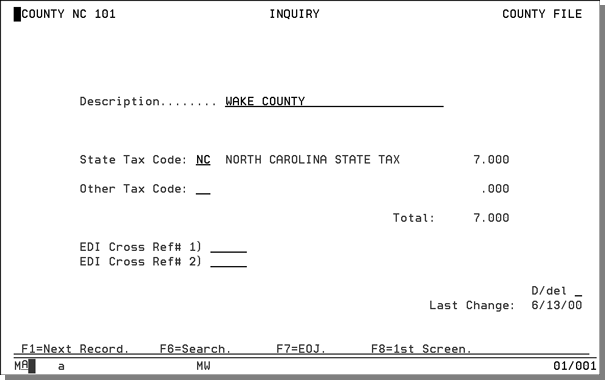

County File - FIL 33

In the County File, you can enter county codes for customers, so that the system charges them the appropriate taxes, even if they are not normally taxed. To create the County File, you'll enter the state code, and then three numeric characters to represent the county code. You'll enter the state and other tax codes created from the Tax File, which makes up the tax for the County File.

You define each county number used in the Billto File. This file is required in order to automatically tax customers for samples if they are normally non-taxable customers. It can also be used for EDI reporting and comparing your sales to national sales models. Many sales models and surveys are assembled by county, and measure total market for each county. By participating in these marketing studies, you can learn your market share for each commodity by county. The County File provides for cross referencing to up to three different reporting services. You can also generate reports and mailing labels by county.

|

Field Name |

Description/Instructions |

|

Description |

Description of this county. |

|

State Tax Code |

State or provincial tax code, if any. The state tax code must have been previously entered in the Tax File. |

|

Other Tax Code |

Enter any other tax code that relates to this county. The other tax code must have been previously entered in the Tax File. For Canadian counties, the other tax code usually represents the GST. |

|

Total |

Total of tax rates relating to your entries in the Tax Code fields. Verify that this total is the total tax rate applicable to this county. This rate is optionally used by the Recurring Invoice System to tax customers, whether or not they are usually taxable. The person running the Recurring Invoice program can optionally tax or not tax. These rates are also used when taxing a normally non-taxed customer via the F9 function on the header screen of Order Entry. The F9 Order Entry function finds the customer's tax rate by first getting the customer's county number and then retrieving the tax rates from this file. |

|

EDI Cross Reference# 1 |

If you need to cross reference to a reporting service that does not use the same county numbers, enter their numbers here. When this field is used, a tape or transmission can be assembled to or from the reporting service. Each reporting service has its own data formats. Some additional programming is required for each EDI link. |

|

EDI Cross Reference# 2 |

Same as above. Use for secondary link. |

|

D/Del |

Enter D in this field to delete this record. |

|

Last Change |

This field is not accessible. The date shown here is the date on which the last changes were made to this record. |

Associated Files

Tax by Zip Codes Table - FIL 43

List County File - RMF 114