AP End of Period Close

Steps for Running the AP EOM Close - Options AP 301 through AP 309

Things to consider when running AP End of Month

Potential Obstacles for AP End of Month

You must run the Accounts Payable (AP) end of month (EOM) process for all companies at the same time. Also, keep in mind, that you can close the month for AP only after all transactions for the month are posted. Closing AP automatically creates the journal entry from AP and posts disbursements to the GL.

AP end-of-month does not require that everyone sign off the system. However, it does require you to close all companies at the same time and for users to not use AP and GL. AP end-of-month can be run on the last day of the month or you may choose to wait a few days in order to capture any remaining invoices received and to post them in the current month. Any payables you enter, or any disbursements written in the extended time should be carefully reviewed to make sure they are entered into the current period or the future month. The following are recommendations on closing AP:

- Run your AP Month-to-Date payables (Menu AP 212) and Check Register (Menu AP 206) to verify that expenses and disbursements for the current month are entered and posted for all companies.

- Run the Unvouchered Posted Receipts report (Menu AP 217) to verify that all manifests on the unvouchered report are accurate for all companies.

- Clear any manifest number from the unvouchered report if it should not be on the report. For example, when a user uses the receiving program to adjust found inventory. This creates a record on the unvouchered report that does not have an invoice in AP.

- Run an AP Edit on all workstations that enter AP invoices to make sure that you have posted all AP transactions for the month.

- Make sure you have no batches of payables that have been edited but not posted. Such batches can remain on the system, but they are posted in the following month. Make sure you know which month you want to post each batch in, before performing EOM closing.

The AP EOM close does not affect users of any other applications. Only the posting of AP and GL transactions are suspended while the AP end of month process is underway.

You must run the steps on Accounts Payable/End of Period menu in the order in which they appear.

Steps for Running the AP EOM Close - Options AP 301 through AP 309

- Run AP Balance Report (AP 301) and Update A/P Balance (AP 302) for each company on your system. You can run step #301 and step #302 continuously for each company in AP end-of-month.

- Check to see that the Balance Reports shows OK TO UPDATE.

- Run Update AP End of Month Date (AP 303).

- Run option Officially Begin EOM Period (AP 304).

- Run options EOM Payables Reports (AP 305), EOM Cash Disbursements Reports (AP 306), and AP EOM Aging Reports (AP 307). These reports are loaded onto the job queue and run in sequence. When the reports print, review the printed copy to make sure all the months' transactions appear correct.

- Run EOM AP File Updates (AP 308). This step resets files by clearing all paid-in-full invoices for the month, creates the journal entries to post to GL, and moves all future transactions into the current month. Do not run this option until all reports have been printed and approved.

- Run Officially End EOM Processing (AP 309). Declare the new month can begin for each company on the system.

- Verify Journal Entries

You should not run steps #308/309 Run EOM A/P File Updates and Officially End EOM Processing until all reports are generated and verified.

The following are recommendations to running the end of month steps.

- Run step # 301 Run AP Balance Report and step #302 Update AP Balance, then stop. Verify that the AP Balance Report is in balance before continuing.

- Continue running steps #303 Update AP End of Month date up to Step #307 and stop. Verify that all vouchers and checks were entered.

- You may not need to run all the different aging reports. You should run the summary and the detailed aging.

- You can have all your reports generated, but not print them until the following day.

- Have your system administrator create a user profile call EOM to store all the end of month reports under this user.

- Up to Step #307 - Run EOM A/P Aging Reports, you can still have the chance to not close AP should you realize you need to enter more invoices or checks were not posted.

- IMPORTANT: Verify that all reports have generated before continuing with Step 8 - #308 Run EOM AP File Update. This step does the following for all companies:

- Removes all invoices paid during the month and leaves only open invoices

- Removes all future transactions from the future month and moves them to the current month.

- Creates your JE to post to GL.

- The last step, #309 - Officially End EOM Processing, should be done for all companies. After this step, AP can enter invoices for the new month.

Run A/P Balance Report (AP 301)

Run this report for each active company on your system to check that the system is in balance. For example, it checks to ensure the system has not suffered any data corruption because of a power failure or programming error.

- On the Accounts Payable/End of Period Menu, enter option 301 - Run A/P Balance Report.

- Enter your one-digit Company #.

- When the menu reappears, you can select this option again to enter another company number.

- Repeat this procedure for all of the companies on your system.

- Review the report. If the last line of the report says OK TO UPDATE A/P BALANCE, you can continue to the next step. If it says ERROR/OUT OF BALANCE, report this immediately to your system administrator.

Update AP Balance (AP 302)

After you have completed the first step on the Accounts Payable/End of Period screen (Run A/P Balance Report (AP 301)), you can update the AP balance. This step simply moves transactions from a holding area into the official monthly transaction file. It runs only if the AP Balance Report is in balance.

- On the Accounts Payable/End of Period Menu, enter option 302 - Update AP Balance. The next screen prompts you to enter a Company #.

- Enter your one-digit Company #, and press Enter. When this menu reappears, you can select this option again and enter another company number.

- Repeat this procedure for all of the companies on your system.

- Continue to the next step.

Update AP End of Month Date (AP 303)

After you have completed the second step on the Accounts Payable/End of Period screen (Update A/P Balance (AP 302)), you can update the AP End of Month Date.

- On the Accounts Payable/End of Period Menu, enter option 303 - Update A/P End of Month Date. The next screen shows EOM DATE YYMMDD. This is your date entry from last month.

- Type the new EOM date over the existing one, and press Enter. This updates all company files. The EOM date must always be the last day of the month you are closing and must be in YYMMDD format, for example, 051131, 051130, 051231.

- A one-page listing prints that shows the new date and the old date. Check the listing. The dates must be correct to ensure proper aging on other end of month reports.

- You can continue to the next step (Officially Begin EOM Period (AP 304).

Officially Begin EOM Period (AP 304)

After you have completed the third step on the Accounts Payable/End of Period screen (Update A/P End of Month Date (AP 303)), you can run this step to officially declare that the EOM process is underway. It sets a flag on the system that prevents other users from posting additional information. Users who try to Post A/P transactions while the EOM flag is on will see the message, Cannot post now. End of Month processing is underway.

- On the Accounts Payable/End of Period Menu, enter option 304 - Officially Begin EOM Period. The next screen prompts you to enter a Company #.

- Enter the Company Number and Password.

- Repeat this procedure for all of the active companies on your system. EOM must be declared for all companies. All companies must be closed at the same time.

- When you have completed this procedure for all companies, continue to the next step (EOM Payables Reports (AP 305)).

EOM Payables Reports (AP 305)

After you have completed the fourth step on the Accounts Payable/End of Period screen (Officially Begin EOM Period (AP 304)), you can run this step. This job step loads a series of reports into the job queue for processing. These reports are useful for future reference and auditing. All payables for the month are included in each report, but are sorted in different ways.

The following reports are available:

- Monthly Payables By Voucher Date

- AP Monthly Payables By Transaction Code

- Payables sorted by A/P Account#

- Payables sorted by Cost Center

- Payables sorted by Job#/PO#

- Monthly Payables By Vendor/manifest#

EOM Cash Disbursements Reports (AP 306)

After you have completed the fifth step on the Accounts Payable/End of Period screen (EOM Payables Reports (AP 305)), you can run this step. You do not have to wait for the payables report to print before beginning this step. This step loads a series of reports into the job queue for processing. These reports are useful for future reference and auditing. Each report includes all cash disbursements for the month, but each report is sorted differently.

The following reports are available:

- Cash disbursements sorted by Check Date

- Cash disbursements sorted by Transaction Code

- Cash disbursements sorted by Cash Account#

- Cash disbursements sorted by Discounts Account#

- Monthly check register by Check#

AP EOM Aging Reports (AP 307)

After you have completed the sixth step on the Accounts Payable/End of Period screen (EOM Cash Disbursements Reports (AP 306)), you can run this step. You do not have to wait for the Cash Disbursements reports to print before beginning this step. This step loads a series of reports into the job queue for processing. The reports include detailed and summarized reports about the AP aging. One report shows the amount due to each vendor in each of the coming months. Another report shows each open invoice for each vendor, and another shows the total due by date, company-wide.

EOM AP File Updates (AP 308)

When you have completed the seventh step on the Accounts Payable/End of Period screen (A/P EOM Aging Reports (AP 307)), you can run this step. This step actually closes the month. It resets all of the A/P files for the new month by clearing all paid-in-full invoices and creates the journal entries for GL. Do not run this step until all of the reports in the previous steps have been printed and approved.

During the month end process, the Company Settings (SET 3) is checked for the #Months of A/P History (found on the System / Miscellaneous Options screen) to keep for AP history.

1. On the Accounts Payable/End of Period screen, enter option 308 - Run EOM A/P File Updates. The program asks if you want to continue the process.

2. Enter Y to run the job or N to return to the main menu. Only answer Y if:

- You have run the balance report and update for each company and all the reports are finished running.

3. When this step is complete, immediately continue with the next step.

If you are using KerridgeNC's General Ledger System, this step automatically creates all of the month's accounts payable journal entries. The program then prints an edit of the journal entries, which is included in journal entry batch number 00. The journal entries are allocated to the companies' branches and cost centers as entered in A/P.

Officially End EOM Processing (AP 309)

After you have completed the eighth step on the Accounts Payable/End of Period screen (EOM A/P File Updates (AP 308)), you can run this step. This program officially ends the EOM period and allows processing for the next month to begin. It lifts the restrictions set by option Officially Begin EOM Period (AP 304).

1. On the Accounts Payable/End of Period screen, enter option 309 - Officially End EOM Processing (opens new month).

2. Enter a one-digit Company Number and the required Password.

3. Press Enter. The following message appears: Entry Accepted/EOM over & new month can begin for this company.

4. Repeat this procedure for all companies on your system.

5. Press F7 when you have finished. The EOM closing for AP is now complete.

Verify Journal Entries

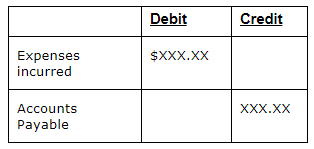

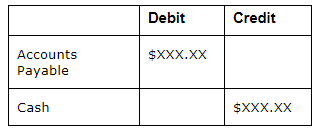

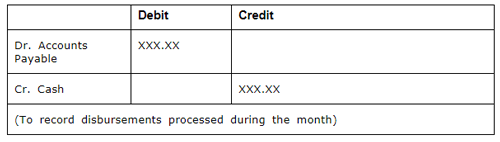

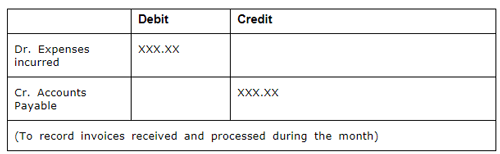

After you have completed the AP End of Month Procedures, you will want to verify the journal entries the system created for you. Two journal entries will be created by these procedures. These journal entries will be similar to the following:

To record invoices received and processed during the month

To record disbursements processed during the month

These journals will be much more complex than this example for the reason that you may have multiple branches, cost centers and numerous expense accounts.

After you verify this journal entry, your balance in the AP GL account should agree with your AP Cash Requirements Report (This is your total open AP).

If you encounter journals that are incorrect, you may access these for update through the normal journal entry update procedures. These journal entries will be in batch 00 for the posting month in which you are closing.

You should review the reports for each step prior to continuing to the next step. Also ensure for each option above where it is noted to run for each company and to not skip any companies. If this occurs, AP End-of -Month may not be able to continue to the next step. Contact KerridgeNC and these flags will be reset by someone in our Client Services Department.

If you are reconciling inventory receipts to AP (manifest reconciliation) make sure you run the unvouchered report immediately after month's end.

You cannot rerun an unvouchered report.

Things to consider when running AP End of Month

The following are topics you need to consider when running AP End of Month. The following are discussions that should be reviewed. Their implementation may cause you to change your processes.

| Topic | Considerations/Recommendations |

| Cut Off Time | When will you do AP month End? The last day of the month or a week later? |

| Multiple Companies | Closing AP closes all companies using the AP module. Make sure you run each step in AP for all companies. |

| Unvouchered Receipts | The unvouchered receipts report is a real time report where as soon as you post an AP invoice with the manifest number, that number is marked as cleared immediately and does not appear on this report. Make sure you run this report prior to month end close because you cannot recapture the report. |

| AP Reports | You have a one month window to rerun your AP end of month reports should you miss printing some of your AP reports. You cannot recapture any of the aging reports once the month is closed. |

AP End of Month Reports

There are many reports that print out during AP end of month. The reports listed here are the key reports the accounting department needs to verify accounts payable. You need to determine if other AP reports are required from the accounting department that are not included in the recommended AP reports below:

Make sure you run the Unvouchered Posted Receipts prior to beginning AP month end close.

- AP Payables by Supplier/Vendor

- AP Payables by Expense Account

- Monthly Check Register

- AP Aging Vendor Summary

- AP Detailed Aging (Cash Requirement Report by Due Date)

- JE created from AP Close - there are two entries that are created from AP end of month.

These journals are much more complex than the example below if you have multiple branches, cost centers and numerous expense accounts.

The first journal entry is the disbursements:

The second journal entry is the payables:

Potential Obstacles for AP End of Month

These situations can arise while doing month end close:

- Someone is in AP or GL entering invoices or journals. This creates a message in step #308 of AP close.

- Checks or invoices were entered in the wrong month. These need to be reversed after you begin AP month end close.