Report. |

|

Batch Edit is Out of Balance |

This batch is currently out of balance or has errors. Correction has to be made to this batch in order to post the journals. |

Period Status Report - GL 107

The Period Status Report lists the status of all periods available on the system. It always displays 36 consecutive months, usually including the past fiscal year, the current fiscal year, and the next fiscal year. Your history files can be set to maintain history as far back as you request, assuming you have the disk space for it. History for months before those listed on this report are accessible for many reports, such as the audit and spreadsheet reports. Only the months listed on this report that are still open are available for running financial statements. A separate page is printed for each company number.

Each month listed on the report is followed by its status. The status of the fiscal year and of the individual months are shown. A fiscal year can have status Closed or Unclosed. A year can be closed only if all months in that year have been closed.

On the General Ledger Menu, select option 107, and press Enter

A month can have the following statuses:

- Never Opened - No JEs have been entered for this month.

- Open - JEs have been entered and the month is still open.

- Closed - The month has been closed.

A month can be closed only if all previous months have been closed. The system ensures that they have been closed. Months and years are closed using the General Ledger Menu - End of Period Section.

A fiscal year can have status Closed or Not Closed. A year can be closed only if all months in that year have been closed.

Income and Expense Spreadsheets GL 108

The Income and Expense Spreadsheets can be arranged to print rows of account numbers and account categories, and columns of companies, branches, cost centers, or months of the year.

You can choose to include all or some companies, branches, cost centers, accounts, or type of accounts. These reports can supplement or even replace formal profit-and-loss financial statements. Some of the reports available via this option include:

- Company profit and loss month-by-month for the entire year plus yearly total.

- Branch profit and loss month-by-month for the entire year plus yearly total.

- Cost center profit and loss month-by-month for the entire year plus yearly total.

- Company and consolidated P&L with ratios of each company to total of consolidated.

- Comparative Branch P&L with ratios of each branch to company total.

- Comparative Cost Center P&L with ratios of each cost center to company total.

- From General Ledger Reports Menu, select option 108, and press Enter.

- Enter option Y to run the income statement, or N to return to the menu, and press Enter.

- This message that appears reminds you that you would normally enter I (Income) or E (Expense), in which case the activity and not the balance for each account is printed.

- Enter 0 and press Enter to continue.

- Enter data only for the categories to which you want to limit the report. For example, if you enter company 1, branches NYC and SFO, and leave all other categories blank, the program selects all transactions that are in company 1 and branches NYC and SFO.

- These reports can be run with or without branch subtotals. The version including branch subtotals lists each branch within each account number. The version without branch subtotals only shows the total for each account.

- After specifying the parameters, press Enter.

- When the message Entry Accepted appears, press F7 to end the job.

Associated Files

GL Account Sub-Categories File (ACT 119)

List G/L Interfaces with Other Applications - GL 110

This report lists which accounts to debit and credit, defined in the Interfaces to G/L.

For example, the option List Invoicing to G/L Interface can automatically create sales and cost of sales of journal entries from the Invoicing System into the G/L System.

In order to utilize this interface, you must:

- Complete all relevant entries in the Invoicing to G/L Interface File. This file is in the Accounting File Maintenance Menu (ACT).

- Test the interface using the Sales Summary by G/L Account Report. This report is available from the Sales Report Menu or from the G/L Demand Reports Menu.

- Choose to create journal entries using the applicable prompts on the Sales Summary by G/L Account Report once the interface is fully tested. We recommend that you run the Sales Summary via an invoice number span representing the accounting month.

- Run the Sales Summary by G/L Account Report and the option to automatically create journal entries at any time after the A/R end-of-month close. You do not have to run these options during or directly after the end-of-month closing. You have the option to perform a trial run before actually creating the G/L journals. A trial run provides the opportunity to check the accounts and cost centers, adjust the invoicing to G/L Inter-face File, if necessary, and rerun.

- Automatic journal entries are stored in batch number 00. This is exactly the same procedure as for the journals created by the automatic A/P to G/L interface.

Sales Summaries by G/L Account - GL 111

You can use this option to generate a report showing all sales activities for General Ledger Account.

- On the General Ledger Menu, select option 111, and press Enter.

- Enter the parameters you want to include on the report, or to include them all the parameters just leave all of the fields blank.

- You must specify a company number. This prevents mistakes - especially when a user is not aware of the GL months that are open or closed for the different companies on your system. If you leave the Enter A COMPANY# (Company# is required for GL Reports) field blank, the system automatically inserts your default company and displays an error message.

- The system validates the date entered and will not allow any updates to a closed period.

- When your input is accepted, press F7 to continue. The next screen gives you three additional sorting parameters. You do not have to use all three sorting parameters. These fields are optional and do not have to be used at all, but they give you more control over the format and content of your report.

- Enter the sorting options, and press Enter, and then F7.

- On the next screen, enter the Posting Month for the report in YYMM date forma, and press Enter.

- On the next screen, enter Y to run the Customer Transfers Report. The default is N (to not run the report). This report can print, and optionally create journals for the value of stock used by each branch out of each warehouse's stock. This option is useful if you need to record these transactions by branch on the general ledger. For example, you could record these transactions to affect purchases or inventory by cost center and branch. These transactions are only for customer transfers. Actual stock to stock inventory transfers are recorded via inventory reports.

- On the next screen, enter Y to post the sales figures you are going to generate to the General Ledger, or enter N to just run the Sales Summary Report. The default is N.

Inventory Summaries By G/L Account - GL 112

The Inventory to G/L Interface can be run anytime after the accounts receivable end of month is completed. The Inventory to G/L Interface can be run in edit mode at anytime. However, to actually post the interface, run the Inventory to G/L Interface anytime after the AR EOM is completed.

- The first screen gives you the option of running a simple or extended Inventory to G/L Inventory Format.

- Enter option 2. Option 1 - Simple Interface was superseded by the Extended Interface and Option 2 is the only recommended method. The extended version lets you edit and post journal entries.

Automatic G/L Journals From Invoicing System

To automatically post sales and cost of sales of journal entries from the Invoicing System into the G/L System, you must:

- Complete all relevant entries in the Invoicing to G/L Interface File. This file is on the second page of the Accounting File Maintenance Menu.

- Test the interface using the Sales Summaries by G/L Account - GL 111. This report is available from the Sales Report Menu or from the G/L Demand Reports Menu.

- Choose to create journal entries using the applicable prompts on the Sales Summary by G/L Account Report once the interface is fully tested. We recommend you run the Sales Summary via an invoice number span representing the accounting month.

- Run the Sales Summary by G/L Account Report and the option to automatically create journal entries at any time after the A/R end-of-month close. You do not have to run these options during or directly after the end-of-month closing. You have the option to perform a trial run before actually creating the G/L journals. A trial run provides the opportunity to check the accounts and cost centers, adjust the invoicing to G/L Interface File, if necessary, and rerun.

- Automatic journal entries are stored in batch number 00. This is exactly the same procedure as for the journals created by the automatic A/P to G/L interface.

Accounting Considerations for Automatic Transfers

Consider these points if you plan to activate the Interwarehouse Freight Cost tables of the Automatic Transfer Programs:

- If you activate the Additional Transfer Cost Tables, then inventory value and cost of sales is increased for all applicable customer transfer orders. The additional costs should be set to match the overhead costs of transferring the material. The benefit is to show lowered gross profit for transfers, and more accurately portray the profitability of branches, customers, and so on.

- You are currently booking the overhead costs of transferring via your A/P and G/L entries, such as payroll, trucking, maintenance, and so on.

- You may be double-booking these expenses if you simply activate the additional cost for transfers without adjusting expenses.

- The Monthly Inventory Transfers Report and Inventory Register for Transfers will show you the total value added to inventory based on the additional cost of transfer. This figure may be used to keep from double booking this cost. You can simply debit inventory and credit an expense account, which offsets the expenses being booked for transfer overhead in other accounts.

- Your inventory value includes the cost of transferring until the material is sold. At that time, the cost of sales includes the cost of transferring.

- You may want to set up clearing accounts within the G/L to match the actual overhead costs to the cost of transfer as calculated by the new automatic transfer process.

Certain methods of accounting can have the affect of deferring the expenses related to transferring by counting them as an asset (inventory) until the cost of sale is actually recorded. This is similar to the inclusion of inbound freight in inventory.

A/R to G/L Interface (GL 113)

The A/R to G/L Interface is consistent with the other applications interfacing with G/L. The interface requires you to create bank code for cash application.

You can change the description on all user-defined codes. You can then create your A/R to G/L Interface for all cash codes used in cash application, user-defined codes, and manually generated codes. In addition, the interface for user-defined and manually generated codes allows you to enter a percentage to break down the total amount posted to these codes, for example, to separate a percentage for a sales tax on code 7A.

Before using the A/R to G/L Interface

- Create a bank code file for cash application. This is used in the A/R to G/L Interface, if you have different G/L account numbers for the different bank codes used during cash application.

- On the Accounting File Maintenance menu (ACT), select option 113 - Bank Code File. The Bank Code Table Maintenance file appears. To create a bank code, press F1. The Bank Code File Maintenance screen appears.

- Enter the Company number, Bank Code, and Bank Name. Enter Y if you want this to be the default bank code while applying cash. Enter the general ledger account number for this bank code.

- This is the default G/L cash account used for miscellaneous cash journal entries during the interface.

- Enter the Description for User-Defined Codes, such as 7a-79 and 8A-89, if necessary.

- On the Accounting File Maintenance menu (ACT), Enter option 112 - A/R Transaction Code Description Maintenance. Create or update transaction codes as needed.

- Create the A/R to G/L Interface

- On the Accounting / File Maintenance Menu (ACT), select option 101 - A/R to G/L Interface.

Details of A/R to G/L Interface

- The A/R to G/L Interface captures all data for the month up to the last Night Job. For example, if you entered cash transactions today, running the A/R to G/L Interface immediately after entering them excludes these transactions, because you have not run a Night Job.

- The A/R to G/L Interface allows the entry of cash application codes, manually generated, and user-defined transaction codes.

- The detail entry screen to enter your G/L account numbers to debit and credit depends on the type of transaction codes.

- You can request the A/R to G/L Interface to create your journal entries for the current month or previous month only.

- We recommend that you request the A/R to G/L Interface to create the entries in test mode first. Verify your entries, then rerun the A/R to G/L Interface Report in update mode. The journal entries created are part of batch 00 (system generated journal entries appear in this batch only).

To enter cash transaction codes

- On the A/R to G/L Interface screen, enter a cash application code. The A/R to G/L Interface Cash Transaction Code screen appears.

- Enter a Branch Code or Bank Code.

- You can record the cash transaction codes interface at the branch and/or bank code level.

- The A/R to G/L Interface Cash Transaction Code Detail screen appears, enter the G/L account numbers to debit and credit for this cash transaction code.

- Enter the G/L Account numbers to debit and credit.

To enter a sales transaction code (for manually and/or user-defined codes)

- On the A/R to G/L Interface, enter a sale transaction code. The A/R to G/L Interface Sale Transaction Code screen appears.

- You can record the sales transaction codes interface at the branch level.

- Enter the Branch Code. The Detail Entry screen appears.

- Enter the G/L Account numbers to debit and credit for this sales transaction code.

- If you want to take a percentage of the total amount posted to this transaction code to go into another G/L account number, for example, sales tax, you can enter the percentage and the G/L account number to debit and credit.

To run the A/R to G/L Interface Report

- On the General Ledger menu, select option 113 - A/R to G/L Interface.