Financial Statements and Custom Reports

Run All Monthly Financial Statements

Run Salesperson Financial Statements

Run Consolidated Financial Statements

Account Groups File

You can use this program to define groups of accounts that are used to create the subtotals appearing on financial statements. For example, you might need a subtotal for current assets on warehouse expenses. To see examples of how to set up financial statements, refer to Creating an Income Statement.

To run financial statements, you must first design the report formats. When designing report formats, you need to set up account groups, which are used for subtotals and grand totals on financial statements. There are two types of account groups:

- A - includes spans of GL account numbers

- G - includes other groups.

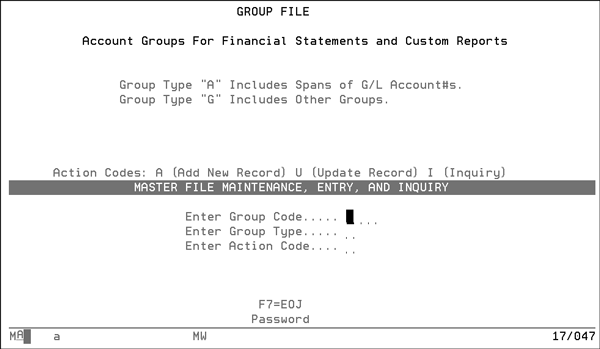

1. Select option 1 - Account Groups File on the General Ledger Financial Statements & Custom Reports.

|

Field Name |

Description/Instructions |

|

Enter Group Code |

A four-character alphanumeric code that represents the group being created. For example, FXAS could be used for Fixed Assets total. |

|

Enter Group Type |

Enter A if the group consists of account numbers. The group represents the total of the balances and activity of the account numbers. Enter G if the group consists of other groups. For example, group TLAS or Total Assets could be defined as a total of groups. FXAS or Fixed Assets, OTAS or Other Assets and CVAS or Current Assets. If you enter A, you enter account numbers on the next screen. If you enter G you enter previously created group codes on the next screen. |

|

Enter action Code |

Enter A to add a new record, U to update records, or I to inquire. |

|

Password |

Enter password, if required. |

2. Do one of the following:

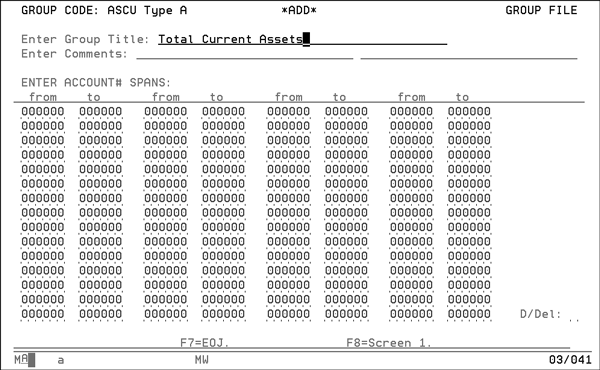

- If you entered Group Type A on screen 1, enter the spans of account numbers that comprise Total Current Assets. Enter as many account number spans as needed. To enter individual accounts numbers, enter the same number in both the from and to columns.

- If you entered Group Type G on screen 1, enter all of the previously entered groups that compose Total Assets. For example, Total Assets could consist of previously entered groups ASCU or Assets Current and ASFI or Total Fixed Assets.

List Account Groups

This program is for listing the account groups file that you created earlier in the Account Groups File. It shows which account numbers or other groups are included in each group record.

- Select option 2 - List Account Groups File on the General Ledger Financial Statements & Custom Reports.

- Select an account group to list and press Enter. A listing of the selected account group is generated.

Report Generator

This program is used to create report formats and to print formal financial statements. First, you create account groups, using option 1 on the Financial Statements and Custom Reports Menu, which will be used by this program for subtotals and grand totals.

Financial Statements and Reports

Financial Report Special Instructions

Select option 3 - Report Generator on the General Ledger Financial Statements & Custom Reports. The screen that appears has the following options.

- 1 - Displays the first screen of the Financial Statements and Reports.

- 2 - Prints a list of all previously designed reports in report number order. It does not print the actual screens, only the report numbers and their titles and descriptions.

- 3 - Duplicates one report format to another. This option is used when you want to create a new report format based upon an existing format.

Financial Statements and Reports

We recommend that you create Report 001 to be your main corporate balance sheet, and Report 002 to be your main corporate income statement. The Financial Statements Menu and the End-of-Period Menu have options to print balance sheet and income statement. These options assume your balance sheet is Report 001 and your income statement is Report 002. We also recommend you number all other reports that are to be run as part of regular end-of-month processing 003-100. This is because the Run All Financial Statement option on the End-of-Period Menu prints any report numbered 001-100. Report numbers 101-999 should be used for reports that are not run as part of the regular End-of-Period process. Report numbers 101-999 can only be run using this program, by entering the report number and pressing F6.

All reports designed using this program can be run for any company number and for any branches within a company. They can also be run for any month that has been opened on the G/L system, as long as it is not in a previously closed fiscal year. For example, you can run reports for any month, closed or open, in the current fiscal year. You can also run reports in a new year, even when months of the previous year remain open. Only months in previously closed year cannot be reprinted. Other reports on the system, such as the spreadsheet and audit reports, can be used to print information concerning previously closed years.

Financial Statement reports can include current year, previous year, and budget information. You define the columns to be included on each report or you can use the ten column format options available. Although this program does not allow reprinting of statements for a month in a previously closed year, you can obtain that information by running statements for the same month, but one year later, and including a Previous Year column. Before using this program to design a report format, you should have created the necessary Account Groups set up through option 1 of the General Ledger Financial Statements & Custom Reports. You should also have designed on paper the various accounts, groups, subtotals, grand totals that you will need. Each detail line of a report can be defined as either an account number or an account group. All subtotals and grand totals are account groups. Once you create a report format, you can print that report at any time. The only time you need to access the report format again is when an account number or group is being added or a change in style is required.

- Select option 1 on the General Ledger Report Generator.

- If you want to design a financial statement or report, enter a Report #, and press Enter. Financial statements and reports can be numbered from 001-999.

- If you want to print that report number, enter a Report #, and press F6.

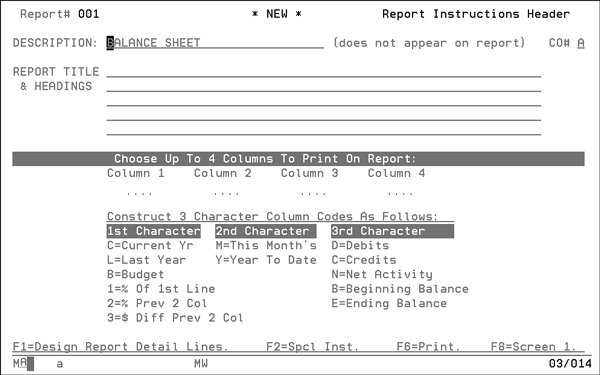

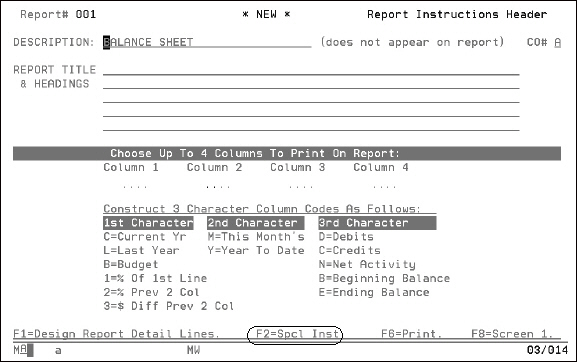

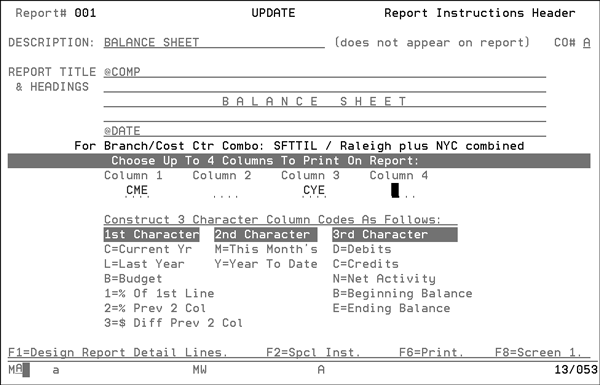

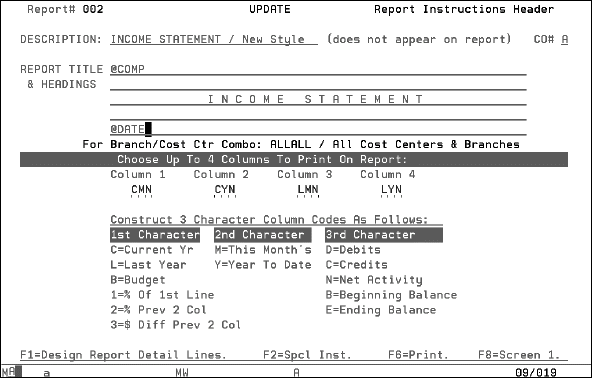

- Type a report number and press Enter, the Header screen is displayed.

- Complete the fields on this screen. The top section of this screen displays the report number as entered on screen 1 and the action.(New if a new report or Update if a report already exists.) This screen accepts both upper and lower case characters. You can use either for title and headings. However, you can only use upper case letters in the CO # and Column Code fields.

- @ COMP Automatically inserts and centers the selected company’s name whenever the report is run.

- @DATE Automatically inserts and centers the period for which the report is run.

-

CMD - Current Month’s Debits

-

CMC - Current Month’s Credits

-

CMN - Current Month’s Net Activity; debits and credits

-

CMB - Current Month’s Beginning Balance

-

CME - Current Month’s Ending Balance

-

CYD - Current Year-To-Date Debits

-

CYC - Current Year-To-Date Credits

-

CYN - Current year-to-date net activity; debits and credits

-

CYB - Current year’s beginning balance

-

CYE - Current year-to-date ending balance

-

LMD - Last Year’s Debits

-

LMC - Last Year’s Credits

-

LMN - Last Year’s Net Activity; debits and credits

-

LMB - Last Year’s Beginning Balance

-

LME - Last Year’s Ending Balance

-

LYD - Last Year-To-Date Debits

-

LYC - Last Year-To-Date Credits

-

LYN - Last year-to-date net activity; debits and credits

-

LYB - Last year’s beginning balance

-

LYE - Last year-to-date ending balance

-

BMD - Budget, month’s debits

-

BMC - Budget, month’s credit

-

BMN - Budget, month’s net activity; debits and credits

-

BMB - Budget, month’s beginning balance

-

BME - Budget, month’s ending balance

-

BYD - Budget, year-to-date debits

-

BYC - Budget, year-to-date credits

-

BYN - Budget, year-to-date net activity; debits and credits

-

BYB - Budget, year’s beginning balance

-

BYE - Budget, year-to-date ending balance

- Press F1 to design report detail lines or F2 to display the Financial Report Special Instructions.

The Header screen is used to establish report title, headings, and columns.

|

Field Name |

Description/Instructions |

|

Description |

Description of this report. For example, P&L Comparative to Budget, Summary Balance Sheet. This is for your own reference. It does not appear in the body of the report. It only appears on the top right-hand side of the report for internal reference. When

entering Reports 001 and 002, the system automatically inserts

default descriptions. For example, Balance Sheet, and Income

Statement, which can be overridden.

|

|

Report Title and Headings |

Five lines are provided for the report title and headings. We recommend that you center all text within these fields. If you are going to use the report for a single company number, then you should type the company name as part of the headings. Special functions are available by typing the following codes on the far left portion of any of the five lines: |

|

CO number |

Enter A in this field if you want to use this format to run a report for any company number. Enter a company number if this report is designed for a specific company number only. |

|

Columns 1,2,3 and 4 |

Enter one or more of the four column definitions. Each column definition is a one- or three- character code in which each character has its own meaning. The meaning of each is described on the screen illustration. Current Month Codes Last Year’s Codes |

|

Columns 1,2,3 and 4 |

Budget Codes |

|

Columns 1,2,3 and 4 |

1 = % of 1st line - This code causes a percent to print in this column. It is the percentage of the first line of the previous column on the report. For example, if the previous column first line is Total Sales - Current Month, then this column would express all figures as a percentage of Total Sales Current Month. 2 = % Prev 2 Col - Percent of previous two columns. This code causes a percent to print in this column. It is the percentage variance between the figures in the previous two columns. For example, if the first column contained Current Year and the second column contained Last Year, then a 2 code in the third column would display the percentage variance between this year and last year for all figures on the report. 3 = $ Diff Prev 2 Col - This code causes a dollar difference to print in this column. It is the dollar variance between the figures in the previous two columns. For example, if the first column contained Current Year and the second column contained Last Year, then a 2 code in the third column would display the percentage variance between this year and last year for all figures on the report. |

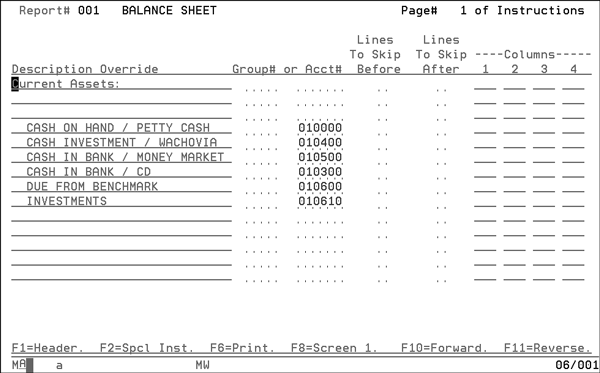

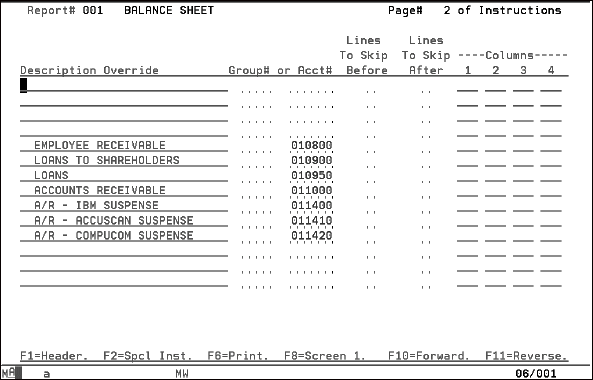

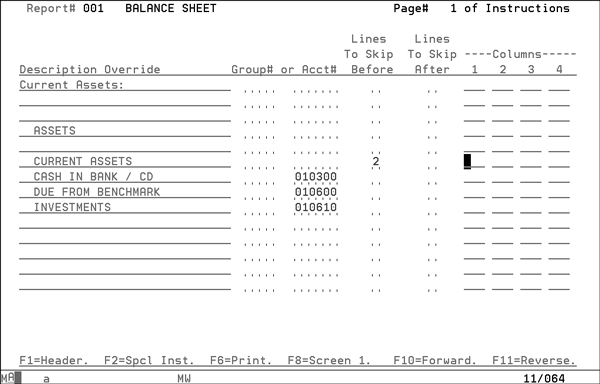

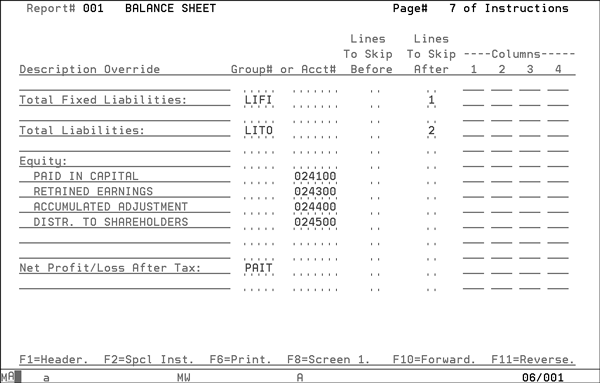

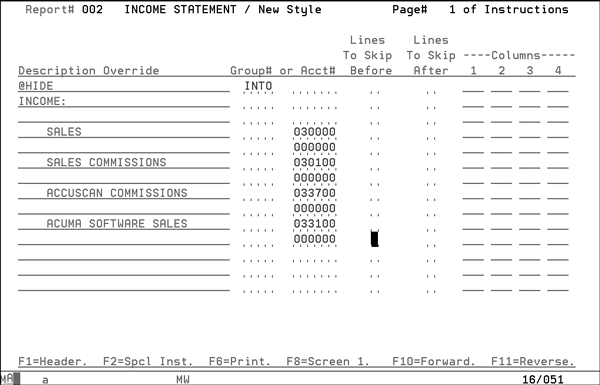

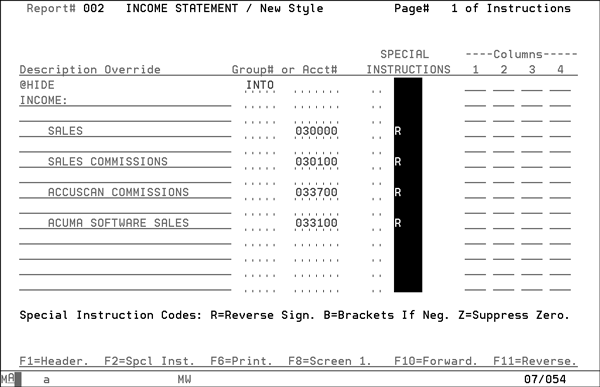

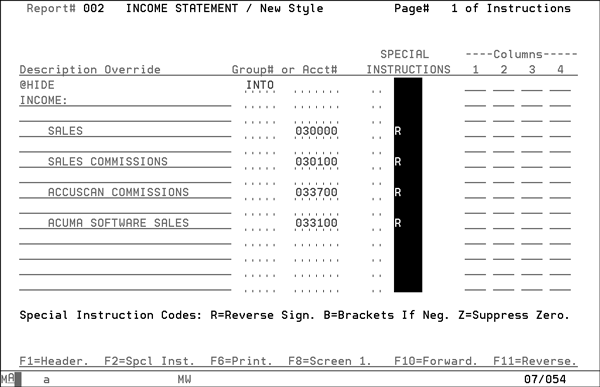

Financial Report Details

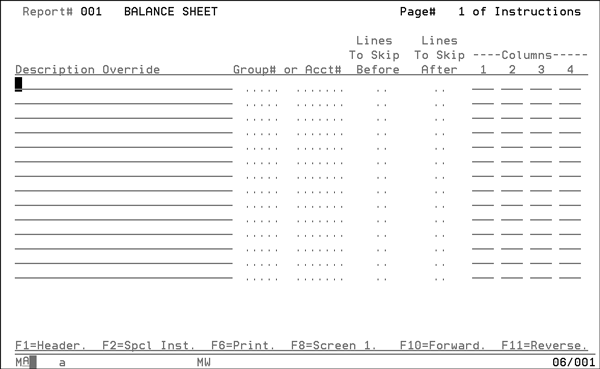

On the Instructions Header screen, press F1.

This screen is used to design the detail lines of a report. You enter the account numbers or account groups in the order they are to appear on the report.

Complete the fields on this screen, leaving plenty of empty lines for future additions.

We recommend that you skip one line for every one or two you enter to allow more lines to be easily inserted later. Leaving empty lines does not affect the way the report is printed and does not take extra space in the system. Use F10 and F11 to page forward or backward.

Following is a description of the fields on the above screen.

|

Field Name |

Description/Instructions |

|

Description Override |

This 30-character field is used for labelling account numbers, groups, totals, or any descriptive text. If you leave this field blank and fill in either an account number or a group number, the program automatically inserts and displays the account or group name in this field. You can override it as needed. The entry in this field appears on the report when printed. You can indent, change wording, and use lower case letters. Also use this field for sub-headings, which delineate sections of a report, for example, Assets and Equity. If you leave this field and all other fields on the line blank, the report ignores the line; it does not print a blank line. You can also enter codes in this field for special functions.

|

|

Group or Account Number |

You can enter a group number, an account number, or neither, but not both. If you enter a group number the report, when printed, shows totals for the group. If you enter an account number the report, when printed, shows totals for the account number. If you leave the Description Override field blank and press Enter, the program displays the group or account name. If you enter or change the Description Override field, the entered or overridden description prints on the report. |

|

Lines to skip before |

If you enter a number from 1-9 the program skips that number of lines before this line is printed. |

|

Lines to skip after |

If you enter a number from 1-9 the program skips that number of lines after this line is printed. |

|

Columns 1-4 |

These fields are used when you need to override the column codes that where set up on the Header screen. For example, if column 1 was coded as CME - Current Year, This Month’s Ending Balance) and on the inventory line you put beginning balance for the year, then you would enter CYB - Current Year, Beginning Balance - in column 1. This override the codes from the header screen for this line only. You could use this method to show the beginning balance, monthly

activity, and ending balance for an account or group. You

would enter the same account number or group on three consecutive

lines, each with its own column override entries.

|

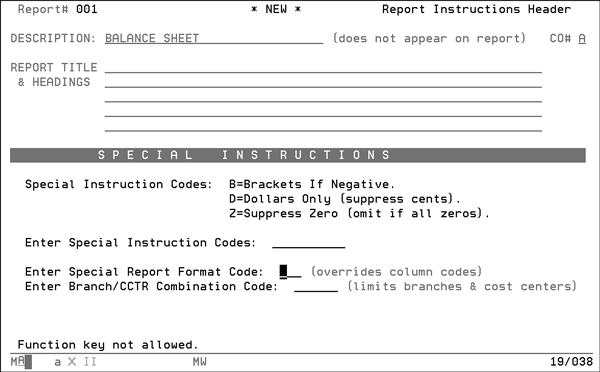

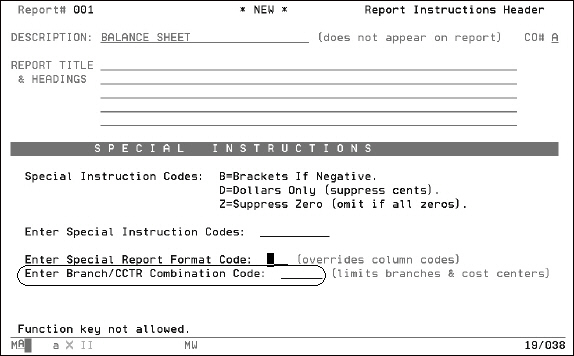

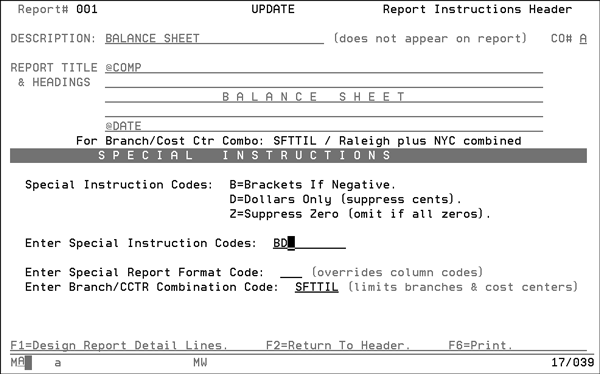

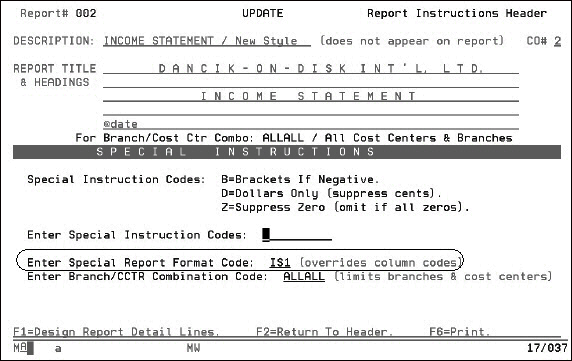

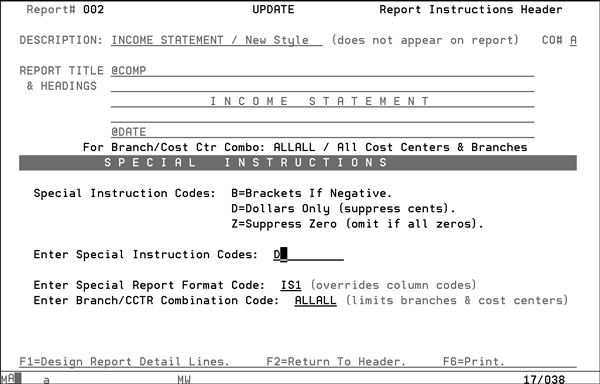

Financial Report Special Instructions

- On the Instructions Header screen press F2.

- To enter special instructions for a detail line, press F2.

- Enter special instructions codes in the highlighted area.

- R - reverses the sign of the amount - positive becomes negative and vise versa. We recommend that you use R for all natural credit accounts that include liabilities, equity, and income. Also use R for groups that belong to these categories. This makes the reports more readable and is a widely accepted accounting practice.

- B - to use brackets instead of minus signs for negative amounts. You can also assign the B code on the Header Special Instructions screen. Code B would automatically apply to all negative that would print on reports.

- Z - omits any accounts with zeros in all the columns selected

|

Field Name |

Description/Instructions |

|

B,D,Z |

There are three special instruction codes B, D, and Z. You can enter all three codes. It does not matter in which order you enter the special instructions codes. B causes all credits to be shown in brackets instead of with a negative sign. D causes only dollar figures to print. No decimal point or cents will be printed. Z omits any accounts with zeros in all the columns selected. |

|

Enter Special Report Format Code |

There are three statement formats available for the Income statement IS1, IS2 and IS3. |

|

Enter Branch/Cost Center Combination Code |

Enter the combination code which you want to use to run your financial statement. |

The three codes are described as follows.

Run Balance Sheet

This option only prints the main balance sheet, which is Report 001. Balance sheets and other financial statements can be run at any time for any month, closed or open, except for months in a previously closed year. All closed journal entries are included in the figures.

- Select option 4 - Run Balance Sheet on the General Ledger Financial Statements & Custom Reports Menu.

- Type a one-digit company number for which you want to run the report and press Enter.

- Type the Branch # for which you want to run the balance sheet, or type A to run for the entire company.

- Type the cost center number for which you want to run the balance sheet, or type A to run for the entire company.

- Type the Posting Month in YYMM format, for which you want to run the balance sheet, and press Enter. The balance sheet is listed on the Job Queue and ready to print.

- Your budget template must be defined as:

- Chart of account number

- Branch

- Cost center

- When entering budgets you do not have to enter each branch and cost center. However, you must enter your budgets against at least one valid branch and cost center. For example, even if you only budget by account number, enter budgets using any branch and cost center. When calculating budgets by company, the system adds all branch and cost center records for each account number. This method allows for flexibility in the future, should you want to budget at the branch and cost center levels later.

- When entering budgets, enter data only into the Amount column. You do not need to enter data into the Gross Profit columns for financial budgets. These columns are meant for sales budgets only. Enter debits as positive numbers and credits as negative numbers.

- When entering budgets, the year relates to the fiscal year, and the budget number relates to the revision number. You should start with budget number 01 each year, and use budget number 02 for the first revision, and so on. Do not use budget 99, which is reserved for actual sales figures.

- When entering budgets, use the percentage code feature whenever possible. It allows you to enter a yearly budget amount with an automatic split by month. The split can be an even monthly split, or based on seasonal and other formulas.

- Do not confuse financial budgeting with the sales budgets or the High-Level Management Budget, which are all created for different specialized purposes.

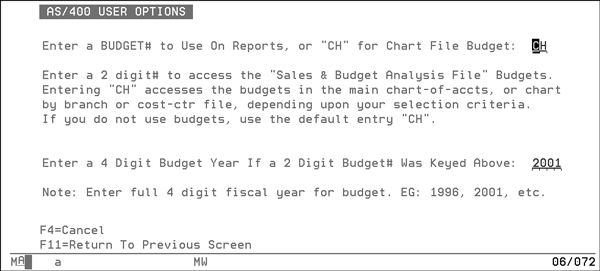

- Enter the Budget Number to use on reports or CH to use the Chart of Accounts budget.

- Enter the Budget Year if the budget number is used instead of the Chart of accounts budget. Press Enter. The balance sheet is listed on Job Queue and ready to print.

Make sure you enter A and not ALL to run the report for the entire company. In addition to the branches you set up, the system automatically sets up a branch number ALL, which is the default branch used by the system for all expenses and other entries that are not assigned to a specific branch.

Make sure you enter A and not ALL to run a report for the entire company. In addition to the cost centers you set up, the system automatically sets up a cost center ALL which is the default cost center used by the system for all expenses and other entries that are not assigned to a specific cost center.

All financial statements, such as balance sheets and income statements, use the Sales and Budget Analysis System files for maintaining budgets. Whenever you request to print financial statements, the program prompts you to select where budgets should be retrieved from. The default option is to retrieve from the Chart of Accounts Files. The following screen shows the budget selection options.

The screen above accesses information stored in the Budget File.

When setting up financial budgets using the new budget files, follow these guidelines:

Run Income Statement

Use this option only to print the main income statement, which is Report 002. Income statements and other financial statements can be run at any time for any month, closed or open, except for months in a previously closed year. All closed journal entries and combination codes are included in the figures.

- Select option 5 - Run Income Statement on the General Ledger Financial Statements & Custom Reports On the screen that appears, type Y and press Enter.

- Type the one-digit Company # for which you want to run the report, and press Enter.

- Type the Posting Month, in YYMM format, for which you want to run the income statement. Press Enter.

- Enter the Budget # to use on reports or CH to use the Chart of Accounts budget.

- Enter the Budget Year if the budget number is used instead of the chart of accounts budget. Press Enter. The balance sheet is listed on Job Queue and ready to print.

Run All Monthly Financial Statements

You can use this option to print financial statements numbered from 1 to 100, a range of numbers or a listing of all the groupings with their balances.

In numbering your reports, we recommend you follow these guidelines:

- Number the main balance sheet Report 001.

- Number the main income statement Report 002.

- Number the other financial statements which are to be printed monthly from 003-100.

Financial statements that are not to be included in the normal monthly run should be numbered 101-999.

- Select option 6 - Run All Monthly Financial Statements on the General Ledger Financial Statements & Custom Reports.

- Type in your choice and press Enter. The Company Selection screen appears.

- Type the one-digit Company # to run for the entire company, and press Enter. The Branch Selection screen appears.

- Type in the Branch # for which you want to run the report, or type A to run the report for all branches, and press Enter. The Cost Center Selection screen appears.

- Type the cost center number for which you want to run the report, or type A to run for all cost centers, and press Enter.

- Type the Posting Month for which you want to run the report in YYMM format, and press Enter.

- Enter the Budget # to use on reports or CH to use the Chart of Accounts budget.

- Enter the Budget Year if the budget number is used instead of the Chart of accounts budget, and press Enter.

- The next screen lets you set a range of reports to run. Enter the First G/L Report # and the Last G/L Report # to define the range of reports you want to run, and press Enter. The reports are generated and sent to the job queue.

The Accounts Groups Update Report is an audit of all the groups that have been established. It lists each group, the accounts within each group, and the activity and balances of each account and group. You need to run this report only when auditing groups or if you want detailed information for inclusion in other spreadsheets or reports.

Make sure you enter A and not ALL when running the report for all Branches.

Run Salesperson Financial Statements

You can use this option to print financial statements for a selected salesperson using any of the formats created using option 3 - Report Generator.

- Select option 7 - Run Salesperson Financial Statements on the General Ledger Financial Statements & Custom Reports.

- Type a three-digit report Number, and press Enter. The following prompt appears:

- Type a three-character salesperson code and press Enter. The following prompt appears:

- Type a Percentage Amount, assuming two decimal places, and press Enter.

- Type the one-digit Company #, for which you want to run the report, and press Enter.

- Type the Branch # for which you want to run the balance sheet, or type A to run for the entire company, and press Enter. The Cost Center Selection screen appears.

- Type the Cost Center Number for which you want to run the report, or type A to run for all cost centers, and press Enter to access the Posting Month Selection screen.

- Type the Posting Month, in YYMM format, for which you want to run the report. Press Enter. The Budget Selection screen appears.

- Enter the Budget # to use on reports or CH to use the Chart File Budget. The report is generated and sent to the job queue.

ENTER A 3 CHARACTER SALESPERSON#.

Enter missing parameter

ENTER A 5 DIGIT PERCENTAGE (This % Of Expenses Will Be Allocated To Salesperson WGB. EG: Enter 100.00% as 10000. Enter 5.75% as 00575.)

Enter missing parameter

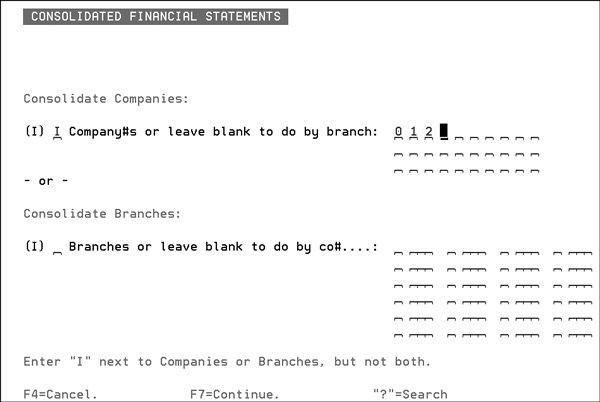

Run Consolidated Financial Statements

The Consolidated Financial Statements program includes the following capabilities:

- Consolidate multiple companies on a single balance sheet or income statement.

- Consolidate multiple branches within a company on a single balance sheet or income statement.

- Consolidate branches that span multiple companies on a single balance sheet or income statement.

Examples of use:

- Company 1 = ABC Floors, with the following branches:

- Branch NYC = New York City

- Branch LAX = Los Angeles

- Branch CHI = Chicago

- Branch LG1 (for logistics services from NYC)

- Branch LG2 (for logistics services from LAX)

- Branch LG3 (for logistics services from CHI)

- Company 2 = XYZ Floors, with the following branches:

- Branch PHI = Philadelphia

- Branch SAN = San Diego

- Branch DET = Detroit

- Branch LG1 (for logistics services from PHI)

- Branch LG2 (for logistics services from SAN)

- Branch LG3 (for logistics services from DET)

- You can consolidate company 1 + 2 into a single combined balance sheet or income statement.

- You can consolidate Branches NYC, LAX, and CHI within Company 1, for Product Sales With-out Logistic Services.

- You can consolidate Branches LG1, LG2, and LG3 within Company 1, for Logistics Business Without Products.

- You can consolidate Branches NYC and LG1 within Company 1, for Total NYC Products & Logistics.

- You can consolidate Branches NYC, LAX, and CHI within Company 1, plus Branches PHI, SAN, and DET within Company 2 for Multi-Company Product Sales Without Logistic Services.

- You can consolidate Branches LG1, LG2, and LG3 within Company 1, plus Branches LG1, LG2, and LG3 within Company 2, for Multi-Company Logistics Businesses Without Products.

- You can consolidate Branches NYC and LG1 within Company 1, and Branches PHI and LG1 within Company 2 for Total East Coast Products & Logistics.

When consolidated financial statements are printed, the heading area shows which companies and/or branches are included.

When you request the Consolidate Financial Statements option, the following parameter screen is displayed:

You may include a list of companies or branches. The branches may span multiple companies. This screen will remember your last parameter selections and redisplays them when you return.

You do not have to create any new financial report templates or layouts. All existing financial report-generator report layouts may be used with the consolidated options.

There are two restrictions/guidelines to adhere to:

- the same chart of accounts must be used across all companies in order for the information to make sense. It is acceptable for some accounts to only be used by some companies. However, all accounts that are used in any company should exist in Company 0. Even if you do not use Company 0, make sure you have a complete chart of accounts set for Company 0. You may copy your chart of accounts from one company to another using the Duplicate Chart Of Accounts program on the Special System Maintenance menu.

- The status for the period you are running the report for must be equal for all companies. The status can be determined by reviewing the period status report.

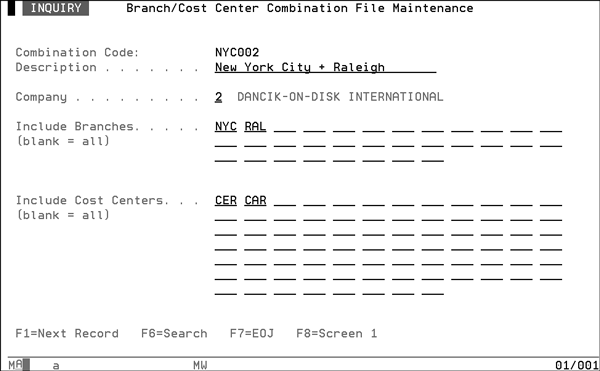

Branch/Cost Center Combination File

You can use this file to define combination records consisting of any groupings of branches and cost centers. These combinations can be used with any financial statement. For example, a combination can include three branches, or 25 cost centers, or a combination of five branches and 10 cost centers. The limit per combination is 32 branches and 80 cost centers, but there is no practical limit to the number of combination records you can create. You can define combinations using option 9 on the Financial Statements and Custom Reports Menu. Combinations can be assigned, temporarily or permanently, to a financial statement format.

1. Select option 9 - Branch/Cost Center Combination File on the General Ledger Financial Statements & Custom Reports. The Branch/Cost Center Combination File entry screen appears.

2. Enter Action Code A to Add a record, U to Update a record, or I to Inquire about a record.

3. Enter a Combination Code. To select from a list of combination codes press F6.

4. The Combination Code Detail Maintenance screen appears.

5. To assign a combination to a financial statement, press F2 on the financial statement header to display header special instructions.

The Special Instructions Screen appears.

6. Enter the six character Branch/CCTR Combination Code.

Only income statements, income and expense supporting schedules, or activity based statements should contain combination numbers. This is because combinations access the Detail G/L History File and extract general ledger activity for specific branches and cost centers. There are no balance forward entries kept by combination. Balance sheets can not be run for combinations.

In using the Branch/Cost Center Combination File, you can generate income statements with the correct year-to-date and last year figures, even if you have not closed the prior year. Simply create a combinations file record that includes all branches and all cost centers by leaving the entire screen blank except for a description and company number. Then, you can run the income statement for that combination code. This technique circumvents a restriction that prevented using the financial statement formats for last year to date figures when a previous year was still open. Now, you can use financial statements or the Income and Expense spreadsheets regardless of which months or years are open or closed.

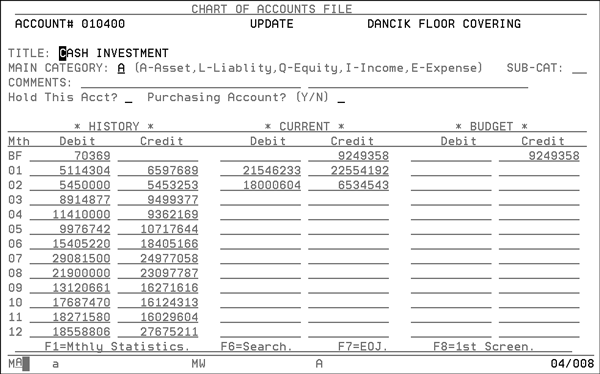

Chart of Accounts File

You can use the Chart of Accounts File to review your journal entries for the current and previous period as well as budgeted amounts. Create each account, denoting it as an asset, liability, equity, income or expense.

The Chart of Accounts File contains a record for each account. Each record contains:

- the title and category of each account

- a place to key a 12-month budget

- a 24-month summary of activity for the account.

- Select option 10 - Chart Of Accounts File on the General Ledger Financial Statements & Custom Reports. The Initial Chart of Accounts File screen appears. Enter the Company Number.

- Enter the chart of accounts Account Number. This is any five digit number from 00000 to 99999. Account numbers should be assigned logically. For example, from 10000 - 19999 are asset accounts; 20000 - 29999 are liability accounts. When multiple companies are on the system, assign the same account numbers to the same companies. For example, the account number for Computer Supplies is the same, except for the first character in the company account.

- Enter A to Add a new chart of accounts record, U to Update or change a chart of accounts record, or I or leave blank to Inquire about an existing chart of account record.

- Enter a Password, if necessary. This password is a two-level password. The lower level allows limited field access, the higher level allows total access.

- Press Enter. The Detail Chart of Accounts screen appears.

- The top line of this screen displays the complete account number and company name. The term account number refers either to all digits in a six-digit field or the last five digits in a five-digit field. The system often indicates what company number is used and only needs the five-digit portion.

- The following is a description of the Chart of Accounts fields.

-

A- Asset account

-

L - Liability account

-

Q - Equity account

-

I- Income account

-

E- Expense account

|

Field Name |

Description |

|

Title |

Enter the name of this account. Two 30-character lines are provided. This title will be displayed on most screens and reports accessing this account number. For better readability, try to use only the first line where possible. |

|

Main Category |

Enter one of the five valid category codes: These categories are used for some reports. However, user defined groups of accounts are also available. |

|

Sub-Cat |

Use this field to further break down the main category. You should define codes for the categories meaningful to your company for example, CA for current assets, NC for non-current assets. |

|

Comments |

Sixty characters are provided for your notes and comments. |

|

Hold? |

Enter Y in this field will disable an account from being posted to via the Accounts Payable or General Ledger systems. It does not affect existing balances in the account. It prevents further posting. Held accounts are noted on the Chart of Accounts Search and Listing. |

|

Purchasing Account? |

This field identifies an account as being a purchasing account. This field is used by the new A/P Entry Manifest Window and by A/P Reconciliation Reports when the system needs to include only purchasing figures. Enter a Y in this field for any purchasing accounts that will be reconciled to inventory value. We do not recommend entering Y in any freight accounts, even though you may consider them part of purchasing. Normally, freight is reconciled differently than material cost. |

The rest of the screen is divided into three sections: History, Current, and Budget.

This is the system’s storage for all final end-of-month figures.

History Section

- Contains last fiscal year figures

- Only current manager has password access

- Up -to-the-month figures are entered during system setup. Do not alter these figures after making corrections to the information. End-of-month statistics are automatically posted here. Access these fields only during system setup. Upon request, Dancik International can remove update access to these fields after setting up the system.

Current Section

- Contains this fiscal year figures

- Only current manager has password access

- Up-to-the-month figures are entered during system setup. Do not alter these figures after making corrections to the information. End-of-month statistics are automatically posted here. Access these fields only during system setup. Upon request, Dancik International can remove update access to these fields after setting up the system.

Budget Section

- Accessed with any level password.

- Filled in at the beginning of each fiscal year, and it is used for comparative analysis.

These sections include seven columns and 13 rows. The first column displays the months of the fiscal year. The first row, BF, stands for Balance Forward from the end of the previous fiscal year. The screen changes automatically to reflect the fiscal calendar of the company being displayed.

The remaining six columns divide the three sections into Debits and Credits. The 13 rows consist of a balance forward from the previous year and a row for each of the 12 months.

The debits less the credits in the BF row of the Current section must equal the sum of all of the history column debits less the sum of all of the history column credits. The months of the fiscal year need not be entered. They are automatically displayed here based on the end-of-fiscal-year entry in the Company file.

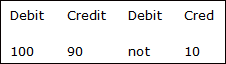

The Debit and Credit figures represent the total account activity for a given month or year, not the net activity. For example, an account with debits totaling 100 and credits totaling 90 in a given month is listed as:

By using this method the total activity and the net activity is preserved.

Each debit or credit field is defined as an 11-digit number with two assumed decimal places.

Note: Enter $100.00 as 10000. The largest acceptable number is 99999999999 999,999,999.99.

After you complete the fields and press Enter, the screen displays the message ACCEPTED next to the mode at the top of the screen, or an error message at the bottom of the screen. If and only if the message ACCEPTED is blinking on the screen has the data been recorded into the file. If there is an error message it will be self-explanatory. Fix the entry in error and press Enter again. Repeat until you see the message ACCEPTED blinking.

The following table explains the function keys available from the Chart of Accounts screen.

|

Command Key |

Screen |

Description |

|

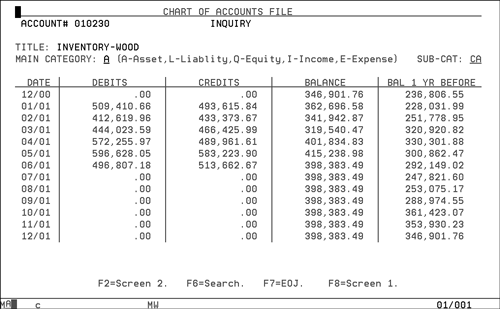

F1 |

Monthly Statistics |

This screen has no input or update fields. It displays some of the information on Screen 2 in a more readable format. It provides an alternate and often a clearer version of the current and history sections. Decimal places and the comparative net figure balance of each month are shown. Also shown is the net figure for each month from the year before. The first row (12/00) is the balance forward of the previous fiscal year, which, in this example, ends in December.

|

|

F6 |

Search |

This command toggles between this program and the Chart of Accounts Search program. You can use the Chart of Accounts Search command to search alphabetically or numerically for an account, and to display the entire chart of accounts on screen. |

|

F7 |

|

To return to menu |

|

F8 |

|

To go to Screen 1 |

Creating a Balance Sheet

Step 1

Once the account groups have been set up, you can start your financial statement design. Remember that Report 001 is always your main balance sheet and Report 002 is always your main income statement. Any other reports such as another balance sheet, income statement, or supporting schedules should be numbered from 003-999. Also note that reports numbered 001-100 are automatically run when End-of-Month Financial Statements are run. For XYZ Company, the Header screen would be entered as below. Also refer the Report Generator.

- From the General Ledger Financial Statements & Custom Reports select option 3 - Report Generator.

- Select option 1 - To Design or Print a Report, and press Enter.

- Enter a Report # and press Enter.

- Enter a Description, Report Title, Headings, and at least one column code in Column 1, 2, 3, or 4.

Entering the @COMP and @ DATE before the report title and headings will automatically center the company’s name and the date requested for the report to print.

Columns 2 and 4 in this example are blank because the format for XYZ Company’s Balance Sheet shows that the totals from Column 1 (CME) and Column 3 (CYE) are carried forward into columns 2 and 4, respectively. (See format, step 1)

The A entered in the CO# field indicates that this format can be used for all companies on the system.

Step 2

- From the Instructions Header screen, press F2 for special instructions.

- Enter B in the Special Instructions Codes field if you credit balances to have brackets around them. Otherwise, the credits are shown with a minus sign.

- Enter a D in the Enter Special Instruction Codes field if you want to show dollars only.

Later in this example, you will see that you can reverse the sign of natural credits such as income, liabilities, and equity. This improves readability, because the only figures displayed as negative will be those with the opposite of a natural sign.

Step 3

- Press F1 on the Financial Report Special Instructions to display report details.

- To design the balance sheet to look like the format in Step 1, first enter any text that is not on the same line as a group number or account number. The text would be subheadings with no figures next to them, as shown above.

Text is entered in the Description Override column. This field uses upper and lower case letters. If you enter a Group # or Account # and press Enter, the title of the group number or account number automatically appears in the Description Override field. You can change the spacing of the title by inserting or deleting spaces, and overriding the text as needed.

Income Statement Format

Income statements can use special statement format code IS3. To assign this format to an existing income statement, press F2 on the Instructions Header screen of the Design Financial Statements and Custom Reports program. Enter IS3 in the Special Format Code field. This entry overrides any column definitions entered in the header screen. The IS3 format contains 12 columns that print as shown in the example later in this section.

The Enter Special Report Format Code field on the The Special Instructions screen of the General Ledger Report Generator (Option 3 on the Financial Statements and Custom Reports menu) is where special format codes are entered.

Income Statement Details

Income statement 002 can have combination codes, and is your main system (default) income statement. Statements with combination codes can now be generated using any available options or function keys that can print statements. For example, you can press F6 on the first screen of the Report Generator. You no longer have to display the header record and combination code first. You can also generate income statement 002 from the menu option Run Income Statement. Prior to this release, your main income statement (002) could not have a combination code.

Step 4

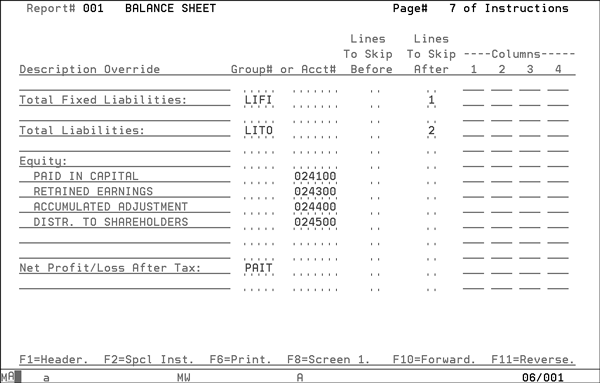

This screen displays Page 2 of the format detail instructions. Each group representing a line on the balance sheet is entered in the sequence that they are to appear. In step 4, Header Screen, the balances of XYZ Company were set to be printed in column 1, CME, and column 3, CYE. To override the columns so that the balances appear in columns 2 and 4 for total current assets fixed assets, security deposits and total assets, you must enter the column codes as shown in columns 2 and 4. The columns entries shown below simply override the Header column entries for specific detail lines. The @U symbol causes an underline to print in the specified columns. Note that the @U is always entered on a line by itself, with no group number or account number. The column overrides are used to move the underlines as well as the figures to columns 2 and 4.

Step 5

The format for XYZ Company has few lines that separate the assets from the liabilities. Therefore, you can enter 2 in Lines To skip Before, as shown. You could have entered 2 in Lines To Skip After, after the last asset line.

Step 6

On the Header Screen Instructions, the request was to bracket all negatives. For example, brackets are used instead of minus signs on all amounts with credit balances. Since all Income, Liabilities, and Equity are natural credits, and you may not want them to show in brackets, press F2 and enter code R in the special instructions for any income, liabilities, or equity account or group. The R reverses the sign of the figures before testing for brackets. Therefore, only debit balances in an income, liability, and equity account show in brackets.

Step 7

The example below is the continuation of the liability section of the balance sheet for XYZ Company. Remember that for each liability and equity line that uses a group code or account number, you should press F2 and enter code R in the special instructions. The entries below illustrate that groups and account numbers can be mixed when applicable. In general, all subtotals are represented by groups, and the detail is made up of individual account numbers and sub groups.

Step 8

The last page of the balance sheet for XYZ Company looks similar to the example below. The EQLI group, final total of equity and liabilities, is followed by a double underline. Note that both the figures and the underlines have been designated to appear in Columns 2 and 4.

Creating an Income Statement

This example is the procedure for creating an income statement for XYZ Company.

- Go to Screen 1 of the Report Generator and label this report 002 - Main Income Statement, and press Enter.

- Enter a Description, Report Title, Headings, and at least one Column code in the four columns provided. Entering the @COMP and @DATE at the beginning of the report title and headings to center the company’s name and the date requested for the report to print. The A entered in the CO Number field indicates that this format can be used for all companies on the system. The codes entered in Columns 1-4 follow the format for the income statement. See Income Statement Format.

- When finished with the Header screen, press F2 for special instructions.

- Press F1 for design report details.

- To design the income statement to look like the format in step 1, you should first enter any text that does not have a group number or account number into the Description Override field. This field uses upper and lower case letters.

- Since all Income, Liabilities, and Equity are natural credits and you might not want them to show in brackets, press F2 and enter the code R in the special instructions for any Income, Liabilities, or Equity account or group. The R reverses the sign of the figures before testing for brackets. therefore, only debit balances in an income, liability and equity account will show in brackets.

- The last page of the income statement for XYZ Company looks similar to the example below. Remember that for every income line that uses a group code or an account number, you should use the R code in the special instructions. The group number or account number that will have an R code in the special instructions are: OPIN, Operating Income; INOI, Interest and Other Income and NTIC, Net Income/Loss.

Entering B in the Special Instructions Codes field if you want anything with a credit balance to print with brackets around it. Otherwise, the credits are shown with a minus sign. Later in this example, you will see that you can reverse the sign of natural credits, such as income, liabilities and equity. This improves readability, because the only figures displayed as negative will be those with an opposite natural sign. The D entered here will instruct the system to show dollars only.

If you enter a Group Number or Account Number and press Enter, the title of the group number or account number automatically display in the Description Override field. You can change the spacing of the title by inserting or deleting spaces and overriding the text, as needed. Note: You should skip lines between account numbers or group numbers, so that you can add something later. The blank lines do not print on the report. To skip lines on the report, use the Line to Skip Before and the Lines to Skip After fields.

On the Header Screen Special Instructions, the request was to bracket all negative amounts. Brackets will be used instead of negative signs on all amounts with credit balances.

To set up supporting schedules, enter @P on the Description Override field. Each time there is a request to print Report 002 for income statement, the supporting schedules will follow immediately on separate pages.