Future and Sale Cost File

You can use the Future Cost File to enter costs from your suppliers in advance of their effective dates. You can also institute sale pricing from your suppliers when temporary special purchase prices are in effect. This file changes the costs on the effective date of the sale and changes them back to normal when the sale is over. They program changes costs automatically during Night Jobs, and prints a list of those changes. These costs represent your standard costs only and are the costs used by the Purchase Order system. Entries in this file do not affect the value of the current inventory.

You should familiarize yourself with setting up the Cost File and Item File before using this option. This file simply mirrors the way you set up costs on your system.

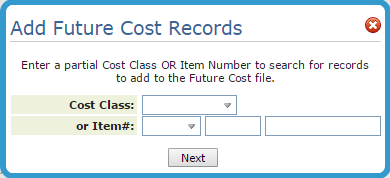

Access the Future and Sale Cost File and click Create under Records.

The first window to appear allows you to search by either cost class or item number to create a new record.

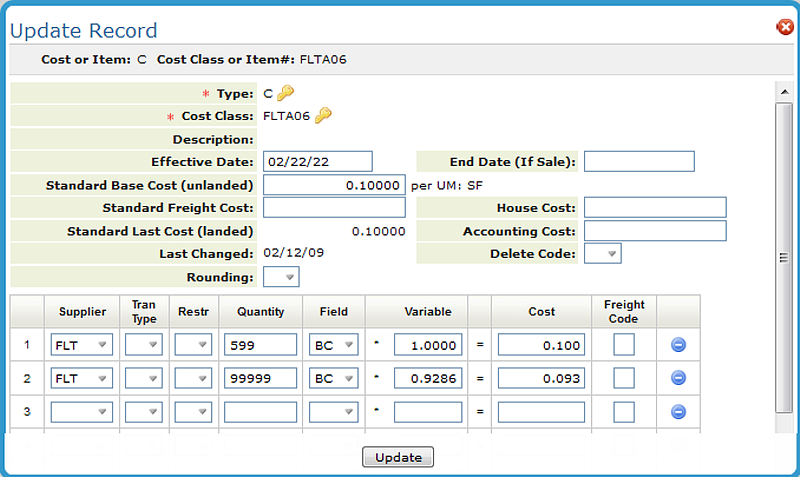

Using Cost File records provides far greater flexibility than using Item File records. You can use the Cost File to specify freight tables and multiple costs based upon supplier, transaction types, restriction codes, and quantity breaks. The Item Master File only provides for a single cost structure that you can split between material and freight.

| Field Name | Description/Instructions |

| Cost Class | If your costs are set up using the Cost File, enter an existing Cost Class code. The program displays that record which can be changed as needed. |

| Item# | If your costs are set up directly in the Item File, and not in the Cost File, enter an item number here. The program displays that record which can be changed as needed. |

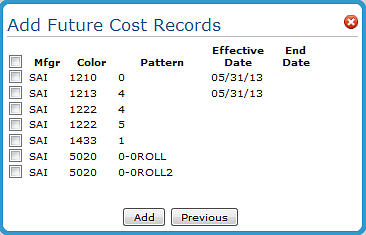

Since you are only entering a partial cost class or item number the system will probably return multiple records.

Select the records you want to create a Future and Sale Cost record for.

If you enter a Cost Class the program displays the fields from the Cost File.

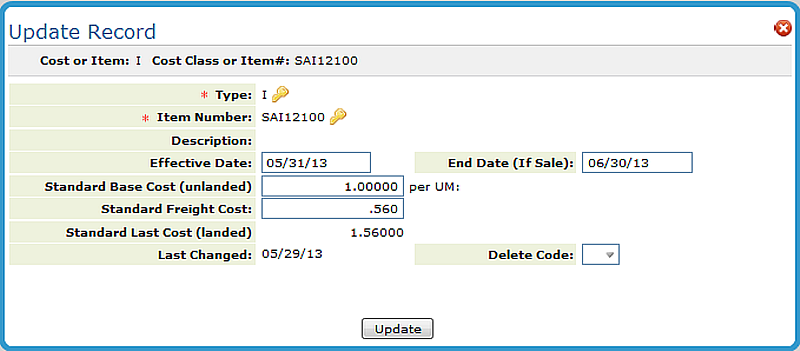

If you entered an item number, the following window is displayed. Notice that the Item File window is less detailed than the Cost File. This is because Item File pricing is more limited than Cost File pricing.

| Field Name | Description/Instructions |

| Effective Date | This is the date on which you want the new prices to take effect. If you enter today's date or an earlier date, the new prices will go into effect tonight after the Night Jobs have completed. If new prices are to go into effect on a Monday, and there are no Night Jobs scheduled for the weekend, enter Saturday's date as the effective date. Then, the Friday night jobs will update the prices. |

| End Date | If you leave this date blank, the system assumes that the new prices go into effect on the effective date and remain active until further notice. If you enter a date here, the new prices go into effect on the effective date, and the old prices are reinstated on the end date. |

| Standard Base Cost (unlanded) | Cost of the item minus freight and handling charges. The unit of measure shown is the native unit of measure for the item. This is the unit of measure to which sales analysis and pricing defaults. You can still purchase in other unit of measures. |

| Standard Freight Cost | Freight and handling portion of the cost. If your supplier sells at a single cost that includes freight, you can enter the total cost in the Standard Base Cost field and leave this field blank. For imported items, the standard freight cost includes all costs other than the material such as freight, duty and broker fees. |

| House Cost | Enter this cost only when you need to alter a cost for the purpose of sales analysis reporting or sales commissions. For example, on a commodity product that has fluctuating costs, you might prefer to base commissions and reports on a single stable cost. When items are to be sold at great discounts, or even below cost, you can artificially create an acceptable profit margin by entering a lower house cost. This could be used for commission, creating an incentive to sell these low or negative margin items. The house cost is an option when running any of the X by Y sales analysis and commission reports. House cost can also be entered in an SKU by SKU basis using the SKU File. |

| Standard Last Cost (landed) | Cost of the item including freight and handling charge, The system automatically computes this figure based on the formula shown on the screen: Last Cost = Base Cost+ Freight Cost. |

| Accounting Cost | Enter this cost if an additional cost, such as LIFO or FIFO cost, is required. The accounting cost can also be entered on an SKU by SKU basis using the SKU File. If you require LIFO costs based upon historical costs, you can store them here. Automatic update of this field is provided for in the Mass Update Accounting Costs option on the Special System Maintenance Menu. This field is accessed only by the Inventory Value Reports. |

| Last Changed | This field is automatically updated by the system. It displays the date the record was last changed. |

| Rounding |

Leave blank or enter one of the following codes:

|

| Supplier | A three-character code for the supplier this cost relates to. You can use the cost chart to enter costs for the same product from multiple suppliers. The Purchase Order program accesses the costs for the supplier to whom the purchase order is being written. |

| Tran Type |

Transaction type to which the cost relates. Some valid entries are:

|

| Restr | Restriction code if one applies to the cost. |

| Quantity | Quantity through which the cost applies. No entry in this field means that cost applies to any quantity. If you have quantity breaks, the last quantity break should equal 99999, which indicates any quantity greater than the previous quantity. A quantity of 00040 means this cost applies to line item purchases up to 40. The quantity field always relates to the unit of measure beside the standard base cost. |

| Field |

Use this field to figure this cost as percentage above or below one of the following:

|

| Variable | Use this field only if a Field code is specified. This is the variable by which to multiply the contents of the field represented by the Field code. For example, if the field code is SC (standard last cost) and the Variable field is.80, the Cost field is calculated as standard cost multiplied by .80. |

| Cost | Actual cost. It can be entered directly or calculated by entering a field code and a variable, as described above. In the illustration, some lines have the Cost field calculated, and other lines have the cost entered directly. |

| Freight Code |

This field is for informational purposes only. It does not control or affect costs. You can define one-character codes that describe how freight is handled. Suggested codes include:

|