Chart of Accounts

You can use the Chart of Accounts to review your net month-end posting entries for the current and previous period as well as a simple 12-month budget. Create each account, denoting it as an asset, liability, equity, income, or expense.

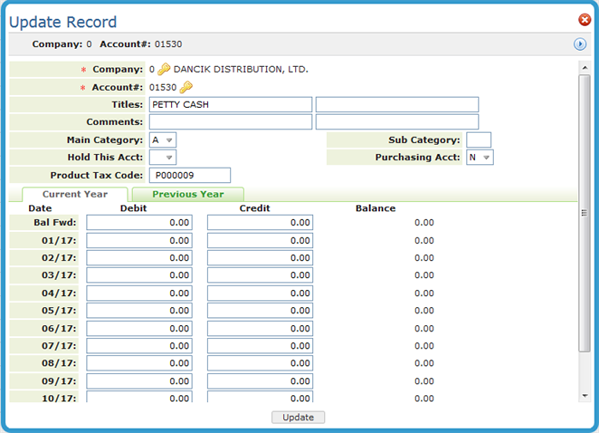

The Chart of Accounts File contains a record for each account. Each record contains:

- The title and category of each account

- A 24-month summary of activity for the account.

Access the Chart of Accounts File. To create a new file, click Records and then select Create.

| Field Name | Description |

| Company# Account# |

Enter the Company Number and the Account Number for the chart of accounts. Use any five-digit number from 00000 to 99999. Account numbers should be assigned logically. When multiple companies are on the system, assign similar account numbers to the same companies. For example, the account number for Computer Supplies is the same, except for the first character in the company account. The most commonly used Chart of Accounts separates the accounts using the following ranges:

|

| Titles | Enter the name of this account. This title appears on most screens and reports accessing this account number. For better readability, use only the first line when possible. |

| Comments | You can enter up to 60 characters for notes and comments. |

| Main Category |

Enter one of the following valid category codes:

These categories are used for some reports. However, you can define other groups of accounts. |

| Sub-Category | Use this field to further divide the main category. You should define codes for the categories that are meaningful for your company, for example, CA for current assets, NC for non-current assets. |

| Hold this Acct | Enter Y in this field to disable an account from being posted to via the A/P or G/L systems. This entry does not affect existing balances in the account, but prevents further posting. Held accounts are noted on the Chart of Accounts Search and Listing. |

| Purchasing Acct | Enter Y if this account is used in A/P for invoices from suppliers to reconcile A/P vs. Receipts. This field is used by the A/P Entry Manifest Window and by A/P Reconciliation Reports when the system needs to include only purchasing figures. Enter a Y in this field for any purchasing accounts that will be reconciled to inventory value. Note that we do not recommend entering Y in any freight accounts, even though you may consider them part of purchasing. Normally, freight is reconciled differently than material cost. |

| Product Tax Code |

This Avalara Product Tax Code is crossed referenced when assessing miscellaneous charges, entered via message lines in order entry, to activate Avalara tax calculations. For more information, refer to Avalara Integration. |

The rest of the window is divided into two sections: Current Year and Previous Year.

These sections comprise three columns and 13 rows.

- The first column shows the months of the fiscal year.

- The first row, Bal Fwd, shows the Balance Forward from the end of the previous fiscal year.

- The remaining columns divide the sections into Debits and Credits.

- The 13 rows consist of a balance forward from the previous year and a row for each of the 12 months.

The debits, minus the credits in the Bal Fwd row of the Current Year section must equal the sum of the Previous Year column debits, minus the sum of the credits for assets, liabilities, and equities. The months of the fiscal year need not be entered. They appear automatically based on the end-of-fiscal-year entry in the Company file.

The Debit and Credit figures represent the total account activity for a given month or year, not the net activity. For example, an account with debits totaling 100 and credits totaling 90 in a given month is listed as:

| Debit | Credit | Debit |

| 100 | 90 | Not 10 |

Using this method preserves the total activity and the net activity.