Need more info or you couldn't find what you were looking for, let us know by sending an email to: support@dancik.com.

Printing AR inquiry Information

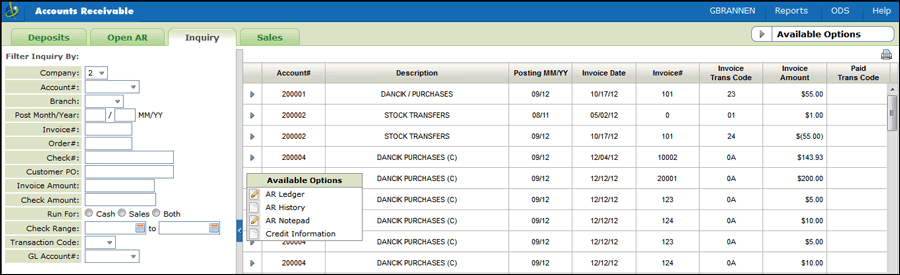

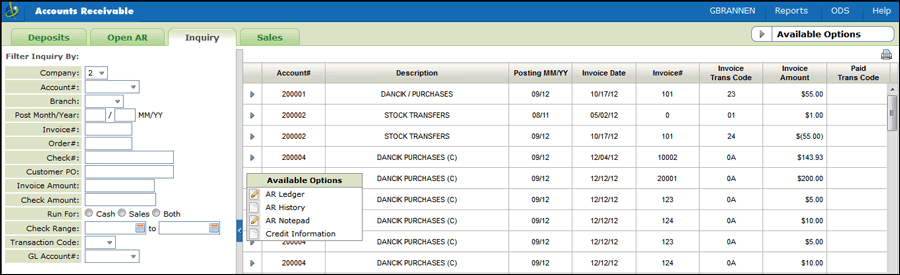

The AR Inquiry tab allows you to access and print AR ledgers and histories to give you a complete and current picture of the account. This information includes a chronological listing of every transaction for an account, sorted by accounting period or date, showing each sale, credit or adjustment, and each payment and when it was applied.

Using the Filters, inquiries can be made across all the AR accounts based on your specific parameters. For example, a report can be generated that list regular invoices (transaction code 03) for a particular time-frame (Post Month/Year).

Entering different search parameters in the Filters tab can take you to different parts of the AR Inquiry screen. For example:

Not entering an account number takes you to the complete listing.

Entering only a company and an account takes you to the AR Ledger screen.

Entering a company, account, and any other parameter takes you to the AR History screen.

Access the AR Ledger, AR History, AR Notepad, and Credit Information by clicking the arrow to the left of an entry.

From this window, you can find each account’s current balances as well as aging and all open transactions, or those paid or closed in the current month.

Note: The account/contact information at the top of the screen is imported in from the Billto File.

Use options in the middle of the screen to further refine the search.

Show Current paid items - Activating this option will include all invoices that have been paid in the current month. If it is not activated paid invoices are not displayed.

Aging Option - The default aging option is set the Company Settings File (SET 3). You can override it to view the AR Ledger via other aging options. One of the options must be selected as the default aging option for each company number. All aging screens and reports will use the default option unless an aging option is displayed. In that case. you can select one of the four options for that particular report or screen.

Options Age Invoice Date from Today’s Date and Age Invoice Date from Last EOM Date age according to how old the invoice is. In other words, Over 30 means it is between 31 and 60 days past the invoice date. Options 1 and 2 do not consider the terms due date. Options 3 and 4 age according to the terms due date. In other words, over 30 means it is between 31 and 60 past the due date.

The current date is today’s date according to the computer’s calendar and clock, except during EOM processing, at which time all AR aging reports use the EOM date as the current date for aging. This is done to allow for closing the month earlier or later then the actual last day of the month. Aging options 2 and 4 use the last EOM date for aging at all times, not just at EOM.

Roll credits - All unapplied credits (except advance deposits) are rolled forward over the oldest open debits. In other words, a credit, regardless of date, will apply the oldest open debits for the purpose of the aging. If there are no open debits to which to apply, unapplied credits will show in the Current category.

If current date is 12/31/09, the aging is Over 60=150.00 (the 100.00 credit rolled over the $250.00 debit leaving only the balance of $150.00 in Over 60) if no rolling of credits was done, the aging would be Over 60=$250.00 and Current = <100.00>.

If you do not choose to roll credits, they are aged the same as debits, except for advance deposits which are always shown in the Current column.

Note: The default for this setting is made via the Company Setting File (SET 3).

Enter Age Limit - The age limits are over 15 days, over 30 days, over 60 days, over 90 days, a blank field will display all open AR transactions (this is the default). If the selected aging option ages based on invoice dates, then the age limits are based on invoice dates. If the selected aging option ages based on due dates, then the age limits are also based on due dates.

Include AD's in AR - Activating this option includes advance deposits on all AR ledgers and reports. Unless advance deposits are tracked separately it is recommend that you activate this option. Not activating this option means all aging screens and reports omit advance deposits from totals. The system assumes that you have a liability account labeled Advance Deposits From Customers in your General Ledger, and that you will maintain this G/L balance on a monthly basis. The default for this setting is made in the Company Settings File (SET 3).

In the Company Settings File (SET 3), you can set the AR History File to store between one and 99 months of history, but the default is set at 24 months. We recommend a 24-month history unless you have enough free disk space to handle more. Also, note that the AR End-of-Month Close final step, Reset Files and Officially End EOM removes old history records. Open transactions are not affected, regardless of their age.

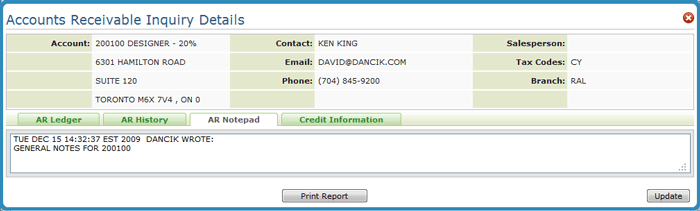

The Notepad window is used for storing notes, comments and other text related to a specific accounts receivable account.

Note: Every entry into the Notepad is time stamped. The format of the time stamp varies depending on the type of web browser you are using. If you are using any browser other than Internet Explorer (IE) 8, the time stamp includes a GMT element (14:14:22 GMT-0500 (Eastern Standard Time)). The IE 8 web browser does not include the GMT information in the time stamp (14:10:23 EST).

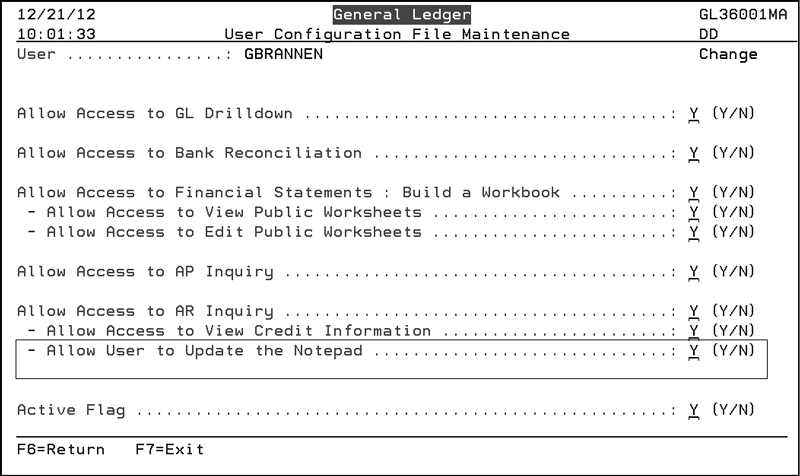

Users have to be given permission to update the notepad through the setting Allow User to Update the Notepad in option GL 301.

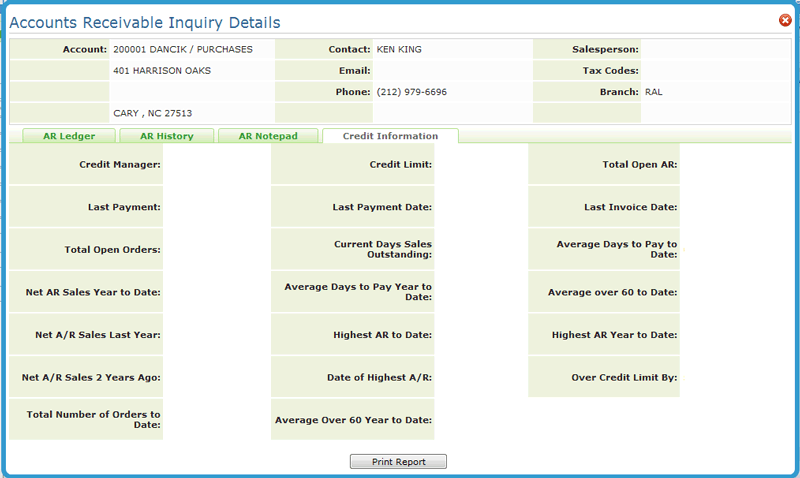

This window shows the amount of credit currently available to an account and the amount an account is over its credit limit, if any. The information is pulled from the AR and Open Order systems.

Field |

Description |

Credit Limit |

The total open orders amount established for a customer. |

Total Open A/R |

The total current accounts receivable balance for this account. |

Last Payment Date |

The date the last payment was received for this account. |

Last Invoice Date |

The date of the last invoice issued for this account. The last check number and payment amount are updated every time a quick deposit or cash application is posted. |

Total Open Orders |

The total open orders for this account, including back orders. Open orders are orders not yet invoiced. |

Curr Days Sales Outst |

Current open A/R divided by average sales per day for this account. Average sales per day is the customer’s sales during the past 90 days divided by 90. In the middle of a month, average sales per day also considers the current month to date. For example, on the 15th of each month, the system divides the last 105 days sales by 105. This statistic is informative, because it relates open A/R to sales volume. Customers with a higher current days sales outstanding might be greater credit risks than customers who owe more total dollars. This information is also available in the Customer Sales and Payment Analysis Report. |

Avg Days To Pay To Date |

The average number of days it takes this account to pay an invoice since the account was opened. This figure is updated as each payment is applied to the invoices. |

Net A/R Sales Yr/Dt |

Total sales posted to A/R during the current fiscal year, includes all computer-generated invoices and manual sales. |

Avg Days To Pay Year to Date |

The average number of days it takes for this account to pay an invoice in this fiscal year. This figure is updated as each payment is applied to invoices. |

Average Over 60 to Date |

The average amount over 60 days overdue in the current fiscal year. This figure is updated at the end of each month. |

Net A/R Sales Last Yr |

Total sales posted to A/R during the previous fiscal year, including all computer-generated invoices and manual sales. |

Highest AR To Data |

The highest amount this account has ever owed since it was opened. |

Highest AR Year to Date |

The highest amount this account has owed this fiscal year. |

Total sales posted to accounts receivable during the year before the previous fiscal year, including all computer-generated invoices and manual sales. |

|

The date related to the highest A/R to date. |

|

Amount over the established credit limit. |

|

Total number of orders processed for this account since this account was entered into this file. |

|

The average amount owed over 60 days overdue since this account was opened. This figure is updated at the end of each month. |

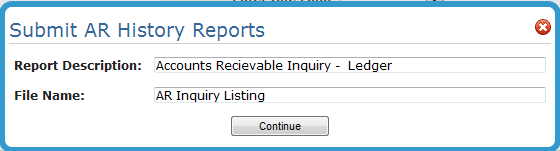

Each of the four AR Inquiry tabs has a Print Report button that prints information specific to the related tab.

1. The first step after clicking Print Report is to give the report a File Name.

2. Click Continue to generate the report.

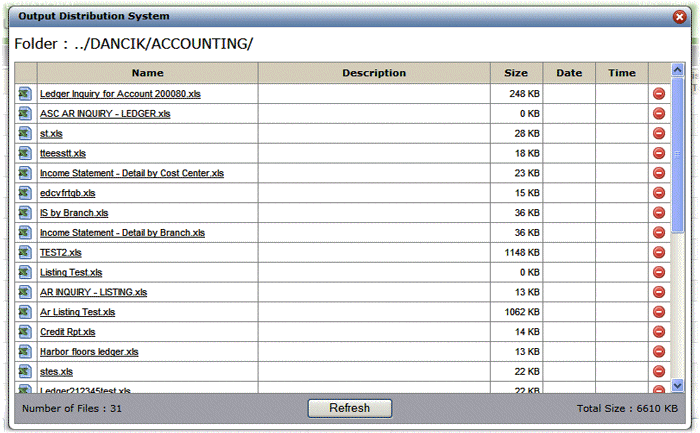

3. The reports are retrieved by clicking the ODS link in the top-right corner.

4. When ODS is clicked, a listing of all the reports appears. Click on a listing to open it as an Excel spreadsheet.

Access to all Navigator applications can be granted or restricted globally, by authority class, or by user. Global settings (NAV 1) are the initial settings, Authority Class settings (NAV 2) override the global settings, and User settings (NAV 5) override both global and authority class.

Bank Code File Maintenance - ACT 113 - The bank code displays along with the check number in the Check# column. Example: check W12345 where W is the bank code.