Vendor File

The Vendor File contains information about your vendors. It primarily consists of information that is used by the Accounts Payable system. The file supports GL account branch and cost center information as well as terms and discontinue date information.

Vendors are distinguished from suppliers, and are kept in a separate file. Suppliers sell material that is considered inventory. Vendors sell products and services that are considered expenses or non-inventory assets.

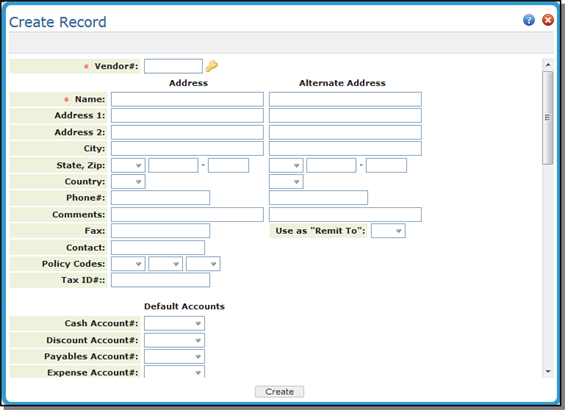

Creating a new Vendor Record

- Access the Vendor file in the Accounting grouping.

- Use the Filters screen to manage what displays on the screen.

- Click Apply to load the Vendor table.

- To create new Vendors, click Records and then select Create.

| Field Name | Description/Instructions |

| Vendor# | The vendor number is a six-digit numeric field. We recommend that vendor numbers are assigned so that when vendors are listed in numerical order by vendor number, they will also be in alphabetical order. Leave a span of numbers for each letter so that there will be at least ten unused numbers between each vendor when the file is initially established. Thereafter, new vendors can be easily inserted in place. Alphabetize by the key name. For example, American Express under A or Joe Smith under S. |

| Address and Phone Information | Enter the applicable address and contact information for the vendor. |

| Comments | Additional information about comments on the vendor (up to 30 characters). If additional space is entered the Notepad can be used. |

| Use as Remit To | The alternate address can be printed on accounts payable checks or simply stored here for reference. The main vendor address is the address to which purchase orders should be mailed. Enter Y to use this alternate address as the remittance address on payments to the vendor. |

| Contact | Name of a contact person at the vendor's location. |

| Policy Codes |

Used to trigger special processing or identifying certain vendors or situations. These can be user-assigned, or assigned. Some examples are:

|

| Tax ID# | This field lets you to enter the Tax ID for issuing 1099s to vendors, suppliers, and miscellaneous vendors. Tax ID numbers are created via menu option ACT 12 - Tax Identification Number File. |

| Defaults Accounts | |

| Cash Account | Default cash account for issuing checks. Paid invoices are deposited here. |

| Payables Account | Account where unpaid invoice information is stored. When the invoice is paid, the information gets sent to the cash account. |

| Expense Account | Expense account number for the vendor. See Chart of Accounts for full listing. Each time an invoice for this vendor is entered in the Accounts Payable system, the default expense account number appears automatically. If multiple expense accounts are used for a vendor, enter the most frequently used expense account or leave this field blank. |

| Default Payment Terms | Enter the terms of payment that are allowed for the vendor. You can enter a percentage discount and the number of days due. For example, enter 2%, 15 days to indicate 2% for 15 days. |

| Default Cost Center | If you use the cost center for accounting purposes, and this vendor's invoices are always charged to the same cost center, enter that cost center code here. If a cost center is entered here, it automatically appears on the Accounts Payable input screen whenever invoices are entered for this vendor. |

| Default Branch | The Default Branch field is automatically inserted into the Branch field of the Enter Payables Program when entering vouchers. |

| Disc, Days. Net Days |

This field, displayed only if the Options for Accounts Payable is activated, gives you flexibility over two tier terms. Two tier terms have 2 due dates - one to get the discount, and a final net due date. For example, if a vendor's terms are 2% 15 Days, Net 30, then the AP system initially sets the due date at 15 days from the invoice date. With two tier terms activated, if the invoice is not paid by the due date, then the due date is changed to 30 days from the invoice date. If you enter terms, then in Accounts Payable when you enter the invoice from this Vendor, the terms are pulled from the respective files. You can override the terms in Accounts Payable. The following are some examples of how these settings work:

Only enter the Net Days field if there is a discount, and the net days is greater than the discount days. |

| Hold/Force# | This field is used by the Accounts Payable application for controlling automatic payments. |

| Group Code |

This field allows you to assign a vendor to a group. A Vendor group provides another level of organization of payments. For example, you can group vendors by the type of product or service they provide, and generate checks by group. You can set up groups for installers, import vendors, domestic vendors, etc. Supplier/Vendor groups are established via the Supplier and Vendor Groups File (ACT 120). |

| Delete Code | Enter D in this field to delete this record, if the security and other restrictions on your system allow. |

| Discontinue Date | Enter the date on which you have or will stop doing business with the vendor, if applicable. |

| Installers Retainage Terms These settings define defaults used when systematic retainage is calculated. Retainage represents a percentage withheld from labor payable. The retained amount is documented and stored for individual vendor / supplier. Use of these settings are activated via the System Wide Setting - Options for Accounts Payable. | |

| Retainage% | The percentage to withhold from the installer's payment. |

| Max Retainage$ | The cumulative amount that can be withheld from the installer's payments. |

| Accrued Retainage Amount | Cumulative retainage amount withheld to date. |

| Billto Offset Account# | AR account used during the calculation of credit payable when labor payable report is loaded into AP entry. Credit amounts are determined by open receivables within this account. |

| Default Liability Account# |

Liability account used by retainage calculations. This account number overrides system default liability account. If no entry is made the default G/L accounts payable account number entered in the Company File is used. When you enter a vendor's invoice, you usually debit expense and credit Accounts Payable. When you issue checks, you debit Accounts Payable and credit Cash, and sometimes credit Purchase Discounts. |

| Default Liability Cost Center | You can allocate the expense to a specific three-character cost center number or code, or to no cost center by leaving the field blank. This cost center overrides system default cost center. |

| Default Offset Account# | Account used by credit payable voucher calculations. This account number overrides system default liability account. |

| The following fields are not accessible for update. The information in these fields is obtained from the Accounting System. | |

| Open A/P$ | Accounts payable amount currently open for this vendor. |

| Paid Yr-To-Dt | Amount paid to this vendor in the current fiscal year. |

| Paid Last Year | Amount paid to this vendor in the last fiscal year. |

|

Template Section The template settings allow you to enter more than one default expense account number, branch, cost center, and instructions as to whether to suppress discounts for each expense line when entering invoices for this vendor. When you create a Vendor File Template screen, it becomes the default AP Entry screen for all invoices entered for the vendor. |

|

| Invoice Amount in Foreign Currency |

Enter Y if the invoices processed in AP are in foreign currency. Otherwise, enter N. If you enter Y, you must also enter into the next two fields. When you enter invoices for this vendor you enter the foreign currency invoice amount, and the conversions and exchange account number entries are created automatically by the AP program. To use this feature, you must first set up the Exchange Rate Table and the Supplier Currency Code Table in the System Settings Menu. |

| Default Exchange Payable Account and Cost Center | The default exchange payable account number and cost center code. |

| Default Exchange Clearing Account and Cost Center | The default exchange clearing account number and cost center code. The default Exchange Payable account and default Exchange Clearing account are automatically inserted as FXP and FXC entries when invoices are entered for the vendor when entering A/P transactions. |

|

Template Settings: Account$ Discount$ Account Branch Cost Center Suppress |

Use the settings in the Vendor Template table to assign default values for this vendor. In most situations, you only need to enter an Account, Branch, and Cost Center. These defaults are automatically imported in the AP Entry screen when paying invoices for the vendor. For recurring invoices where the invoice amount is the same, such as for rent payments, you can enter an Amount$ and Discount$ (if applicable). |