Base Commission Rates

This file allows you to establish and update commission rates for your sales force. You can also add or subtract from a commission (by percentage points) using several parameters. Base commissions may be adjusted based upon gross profit percentage, age of invoices, and other factors. For example, this file supports a positive or negative percentage for cuts. This means you can either raise or lower commission rates if the order is a cut. Cuts are identified by the C code in the restriction field of a line item and are usually associated with rolled goods or laminates.

You can create base commissions that are very general, such as one rate for an entire company, including all branches, cost centers, and salespeople. You can also create very specific base commission rates that apply to one salesperson and/or cost center.

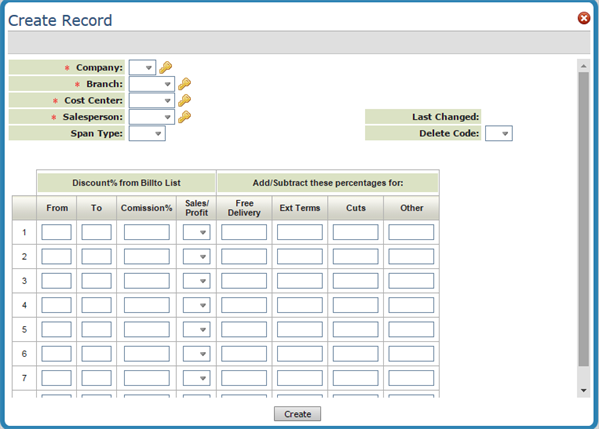

To create a new Branch Commission Rate, click Records and then select Create.

The fields on this window are described in the following table.

| Field | Description |

| Company | Enter a valid company number. |

| Branch | Enter a branch code or ALL to apply this rate to all branches. |

| Cost Center | Enter a cost center code or ALL to apply this rate to all cost centers. |

| Salesperson | Enter a salesperson code or ALL to apply this rate to all salespeople. |

| Span Type |

These options offer different methods for calculating commissions.

Using Disc % off of list price or Billto List price does not preclude you from using a mixed strategy. You can base some commissions on discounts and others on GP%. Also note, commission exceptions can still be used but that they will not support the commission based on disc% off. These options enable field salespeople who are allowed to negotiate prices to think in terms of the discounts they are offering without having to calculate gross profit percentage. The normal use case is to assign the full commission rate to prices that are not overridden, and then to reduce commissions commiserate with discounts from the customer's regularly assigned price. The new commission system allows for promotions to be paid at full commission rate, or to have their own exceptional rates. |

| Comm% | Enter the commission percentage to apply if the GP% Span is met. Assume 2 decimal places when entering a commission percentage. For example, you can enter 15.00 to apply a 15% commission for meeting the GP% Span. |

| From To Commission% |

|

| Sales Profit | Enter S if the percentage applies to sales, or P if the percentage applies to gross profits. |

| Free Delivery | If the Billto file Delivery Charge field is set to N and the sale is a delivery (has a truck route), the percentage entered will be added or subtracted from the commission rate. This figure should normally be entered as a negative number. |

| Cuts | You can either raise or lower commission rates if the order is a cut. Cuts are identified by the C code in the restriction field of a line item and are usually associated with rolled goods or laminates. The percentage you enter will not apply to special orders or direct shipments. |

Examples

Commission based on GP Span

Commissions Based on LP Span

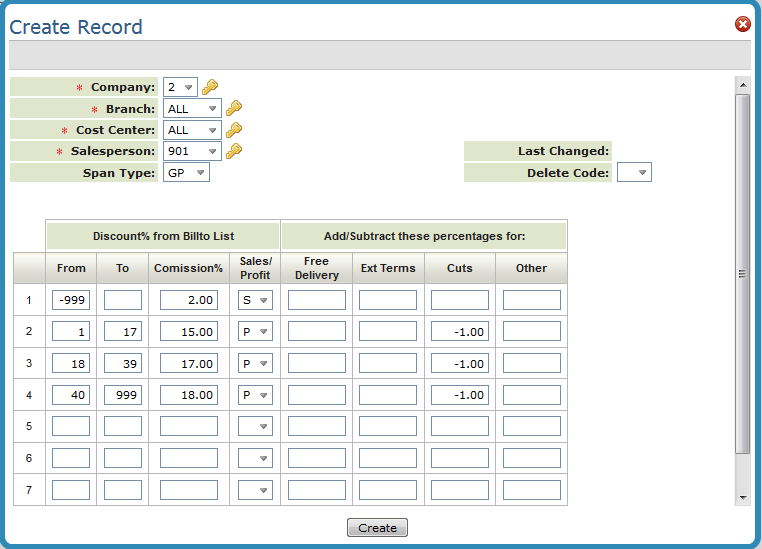

Commission based on GP Span

This example applies to salesperson 901, for sales with any branch and cost center within company #2.

The commission rates shown above should be interpreted as follows:

- Sales with gross profit percentage of 0.00% or less receive a commission equal to 2.00% of the sales value. (This entry covers all sales that have zero gross profit margin, or a negative gross profit margin. This may be important to compensate for sales of drops and other below cost items.)

- Sales with gross profit percentages between 1-17%, receive a commission of 15.00% of the gross profit value.

- 17.00% of gross profit is paid on sales with gross profit percentages between 18-39%.

- 18.00% of gross profit is paid on sales with gross profit percentages above 40%.

- A 1.00% reduction in commission is applied to sales flagged as cuts.

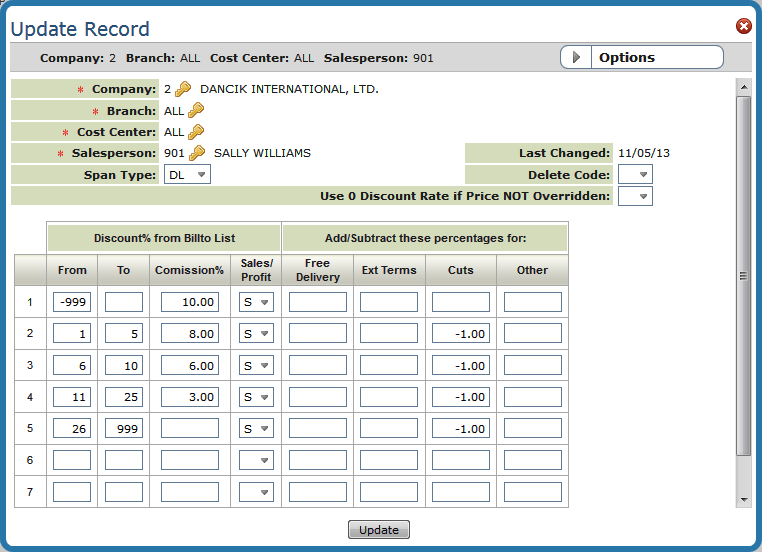

Commissions Based on LP Span

In this example:

- All commission percentages are based on sales.

- If the sale price is equal to or greater than the List Price (999- to 0), the commission is 10%.

- Sales with a 1-5% discount applied earn 8% of the sale value.

- Sales with a 6-10 discount applied earn 6% of the sale value.

- 3% of the sale value is paid, if the list prices were discounted from 11-25%.

- No commission is paid for sales with discounts of 26% or higher.

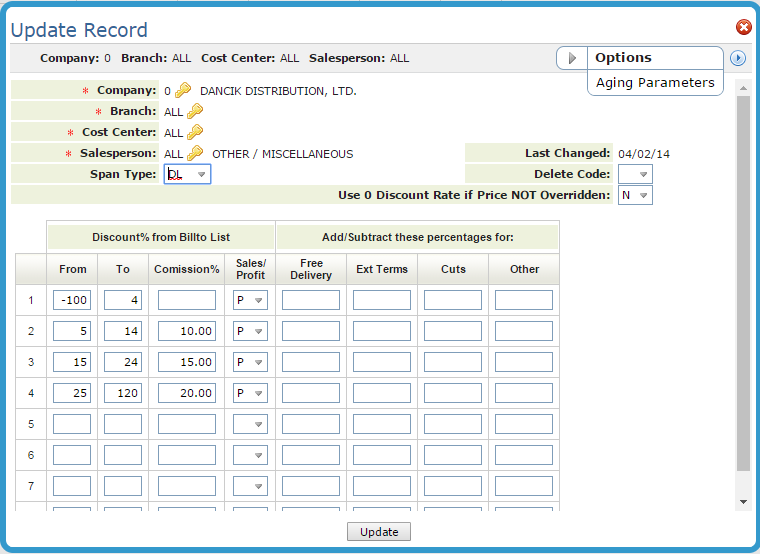

Available Options

The Available Options are accessed via the drop down menu in the upper right-hand corner of existing records.

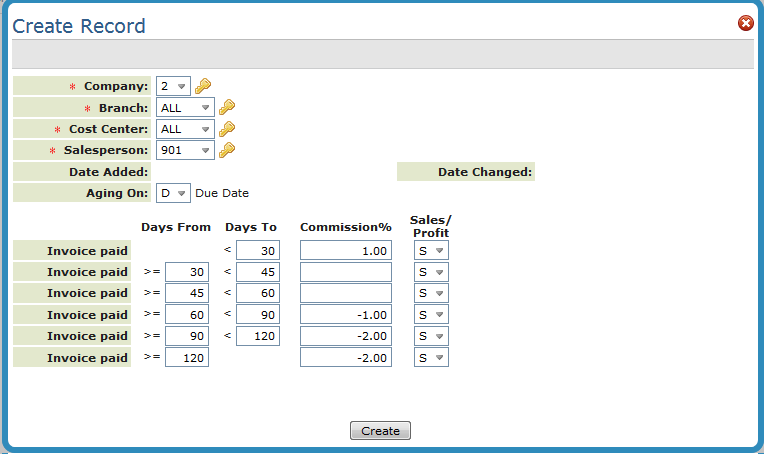

Aging Parameters

Use this option to establish commission adjustments based upon invoice aging parameters.

In the example above, if an invoice is paid in less than 30 days 1.00% gets added to the base commission. If the invoice is paid between 30 and 60 days, the commission rate is not affected. An invoice paid after 60 days, but less than 90 days has its commission rate reduced by 1.00%. Invoices paid equal or later than 90 days are reduced by 2.00%. The S code means the adjustment is based upon sales. A P code means the commission adjustments are based on gross profit. An E code eliminates the commission altogether.

The fields on the Aging Parameters Screen are described in the following table.

| Field | Description |

| Aging on |

Enter X before Due Date to calculate the age of a payment comparing the payment due to the due date. Enter X before Invoice Date to calculate the age of a payment by comparing the payment date to the invoice date. |

| Days fields | Fill in all of the days fields, even if some date ranges have the same commission % entries. You can enter any numeric values, as long as the days in the left column are always equal to the days in the right column of the entry just above. This ensures that there are no holes in the days covered. |

| Comm% | The commission % to add or subtract from the Base Commission Rate. |