Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Job Work-In-Progress Report (WIP)

Sales Tax Report with Filters for Auditing

The Credit Register lets you choose to include credits lines that have negative quantities, or all lines on a Type C order, or a combination of those definitions.

Because a pricing adjustment is entered as a credit plus a debit, defining a credit as any line on a Type C order shows the net credit or the difference between the “wrong” price and the “right” price.

On the second screen you have the following options in regards to which lines to include on the report:

Option 1 - to show any debit on a type C invoice, regardless of the credit code field.

Option 2 - to include only lines that have a credit code. A credit code appears as the result of price adjustments.

Job Work-In-Progress Report (WIP)

This report tracks actual billing and costs against estimated billing and costs. It does this by comparing order dollar amounts against invoiced dollar amounts for the same order or time span.

Note: This report works in conjunction with the Job Estimates and WIP Reporting screen. This screen is accessed, if permission is given, via the Available Options in Order Entry or Order Change.

Enter any combination of invoice dates, invoice numbers, order dates, and order numbers. You can use the dates and ranges in any combination. However, the defaults of last month's sales & orders taken are the most applicable.

Use the I/O fields to include or omit parameters. If you include parameters, the report only includes information for the selections you enter. If you omit parameters, the report runs for all parameters except those you enter.

Enter at least two and up to four sort selections, by entering a 1, 2, 3, and 4 next to your choices. To control where the page break occurs, enter a sort level in the Page Break on Sort Level field. If you don’t want a page break enter 1, which will only page break on the 1st level which can be company number.

The report includes totals for all regular line items on the orders. This includes, but is not limited to, material, labor, freight, use taxes, etc. — Anything that is placed as a line item on the order is reflected on the report.

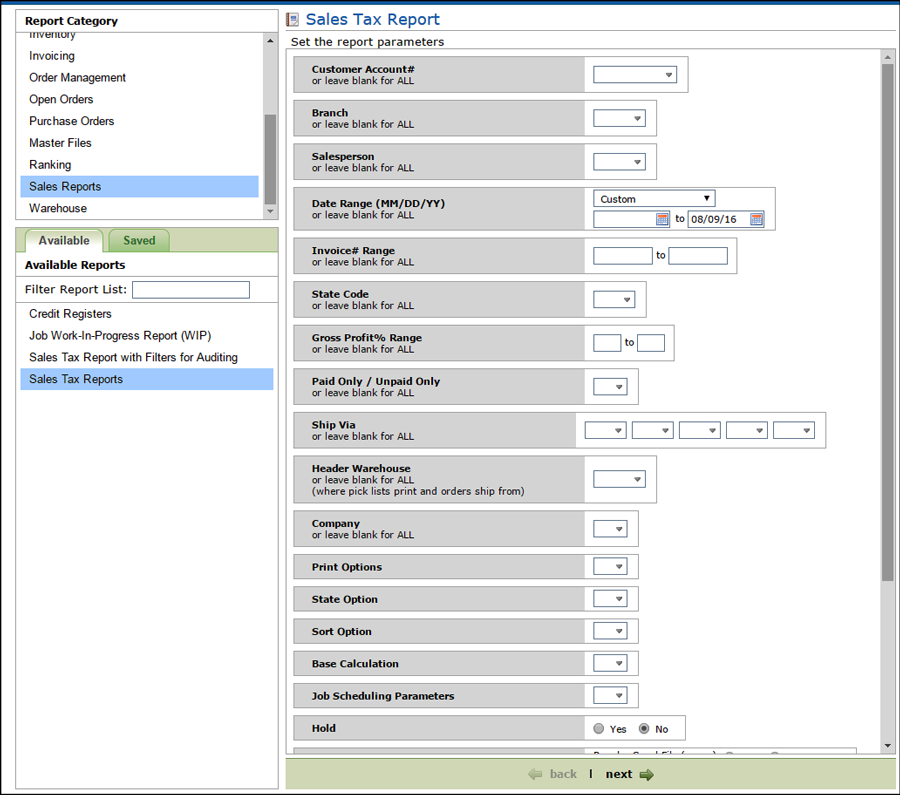

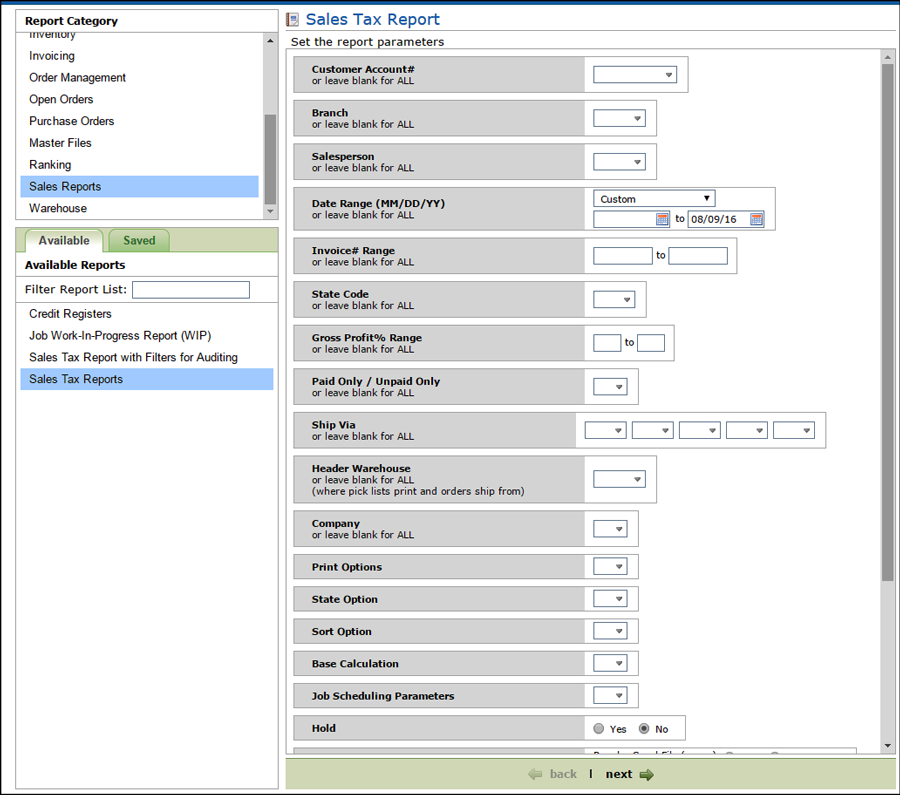

This is the main sales tax report, usually run at the end of a month or period, for reporting how much tax was charged.

Enter a Gross Profit % Range to narrow the report down to a specific gross profit margin.

Enter “P” for Paid Only, “U” for Unpaid Only, or Blank for All - Allows you to include only paid transactions, only unpaid transactions, or both.

You can use Ship Via codes as one of the parameters to sort and organize this report. This is useful for retail businesses that use special ship via codes for installs versus non-installs. It can also be used to separate “will call” versus other ship via methods. This option can also be important if taxes are applied differently based on ship via codes, such as WILL CALL versus DELIVERY versus INSTALL.

Use the State Option to choose whether to run the report for the state on the billto or the shipto address. When the Sales Tax Report is formatted and sorted, it uses either the state within the billto address or the state within the shipto address. When an invoice does not contain a shipto address, the billto address is assumed as the shipto address.

Choose a Sort Option that best serves you. For example Option5 to use the county from the zip table is recommended for any companies that have set up FIL 43 (Tax by Zip Code Table). It sorts by state/county/tax codes. The use of this tax report sort enables you to use the same tax codes for multiple counties, yet still break out taxes and sales by county. For example, tax code A1 could indicate Alabama 10% and can apply to multiple counties. The report can still break on county even through multiple counties are assigned A1.

For Base Calculations:

Use Option 1 - Base Calculations on Tax Rates in Current File if you want to run the tax report using the current tax rate in the Tax file.

Use Option 2 - Base Calculations on Tax Rates applied at time of Invoice if you want to run the tax report to see the amount that was collected at the time of invoicing (tax rate could have changed since then) for tax audits. When you choose option 2, the tax amounts are shown, but not the tax rate, as the rate could vary within a single sub-total, if the rate was changed during the date span of the report.

Report Type:

Regular Spool File - generates a regular report that gets sent to your spool file where you can print it out as needed. If you choose this option, none of the other fields are required.

Generate Spreadsheet - generates a file in a spreadsheet friendly format. You can then choose to print it or email it.

Generate PDF - generates a file in a spreadsheet friendly format. You can then choose to print it or email it.

Note: The following fields are required only if you choose to email a spreadsheet or PDF file.

File Name - Enter the file name.

Destination Folder - This is the IFS directory where you want the report to be placed. Once the spreadsheet or PDF is generated and sent to this destination you can retrieve it via the Windows Explorer, if you are mapped to the folder. It can also be accessed via WRKLNK command on the IBM iSeries. You cannot use directory /QDLS.

Note: If you do not enter a destination folder, you must enter an email address. If no destination folder is entered, a temporary one is created that is automatically deleted when the email is sent.

EMAIL File to - Enter the email addresses of the person or people you want to receive the report.

The following guidelines pertain to the email feature:

You do not have to assign a directory if you email only, the system will automatically use /home/dancik/reports/temp

A Java Kit must be installed on your server (automatically installed via the IBM V5R3 Upgrade).

The HTTP Server, TOMCAT and APACHE servers must be running.

If you use the ODS system these servers will already be running.

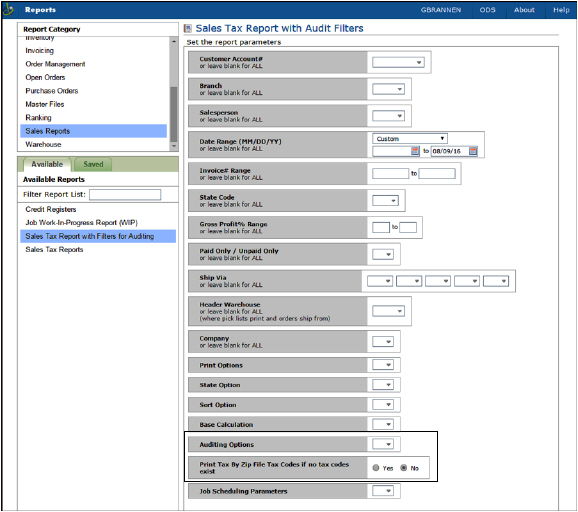

Sales Tax Report with Filters for Auditing

This report is similar to the main sales tax report. This report has additional features for auditing.

Auditing Options:

Include all invoices (taxed or not)

Only include invoices with no tax codes

Only include invoices with tax codes, but with a zero rate

Only include invoices with no tax codes OR a zero rate

If an invoice does not contain any tax codes, activate the setting Print Tax By Zip File Tax Codes if no tax codes exist to use the tax codes in the Tax by Zip Code Table (FIL 43).