Company File

The Company File contains a record for each company you manage on the system. If you only operate a single company, regardless of how many branches, you need to enter a single company record in this file.

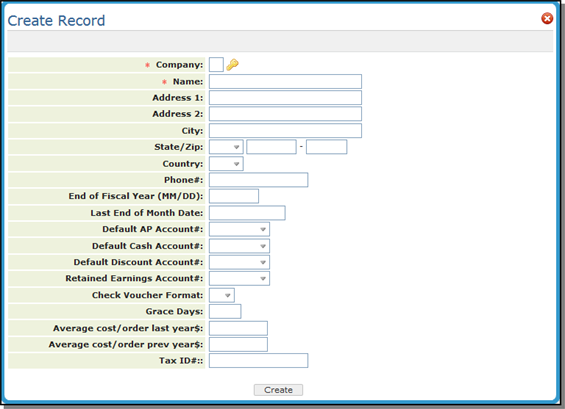

To create new Companies, click Records and then select Create.

| Field Name | Description/Instructions |

|

Company Name |

The company's one character identifier and name. |

| Address 1 | The company's address. This address should be the remittance address for the company if you have a centralized remittance address. You can also use the Branch File to set up remittance addresses to which your customers mail payments. |

| Address 2 | Additional line for address information. |

| City | The company's city. |

| State | The company's state abbreviation. |

| Country |

If the company is in a foreign country, enter the two-character code of the country. Foreign indicates a country other than the country in which this system is installed. Canadian companies should enter CN as the country code regardless of where the system is located. The CN code activates all fields and functions that are applicable only in Canada. |

| End of Fiscal Yr | The day and month of the end of the company's fiscal year in MMDD format. For example, 12/31 indicates December 31. This field is accessible only when a high-level password is entered. |

|

Last End of Month Date |

The end-of-month date of the last month closed in the Accounts Payable System. This date should never be overridden. This field only accessible when a high-level password is entered. |

| Default A.P. Account# | The chart of accounts number for Accounts Payable. |

| Default Cash Account# | The chart of accounts number for the Cash Account (bank account) used for issuing accounts payable checks. If more than one cash account is used for issuing checks, this field is blank, or contains the most commonly used account. This is the default used by the AP system. |

| Default Discount Account# | The chart of accounts number for discounts taken on vendor bills. This is the default discount account number used by the Accounts Payable entry program. |

| Retained Earnings Acct# | The chart of accounts number for retained earnings. This is the account number used by the G/L system when a year is closed and all income and expense accounts are cleared. This account must be entered before the G/L system is used. |

| Check Voucher Format |

The format of the check voucher:

|

| Grace Days | The number of days you allow, in excess of the due date, on an invoice to your customer, before considering cash discounts unearned. The grace days are usually entered to compensate for mail time, or EDI transmission time. Grace days are also used in the calculation of interest charges for past due invoices. |

| Average Cost per Order (COP) Last Year and Prev Year | The average cost of processing an order in this company. To calculate, divide the total general and administrative expenses by the total number of orders processed in a given year. Two fields are provided; one for the past year and one for the previous year. You must calculate and enter these figures. Average cost per order is used to calculate amounts such as the net operating profit per customer and salesperson. |

| Tax ID# | This field lets you to enter the Tax ID for issuing 1099s to vendors, suppliers, and miscellaneous vendors. Tax ID numbers are created via menu option Tax Identification Number File - ACT 12. |