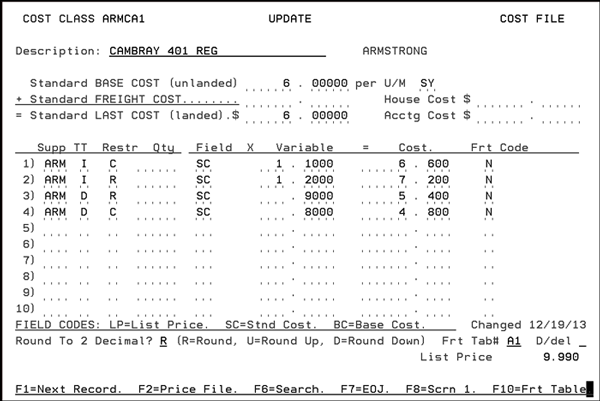

Cost File - FIL 10

The Cost File establishes cost structures called cost classes, that you can assign to groups of items. You can assign items with identical costs and cost structures to the same cost class, and when costs or the cost structures change, you only need to update the Cost File.

In this file, you can establish costs for different suppliers, transaction types (inventory or direct), restriction codes (cut or roll), and order quantities.

The costs entered in this file are standard costs, which reflect the current market value or the current cost of purchase from your suppliers. Actual costs, based on each receipt, are maintained automatically by the system.

If you factor freight into your cost, you should enter your base cost and the amount of freight you pay. This combination of freight and base cost is a landed cost. Notice the accounting cost and house cost fields. These can be populated to allow you to perform sophisticated valuations on your inventory for financial analysis.

You can run commission report from house cost versus average cost. House costs are user defined cost dollar figure.

Accounting cost is used only in valuing your inventory.

On this screen you can use the standard cost (landed), the base cost, or the average cost. Like the Price File, if you enter a cost, the system generates the variable.

The following table describes the fields on this screen.

|

Field Name |

Description/Instructions |

|

Description |

Description of the group of items to which this cost code applies. |

|

IMPORTANT: The costs listed below represent standard or current market costs, not the current value of your inventory. Actual costs are recorded on a receipt-by-receipt basis. The system retains actual Last Cost and Average Cost for each serial number and stock keeping unit. You can use the inventory value reports to print inventory values using any of the costs on the system. However, the value/cost used by the system for normal calculation of gross profit are the actual/average costs of each SKU/serial number on the system. These standard costs are never changed by the system. You control these fields. They are, however, used as default costs if no other cost is available to the system. |

|

|

Standard Base Cost & U/M (unlanded) |

The cost of the item minus freight and handling charges and unit of measure. The unit of measure should always be the native unit of measure for the item, which is the unit of measure to which sales analysis and pricing defaults. You may still purchase in other units of measure. |

|

Standard Freight Cost |

The freight and handling portion of the cost. If your supplier sells at a single cost that includes freight, you can enter that total cost in the Standard Base Cost field and leave this field blank. For imported items, the standard freight cost includes all costs other than the material. This figure includes all costs, such as freight, duty, and broker fees. |

|

Standard Last Cost (unlanded) |

Cost of the item including freight and handling charge. You do not have to enter the Standard Last Cost, as the system automatically computes that figure based on the formula shown on the screen: Last Cost = Base Cost + Freight Cost. |

|

House Cost |

This cost is entered only when you need to alter a cost for the purpose of sales analysis reporting or sales commissions. For example, on a commodity product that has fluctuating costs, you might prefer to base commissions and reports on a single stable cost. When items are to be sold at great discounts, or even below cost, you can artificially create an acceptable profit margin by entering a low house cost. This could be used for commission, thereby creating an incentive to sell these low or negative margin items. The house cost is an option when running any of the X by Y Sales Analysis and Commission Reports. House cost can also be entered on an SKU by SKU basis, using the SKU File. |

|

Acctg Cost |

This field can be used if an additional cost, such as LIFO or FIFO cost, is required. The accounting cost can also be entered on an SKU by SKU basis using the SKU File. If you require LIFO costs based upon historical costs, you can store them here. Automatic update of this field is provided for in the Mass Update Accounting Costs option on the Special System Maintenance Menu. This field is accessed only by the Inventory Value Reports. |

|

Supp |

Three-character code for the supplier to whom this cost relates. You can use the cost chart to enter costs for the same product from multiple suppliers. The Purchase Order program accesses the costs for the supplier to whom the purchase order is being written. |

|

TT |

Transaction type to which the cost relates. Valid entries are:

|

|

Restr |

Restriction code if one applies to the cost. The valid codes are:

If a code not listed above is entered, an error message displays. The unique aspect of pricing and costing by restriction code is that it does not depend on the quantity of each line being entered. Instead, it depends on a total quantity you are building, as when you are building a truck or building a container with a supplier. Many suppliers offer this type of discounting, regardless of the number of items included in the full truck or container. When you enter a restriction code, the respective price or cost is used regardless of the line item quantity. Restriction Codes are maintained via the Classification Codes File (FIL 19). |

|

Qty |

Quantity through which the cost applies. No entry in this field means that cost applies to any quantity. If you have quantity breaks, the last quantity break should equal 99999, which indicates any quantity greater than the previous quantity. Refer to the example to see how quantity breaks should be entered. A quantity of 00040 means this cost applies to line item purchases up to 40. The quantity field always relates to the unit of measure as shown next to the standard base cost. |

|

Field |

Use this field to figure this cost as percentage above or below one of the following:

|

|

Variable |

This field is used only if a field code is specified. This is the variable by which to multiply the contents of the field represented by the Field code. For example, if the field code is SC (standard last cost) and the Variable field is.80, the Cost field is calculated as standard cost multiplied by .80. |

|

Cost |

Actual cost, which can be entered directly or calculated by entering a field code and a variable, as described above. Some lines have the Cost field calculated, and other lines have the cost entered directly. |

|

Frt Code |

For informational purposes only. It does not control or effect costs. You can define one-character codes that describe how freight is handled. Suggested codes include:

|

|

Changed |

This field is automatically updated by the system. It displays the date the record was last changed. |

|

Round to 2 Decimal |

Leave blank or enter one of the following codes:

|

|

Frt Tab # |

A freight table defines the freight cost or rates between one or more suppliers and each of your warehouses. Freight tables offer a more precise means of calculating the freight cost per unit upon receiving, when and if you have consistent and defined freight costs. Freight table rates override the standard freight cost. These rates can be per unit, per weight in pounds or kilograms, or per cube. A two-character Frt Tab # is assigned to each freight table. For example, freight table E1 could represent the freight rate for a group of east bound suppliers, or it could represent a single supplier. Each Cost File record can be assigned a freight table by entering the two-character freight table number in the Frt Tab # field on this screen. You can enter ? in this field to display a list of freight table numbers available on your system. Freight tables are established using the Freight Cost Override Table on the System Settings Menu. If you intend to use the freight table feature, you must also activate its use for each of your warehouses, using the Warehouse Settings Program on the System Settings Menu. If a freight table number is entered on this screen, press F10 to display the contents of the freight table. |

|

D/Del |

Enter D in this field to delete this record. |

|

List Price |

This is the list price as entered in the Price File for this group of items. It is displayed only if a price class equal to the cost class is found. |

Function Key

|

Function Key |

Description |

|

F1 |

Go to the next cost code record without going back to the first screen. This is helpful if you are updating or viewing record by record within the Cost File. Press F1 to enter the current screen and then display the next record in the Cost File. |

|

F2 |

Go to the corresponding Price File record. When you press F2 it is assumed that you have used the same price class code as cost class code for same group of items. If you have not done this, there may not be a corresponding Price File record. |

|

F6 |

Search for cost class codes or view a summary of the existing cost class codes. |

|

F7 |

Return to File Maintenance Menu. |

|

F8 |

Return to Cost File Entry screen. |

|

F10 |

Go to the Freight Cost Override Table. |

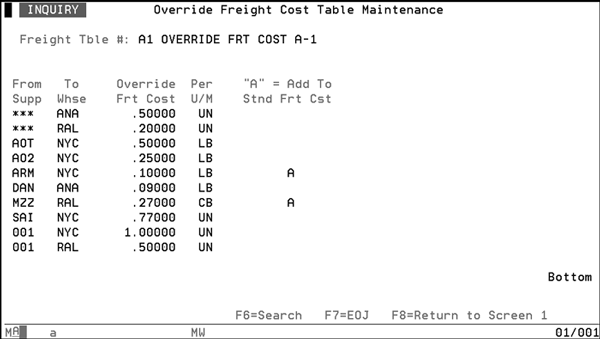

Freight Cost Override Table

The Freight Cost Override Table is set up in the System Settings Menu. You can use the Freight Cost Override Table to define or override the standard freight cost used in receiving. The freight cost defined in this table overrides the Standard Freight Cost in the Cost File. Press F10 on the Cost Profile screen to display the freight table if a freight table number appears on the screen.

The Freight Cost Override Table is a list of from/to combinations and their respective rates. Each rate applies when goods are received from the specified supplier to the specified warehouse.

|

Field Name |

Description/Instructions |

|

Freight Table # |

A two-character code representing the freight table. These are established using the Freight Cost Override Table on the System Settings Menu. The description of the freight table is shown beside the table number. |

|

Cost Class |

The cost class you entered earlier |

|

Stnd Frt Cost |

This is the standard freight cost, if any, that you entered on the Cost Profile screen. |

|

From Supp |

Supplier code from which freight cost is overridden.Three asterisks (***) in this field indicate any supplier. |

|

To Whse |

Warehouse code to which freight cost is overridden. |

|

Override Frt Cost |

Freight cost that is overridden if receipt is entered for that supplier and warehouse. |

|

Per U/M |

Unit of measure to which the freight cost refers. Valid entries are: LB - pound (weight) CB - cube UN - unit. Relates to the unit of measure of the cost class. |

|

A = Add To Stnd Frt Cost |

Enter A to add in the standard freight cost (from the Cost Profile scree) and the override freight cost to calculate the total freight cost. If you do not specify an A, only the override freight cost is used. |

|

Total Frt Cost |

Total of override freight cost on this screen and, optionally, standard freight cost from the Profile screen when you enter A. |

Associated Files

Organize Price, Cost, Packaging, Manufacturer, Supplier, Salesman, & Product Line Files - SYS 104

Change Price, Cost, or Packaging Codes - SYS 106

Run Future Price & Promo File Update (check effective/ending dates) - SYS 308